SAN JOSE, Calif. - PayPal Holdings, Inc. (NASDAQ: PYPL) has expanded the utility of its PayPal USD (PYUSD) by integrating with the Solana blockchain, announced at Consensus 2024 today. This move positions PYUSD on a platform known for its high-speed and low-cost transactions, enhancing its functionality for digital commerce.

Solana's capability to process vast transaction volumes swiftly and affordably aligns with PayPal's initiative to provide a stablecoin optimized for commerce and payments. The integration with Solana is expected to offer users greater flexibility and control, as they can now choose from multiple blockchains when utilizing PYUSD.

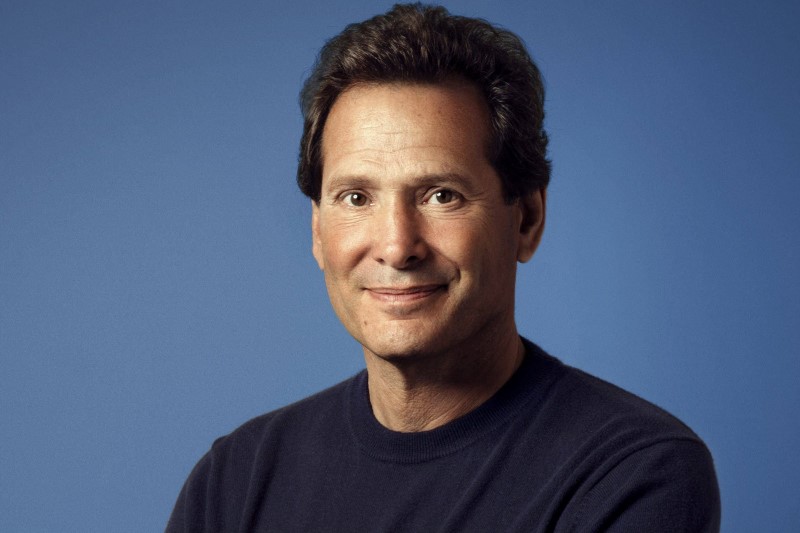

Jose Fernandez da Ponte, Senior Vice President at PayPal, emphasized the company's commitment to digital commerce innovation, noting that PYUSD's availability on Solana is a step towards evolving digital currency for commerce. Sheraz Shere from the Solana Foundation also commented on the importance of Solana's speed and scalability for developing accessible and cost-effective payment solutions.

Users will see PYUSD represented as a unified balance within PayPal and Venmo wallets, simplifying the user experience. Additionally, external transfers give users the option to send PYUSD via Ethereum or Solana. Crypto.com, Phantom, and Paxos are among the first platforms to offer PYUSD on Solana, facilitating a smooth transition from fiat to crypto for consumers and businesses.

Paxos Trust Company, a regulated entity, issues and safeguards PYUSD, with reserves fully backed by U.S. dollar deposits and U.S. Treasuries. PayPal USD is purchasable or sellable through PayPal and Venmo at a one-to-one rate with the U.S. dollar.

This announcement is based on a press release statement from PayPal Holdings, Inc. It should be noted that PayPal's virtual currency business activities are licensed by the New York State Department of Financial Services, with certain geographical restrictions, such as the exclusion of residents in Hawaii. For more information about PayPal and PYUSD, users are encouraged to refer to PayPal's Cryptocurrency Terms and Paxos Terms.

In other recent news, PayPal Holdings Inc (NASDAQ:PYPL). has been making strategic moves to expand its business model, with a particular focus on the launch of a new advertising platform. The company has appointed Mark Grether, a seasoned advertising industry executive, as Senior Vice President and General Manager of PayPal Ads. This platform aims to leverage PayPal's extensive customer data to enhance merchant sales and create personalized consumer experiences. The company's foray into advertising is backed by JMP Securities, which maintained a Market Outperform rating on PayPal's shares, and Wolfe Research, which maintained a Peerperform rating.

Additionally, the company's recent actions have caught the attention of prominent investors. Cathie Wood's ARK Invest ETFs have increased their stake in PayPal, signaling a growing confidence in the company's future prospects. This investment activity comes amid a series of other strategic initiatives by PayPal, including the launch of Smart Receipts, PayPal CashPass, and the upcoming introduction of Fastlane, an expedited guest checkout experience.

InvestingPro Insights

As PayPal Holdings, Inc. (NASDAQ: PYPL) forges ahead with its integration of PYUSD on the Solana blockchain, the company's financial metrics and market sentiment provide additional context to this strategic move. With a market capitalization of $65.03 billion, PayPal remains a formidable player in the financial services industry. The company's commitment to innovation is underscored by aggressive share buybacks, as noted in one of the InvestingPro Tips. This reflects management's confidence in the company's value and future prospects.

From a valuation standpoint, PayPal is trading at a P/E ratio of 15.53, which is considered low relative to its near-term earnings growth, and the PEG ratio stands at an attractive 0.22, suggesting that the stock might be undervalized given its growth trajectory. Moreover, analysts have recognized PayPal's strength, predicting profitability for the current year, which aligns with the company's positive performance over the last twelve months.

Investors should note that despite 26 analysts revising their earnings expectations downwards for the upcoming period, PayPal's revenue growth has been steady, with an 8.39% increase over the last twelve months as of Q1 2024. Additionally, the company's operating income margin of 16.67% indicates a healthy level of profitability.

For those interested in deeper analysis and more InvestingPro Tips, including the company's dividend policy and additional insights, visit https://www.investing.com/pro/PYPL. There are 6 additional tips available to help investors make informed decisions. Remember, you can get an extra 10% off a yearly or biyearly Pro and Pro+ subscription with the coupon code PRONEWS24.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.