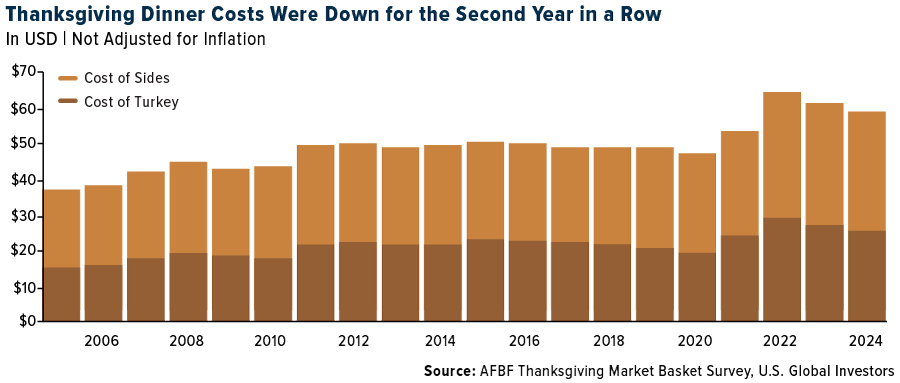

As families gathered to celebrate Thanksgiving last week, there was a morsel of good news for consumers: the cost of the traditional feast fell for the second year in a row. A classic Turkey Day dinner for 10 cost $58.08, down 5% from last year, according to the American Farm Bureau Federation’s (AFBF) annual survey.

That should come as welcome relief, but before we raise a toast to declining prices, keep in mind that costs are still nearly 20% higher than they were just five years ago.

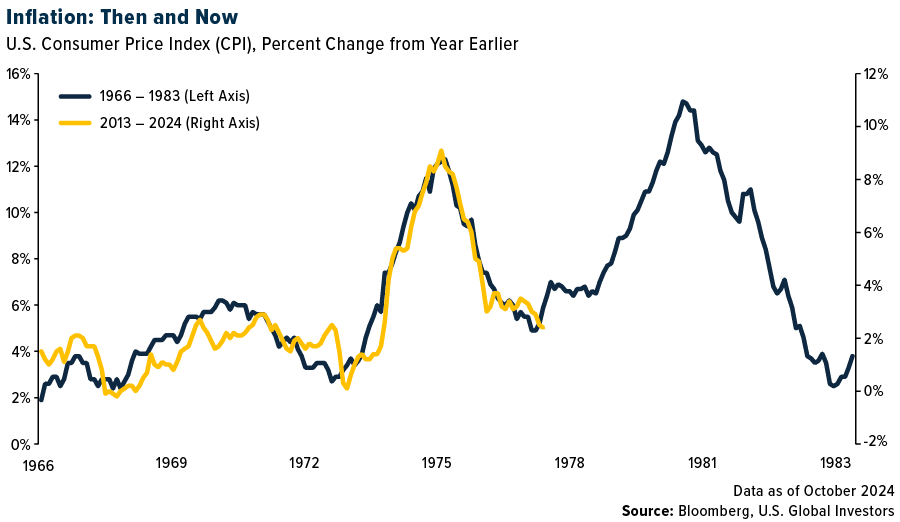

Could we be on the cusp of another wave of rising costs? If President-elect Donald Trump’s proposed tariffs on imports from China, Mexico and other key trade partners come to fruition, the answer may well be yes.

History teaches us that tariffs—while well-intentioned as tools for protectionist policies—tend to raise consumer prices. And the American dinner table may once again feel the squeeze.

Are Tariffs a Recipe for Higher Costs?

Among Trump’s proposals is a sweeping 60% tariff on all goods imported from China and a 25%-tariff on goods from Mexico and Canada. The tariffs will remain on Mexican and Canadian goods until the two countries crack down on their “ridiculous Open Borders,” Trump says.

Most economists agree that these policies, if enacted, would result in higher costs for U.S. consumers. After all, tariffs are essentially taxes on imports, and the importing businesses typically pass those costs on to the end consumer.

The size of the impact would depend on the specifics. A hypothetical 10% tariff on all goods entering the U.S. would increase overall prices by an estimated 1.3% annually, according to UBS. Selective tariffs targeting specific goods or countries could be even more disruptive, especially if supply chains can’t adjust quickly enough to avoid the additional costs.

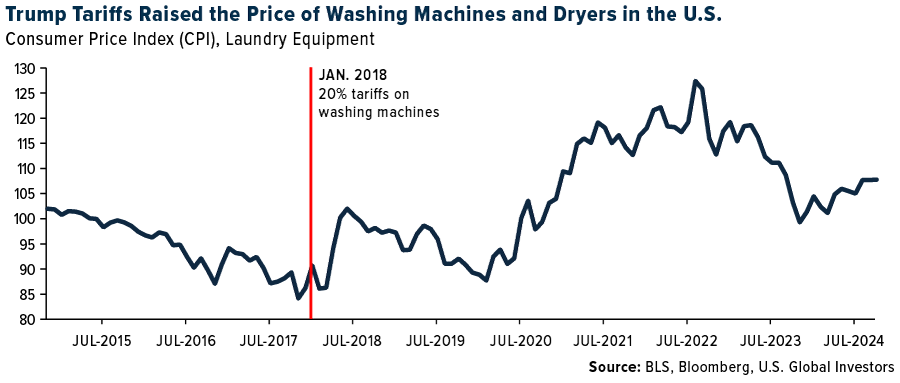

Consider the washing machine tariffs imposed during Trump’s first term. From February to May 2018, the price of laundry equipment in the U.S. rose a massive 16.4%—the largest three-month price jump in 40 years of Bureau of Labor Statistics (BLS) data. Twelve months after the tariffs were in place, Americans were paying roughly $100 more per washing machine and dryer.

Similarly, the broader trade war with China raised costs for everything from electronics to furniture, adding an estimated $3.2 billion per month in additional taxes for American consumers.

The same could happen again, but on an even more dramatic scale. Under Trump’s trade policies, a pair of $80 jeans could cost between $10 and $16 extra, while a $50 tricycle could cost an additional $18-$28 more, according to a new report by the National Retail (NYSE:NNN) Federation (NRF).

What It Means for Consumers and Investors

Trump’s proposed tariffs have significant implications for much more than just Thanksgiving dinners. If you believe tariffs are going to drive up prices on imported goods, consider stocking up now on items likely to be affected: toys, household appliances, apparel and even travel goods.

Investors should watch this space closely. Industries with lots of exposure to imported goods—retail, electronics and even agriculture—could face significant headwinds. China, Mexico and Canada are three of the U.S.’s largest trading partners, and disrupting these relationships could lead to ripple effects across commodities markets, manufacturing and technology sectors.

On the other hand, companies that produce goods domestically or operate in sectors less sensitive to global trade could find opportunities in a high-tariff climate. U.S. manufacturers that compete with imports could see increased demand due to higher prices on foreign alternatives.

Among steel producers, for instance, think Nucor (NYSE:NUE) or U.S. Steel. Higher material costs could also encourage more recycling, potentially boosting profits for scrap metal firms such as Radius Recycling (formerly Schnitzer Steel Industries (NASDAQ:RDUS)) and Steel Dynamics (NASDAQ:STLD).

Trump’s tariff proposals will likely dominate headlines in the New Year. Whether they are implemented in full, selectively or through compromise remains to be seen. What should be clear, though, is that these policies will carry costs—not just for consumers but for the economy as a whole.