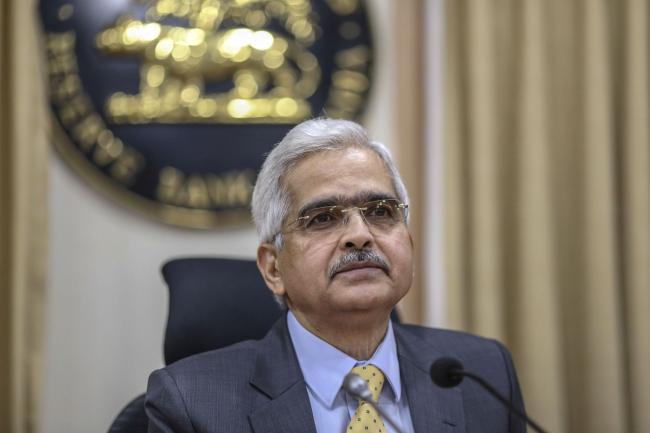

(Bloomberg) -- Reserve Bank of India Governor Shaktikanta Das reiterated there’s room to cut interest rates amid new risks to economic growth from the spread of the coronavirus.

Inflation, which had kept the central bank from cutting interest rates since December, is expected to moderate, Das said in an interview in Mumbai Tuesday. A rate cut is one policy option, with the other being supporting the market through liquidity measures, he said.

While inflation spiked to 7.6% in January, well above the central bank’s 2%-6% target, policy makers have been under pressure to respond to the coronavirus outbreak that’s threatening economic growth globally.

“We’re ready for a response should the situation warrant,” Das said when asked how the RBI will counter the impact of the virus outbreak.

India’s sovereign bonds gained after the governor’s comments, with the 10-year yield dropping to 6.35% from 6.36%.

Earlier Tuesday, the RBI said in a statement it’s ready to act to calm market volatility, although so far the spillover to the nation’s stocks and bonds have been relatively contained.

From the U.S. to Japan, governments and central banks across the world are taking steps to calm financial markets and shore up economic growth as the coronavirus disrupts supply chains and hurts trade and tourism. The Federal Reserve signaled a possible rate cut last week, while monetary authorities in Japan and the U.K. pledged action to stabilize markets -- a throwback to the coordinated action in the aftermath of the global financial crisis more than a decade ago.

The RBI cut interest rates five times last year to support an economy headed for its weakest expansion in 11 years, but has been on pause since December following a spike in inflation. Data on Friday showed growth decelerated to 4.7% in the three months through December from a year ago, the third straight quarterly slowdown amid flagging investments and subdued consumption.

Das said the virus’s impact on India’s growth will come through two channels: trade with China and weaker global growth. The RBI would be able to quantify the hit to growth at its next policy meeting in April, Das said.

With only five confirmed coronavirus cases as of March 2, India has been relatively insulated from the outbreak. However, the economy probably won’t be, since India depends on China for more than one-fifth of its total non-oil, non-gold goods imports.

Indian businesses aren’t currently facing any problem in securing supplies of raw materials, but there may be issues if the shutdowns in China continue for longer, Finance Minister Nirmala Sitharaman said last week. The government is ready to respond with measures, she had said separately.

The OECD this week cut its global growth projection to 2.4% -- which would be the weakest since 2009 -- from 2.9%.

(Updates with bonds in fifth paragraph, governor’s comments in ninth)