Investing.com – The weakness in the post-pandemic recovery of China's economy remains on investors' radar, particularly in the industrial and infrastructure-related metals market. With data showing a slowdown in industrial production and a cooling of investments in metal-intensive fixed assets, perspectives are varied, highlighted Julius Baer in a note sent to clients and the market on Tuesday.

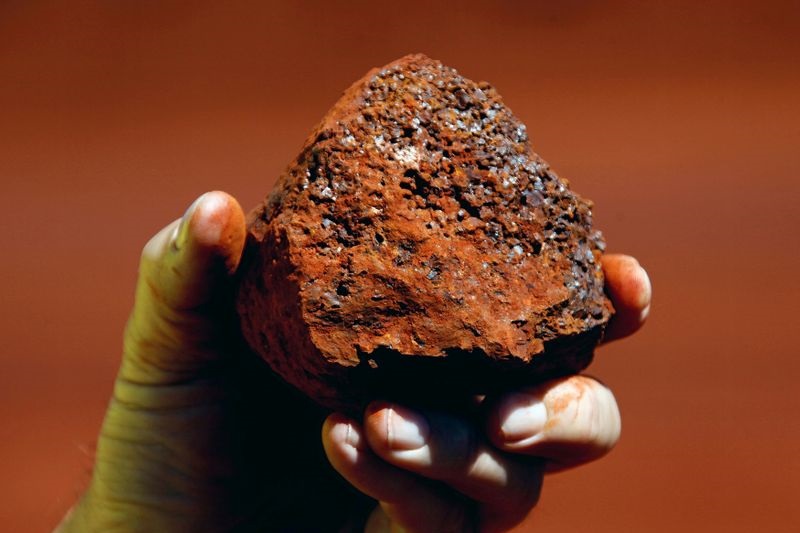

"We are cautious regarding iron ore, which is more heavily exposed to the real estate market, and constructive regarding copper, although prices are likely to remain range-bound as evidence of an industrial recovery is lacking," points out Carsten Menke, Head of Next Generation Research at Julius Baer.

Iron ore prices seem "to have lost their stimulus hope premium," adds Menke, reinforcing unchanged opinions for these commodities. Meanwhile, steel prices in the Chinese market are at their lowest levels in the last seven years, and the Swiss group's specialist does not see any change in this scenario for now.

Copper, on the other hand, has been driven by hopes of a global industrial recovery, and the recent correction is seen as a "cooling of the overly optimistic market climate," assesses Menke, who has a constructive long-term outlook for prices. However, he states that prices should remain "within limits as evidence of a global industrial recovery does not increase."

**

Want to know if a commodity sector stock can rise or pay good dividends?

On InvestingPro, with just a few clicks, you know all this and still have access to:

- ProPicks: Strategies using AI to select explosive stocks.

- Fair Price: Know if a stock is expensive or cheap based on its fundamentals.

- ProTips: Quick and direct tips to simplify financial information.

- Advanced Filter: Find the best stocks based on hundreds of metrics.

- Ideas: Discover how the world's top managers are positioned and copy their strategies.

- Institutional-level Data: Build your own strategies with stocks from around the world.

- Turbo Navigation: Investing.com pages load faster, without ads.

WE HAVE A WINTER PROMOTION! Take advantage and use the coupon BEPRO to get an additional discount on the 1 or 2-year Pro or Pro+ promotion. Click here and secure your special price now!