Yesterday, I was speaking at the Italian Stock Exchange's TOLEXPO event; a very important event in Milan that gave me the opportunity to speak and engage with several investors.

Feelings ranged from fear to anxiety, to uncertainty, but in general, there was a good deal of pessimism. Then some (a few actually) were also inclined to invest because when the markets go down you buy better, but again a small minority.

Yet, once again, we must put the situation in context...

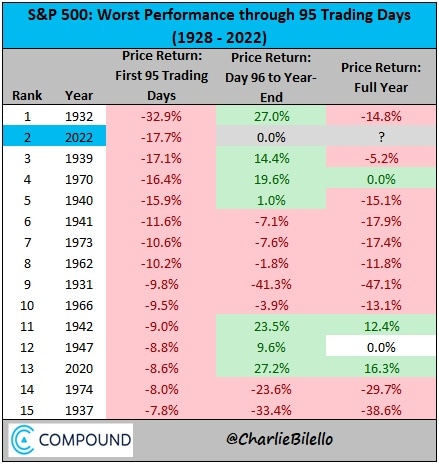

The stock market, if we look at the S&P 500 index, has lost 18.16% since the beginning of the year, and in addition to this, we note that the Drawdown (calculated to the day before), since the beginning of the year is the second-worst in history.

Here we can look at the glass as half empty or half full, meaning we can focus on how negative this period is, or we can focus on the opportunities it offers.

I personally focus on the latter, but I do so for a specific reason: I am an investor, and my strategy foresees a first major check in 2030, this period will be just one of many that I will probably have to face.

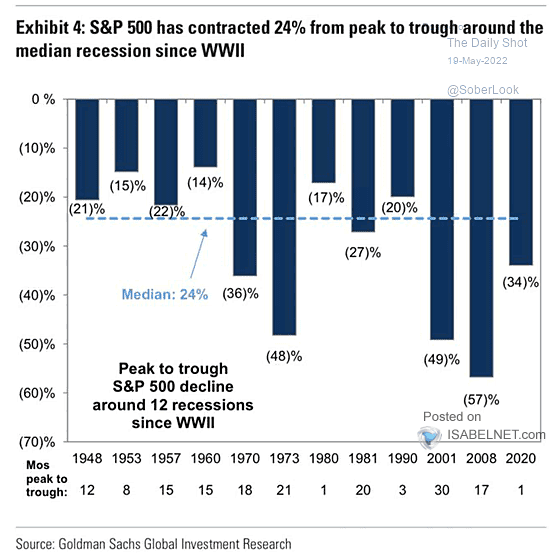

Also, I always remember, now that everyone is talking about recession, that the average drawdown in recessionary periods is -24% (see below), so when I say prudently let's put it in the perspective of a -25%/-30% market this is also inclusive of similar reasoning, of course, there have also been worse drawdowns, but as always we have to look at probability and statistical frequency.

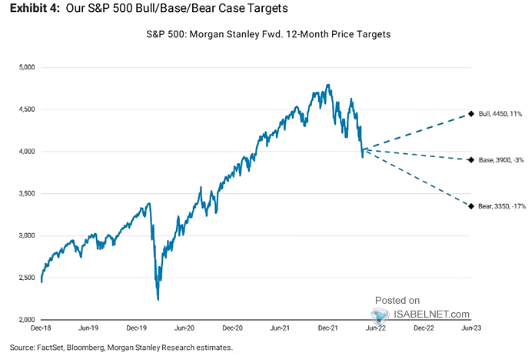

Recently, Morgan Stanley released a report regarding the possible levels of the S&P 500 between now and next year, in 3 scenarios (basic, pessimistic, optimistic) and ranging from a 17% drop from the current level to an 11% rebound, see image below.

Once again, however, I personally feel that predictions of this kind are really of almost no value if not purely for bar talk, as one cannot predict the future.

Better as I always say to focus on strategy, and how to behave should certain scenarios actually occur, I find it much more practical.

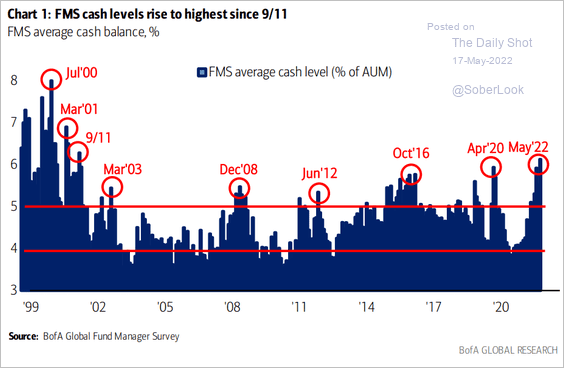

Finally, once again we note that despite a -18%, prudent investors' cash levels have surpassed not only the COVID period, but even the subprime crisis.

This is yet another demonstration that going with the flow and getting slammed left and right by the markets is common practice, here they are cash positions probably resulting from selling (at a loss) positions that were evidently mismanaged before.

Once again, I always have to laugh, people do the opposite of what they should do when buying in a store, i.e. purchasing products at the normal rate instead of waiting for discounted prices.

A contradiction that has no parallel in human behaviour, and should make us reflect on how very often disappointing results come not from the market, but from oneself.

Until next time!

If you find my analyses useful and would like to receive updates when I publish them in real-time, click on the FOLLOW button on my profile!

"This article is written for informational purposes only; it does not constitute a solicitation, offer, advice or recommendation to invest as such and is in no way intended to encourage the purchase of assets. I would like to remind you that any type of asset, is valued from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with you."