(Bloomberg) -- Federal Reserve Governor Lael Brainard said a failure by Congress to reach an agreement on further support for the economy is the biggest risk to the outlook aside from the coronavirus itself.

“Premature withdrawal of fiscal support would risk allowing recessionary dynamics to become entrenched, holding back employment and spending,” said Brainard, viewed as a possible pick for Treasury secretary if Democratic presidential nominee Joe Biden defeats President Donald Trump next month.

“Apart from the course of the virus itself, the most significant downside risk to my outlook would be the failure of additional fiscal support to materialize,” she told the Society of Professional Economists in an online speech Wednesday.

U.S. central bankers next meet Nov. 4-5, immediately after election day.

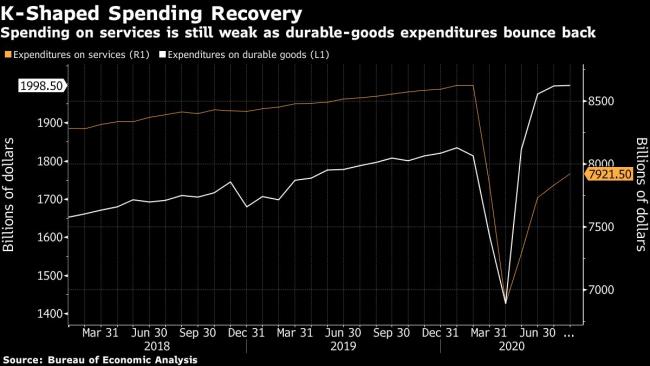

The U.S. economy is recovering from the severe recession triggered by the coronavirus pandemic, but the pace is showing signs of slowing and recent data has been mixed. Retail sales have picked up and sales of homes and autos also rebounded from the second-quarter lows. Still, the economy has recovered only about half of the 22 million jobs lost and non-farm payroll gains have slowed for three consecutive months.

Brainard highlighted the disparate outcomes in the recovery for minorities and working women. “Minority small businesses have been particularly hard hit,” Brainard said, while also noting that the “pace of labor market improvement is decelerating at a time when employment is still far short of its maximum level.”

The decline in the labor force participation rate for women between the ages of 35-44 was pronounced in September when many schools moved to virtual instruction, she said. “If not soon reversed, the decline in the participation rate for prime-age women could have longer-term implications for household incomes and potential growth,” she said.

The Fed cut rates to nearly zero in mid-March, launched a raft of emergency lending facilities and ramped up bond buying to ensure low borrowing costs and smooth market functioning. Lawmakers approved about $3 trillion in fiscal stimulus, though Fed officials have said that further fiscal action will likely be needed.

In response to a question, Brainard emphasized that the central bank’s bond purchases were a key component of monetary policy now.

“It is an important part of helping to achieve our goals by keeping borrowing costs low for households and businesses along the yield curve,” she said. “We will no doubt have the opportunity in the months ahead to deliberate and to further clarify how the asset program could best work in combination with that new forward guidance.’

Fed officials in August published a new framework for monetary policy that seeks to achieve inflation that averages 2% over time and tolerates moderate overshoots of that target after periods of running too low. They also said they would assess their employment goal in terms of “shortfalls” from its maximum level, which they defined as a broad-based and inclusive goal.

“While inflation may temporarily rise to or above 2% on a 12-month basis next year when the March and April price readings fall out of the 12-month calculation, my baseline forecast for inflation over the medium term is for it to remain short of 2% over the next few years,” Brainard said.

She also said that it could take time for inflation expectations to move up toward the Fed target.

“I anticipate that it will take some time to start seeing that kind of longer-run slower move of inflation expectations becoming very sustainably anchored at 2%,” she said in response to a question.

(Adds comment on bond purchases in tenth and final paragraph)

©2020 Bloomberg L.P.