On Thursday, Piper Sandler maintained its Overweight rating on shares of Moderna (NASDAQ:MRNA) with a price target of $115. The decision followed the Advisory Committee on Immunization Practices' (ACIP) recommendation to increase the number of annual COVID-19 vaccinations for older and immunocompromised individuals. ACIP, which is part of the Centers for Disease Control and Prevention (CDC), now advises two yearly shots for adults over 64 and those with moderate to severe immune compromise who are at least 6 months old. It also suggested that more than three doses could be administered to immunocompromised individuals based on their healthcare provider's advice.

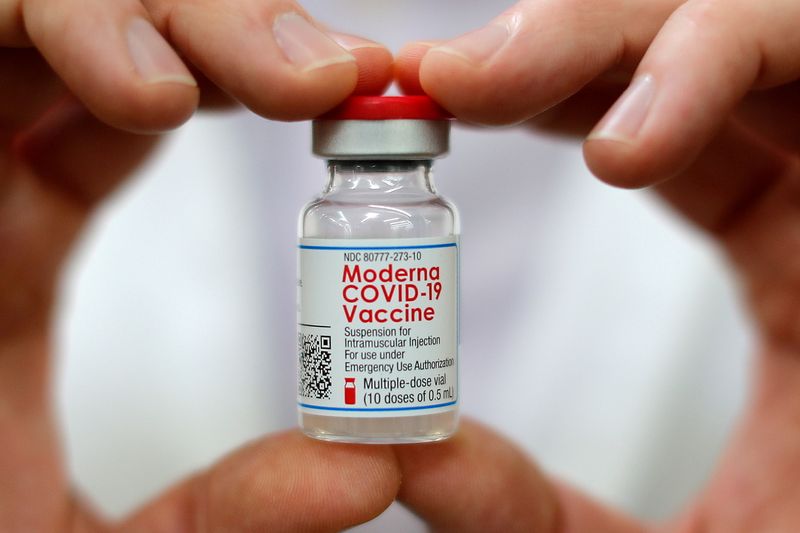

The endorsement comes after the Food and Drug Administration (FDA) approved Moderna's updated SpikeVax vaccine in August, targeting the KP.2 variant of the virus. Despite a general decline in vaccination rates, Piper Sandler suggests that the increased vaccination recommendations for specific populations may lead to higher sales than the current guidance of $3 to $3.5 billion in 2023 and $2.5 to $3.5 billion in 2025.

Looking ahead, Moderna plans to submit Biologics License Applications (BLAs) for its next-generation COVID vaccine mRNA-1283, a combination flu and COVID vaccine mRNA-1083, and mRESVIA for high-risk adults. These submissions are anticipated to potentially receive expedited approval in 2025. The firm's financial position appears robust, with Moderna reporting $10.8 billion in cash at the end of the second quarter of 2024, which Piper Sandler notes should be enough to reach cash flow breakeven.

The analyst's commentary highlights the potential for Moderna's product sales to outperform current projections, bolstered by the ACIP's updated vaccination recommendations and the pipeline of new vaccines awaiting approval. Piper Sandler's reaffirmed price target reflects confidence in Moderna's financial health and future market performance.

In other recent news, Moderna has seen significant developments in its financial and operational landscape. TD Cowen maintained a Hold rating on Moderna shares, adjusting the company's financial model, including a reduction in projected expenses and a revised sales forecast for Moderna's Respiratory Syncytial Virus (RSV) vaccine. The firm set a new third-quarter GAAP EPS estimate for Moderna at a loss of ($1.55). Moderna also faces a lawsuit from GlaxoSmithKline (NYSE:GSK) over alleged patent infringement related to its COVID-19 vaccine, Spikevax.

Moderna reported revenues of $6.7 billion from Spikevax last year and projected third-quarter revenues around $1 billion. Analyst firms such as Jefferies and Piper Sandler have adjusted their hold ratings and price targets due to these developments. Moderna has also appointed former CEO of Vifor Pharma, Abbas Hussain, to its board of directors and initiated a Phase 3 clinical trial for its investigational norovirus vaccine, mRNA-1403.

Furthermore, Moderna's updated COVID-19 vaccine, SPIKEVAX®, has received approval from Health Canada. The company estimates product sales to be between $3 billion and $3.5 billion for the current year, with projected revenues of approximately $6.0 billion in 2028. These are the recent developments for investors to consider.

InvestingPro Insights

Recent InvestingPro data provides additional context to Moderna's financial situation and market performance. As of the last twelve months ending Q2 2024, Moderna reported revenue of $5.05 billion, representing a significant year-over-year decline of 52.6%. This aligns with the article's mention of declining vaccination rates and the company's guidance for lower sales in the coming years.

Despite the revenue decline, Moderna's balance sheet remains strong, with InvestingPro Tips highlighting that the company "holds more cash than debt" and "liquid assets exceed short term obligations." This corroborates the article's statement about Moderna's robust financial position with $10.8 billion in cash at the end of Q2 2024.

However, investors should note that Moderna is currently unprofitable, with a negative gross profit margin of -62.99% and an operating income margin of -91.78% over the last twelve months. An InvestingPro Tip also indicates that the company is "quickly burning through cash," which may be a concern if the new vaccination recommendations don't translate into increased sales as anticipated.

The stock's recent performance has been challenging, with InvestingPro data showing a 54.83% decline over the past three months and a 50.95% drop over six months. This context makes Piper Sandler's maintained Overweight rating and $115 price target particularly noteworthy, suggesting potential upside from current levels.

For investors seeking a more comprehensive analysis, InvestingPro offers 14 additional tips for Moderna, providing a deeper understanding of the company's financial health and market position.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.