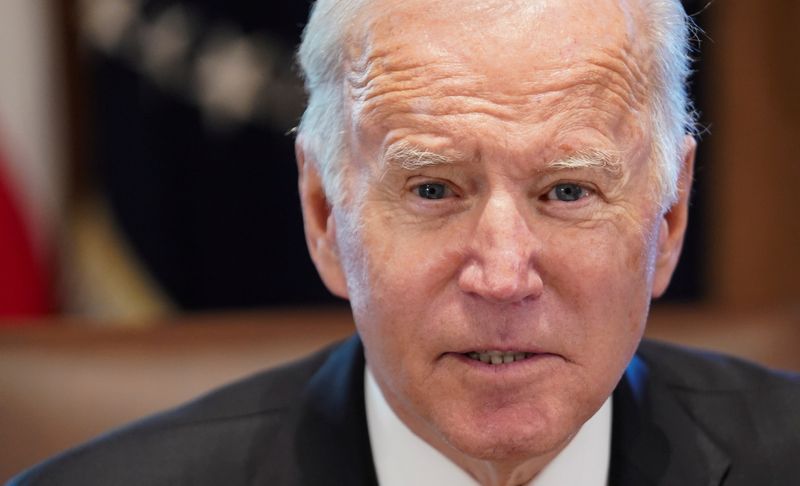

Investing.com -- President Joe Biden will likely see to it that America’s heavily-drawn oil reserve is refilled although he might require another term of office to finish the task, Energy Secretary Jennifer Granholm said Wednesday.

“The bottom line is we are going to replenish,” Granholm said in an interview with CNN, referring to the Strategic Petroleum Reserve, or SPR.

Since Biden’s term is ending in less than 18 months, “I’m not sure it’ll be fully replenished,” Granholm said. But she added: “Certainly, the plan is this term and the next term to be able to do that.”

Biden is up for reelection in November 2024.

His administration has leaned heavily on the SPR since late 2021 to offset tight crude supplies that had raised fuel costs for Americans. As of last month, the SPR's crude balance was at its lowest since November 1983 after the release of about 200 million barrels or more over the past 18 months.

Biden’s use of the SPR has, however, been a highly-charged matter for oil bulls and his political opponents. Both sides accuse him of indiscriminately releasing hundreds ofMs of barrels from the stockpile to subdue crude prices and shore up his political standing with American voters — when the reserve is meant for emergency use, in times of critically short oil supply.

The president, in his defense, has said he was only acting to reduce record high pump prices of gasoline, which stood at above $5 per gallon last June and have fallen since to around $3.50. Biden also blames last year’s high crude oil prices for US inflation getting to four-decade highs of above 9% in June 2022.

In recent months though, the administration has moved to refill the SPR after canceling sales from the reserve mandated for 2024.

Last week, the Department of Energy announced buying plans of about 6M barrels for the SPR, on top of a previously-stated 12M, and invited U.S. energy firms to offer their selling prices.

The administration has previously stated that it intends to buy oil for the SPR at around $70 per barrel. At Friday’s market settlement, U.S. crude’s U.S. West Texas Intermediate benchmark settled $75.75 a barrel.