Do we need to worry about the end of the US dollar dominance in international trade – the de-dollarization of global finance?

There is widespread discussion and concern in some quarters as China and Russia push forward efforts to establish the Chinese Yuan as an alternative currency for international trade settlement and that this could spell the sunset of the dollar’s dominance. Some of the more animated commentators declare that de-dollarization will dramatically and immediately eviscerate the standard of living in the United States and condemn the nation to be an also-ran third-rate economy as its citizens descend into unspeakable squalor.

Obviously, such ghoulish prognostications are ridiculously overdone for the purpose of generating clicks. But how much of it is true, at least on some level? What would happen if, tomorrow, the US dollar lost its status as the world’s primary reserve currency?

One thing that wouldn’t change at all is the number of dollars in circulation. That’s a number that the Federal Reserve exerts some control over (they used to have almost total control when banks were reserve-constrained; now that banks have far more reserves than they need, they can lend as much as they like, creating as many floating dollars as they like, constrained only by their balance sheet). The holders of dollars have absolutely no control over the amount of them in circulation! If Party A doesn’t like owning dollars, they can sell their dollars – but they have to sell them to Party B, who then holds the dollars.

What also wouldn’t change immediately is how many dollar reserves every country holds. From time to time, people get concerned that “China is going to sell all of its dollars.” But China got those dollars because they sell us more stuff than we sell them, which causes them to accumulate dollars over time. How can China get rid of its dollars? Their options are fairly limited:

- They can start buying more from us than they sell to us. We’ve been trying to get them to do this for years! Seems unlikely.

- They can buy our stuff priced in dollars, but only sell goods to us that are priced in Yuan. To get Yuan, a US purchaser would have to sell dollars to buy Yuan. Since China doesn’t want to be on the other side of that trade (which would leave them with the same amount of dollars), the US purchaser would have to go elsewhere to buy Yuan. This would strengthen the Yuan. This is also something we’ve been trying to get them to do for years! The Bank of China stops the Yuan from strengthening against the dollar by…selling Yuan and buying dollars. Hmmm.

- They can just hit the bid and sell dollars against all sorts of other currencies. This would greatly weaken the dollar and is perhaps the biggest fear of many of the people worried about de-dollarization.

Supposing that China decided on #3, they would be making the US industry much more competitive around the world against all of the currencies that China was buying. Foreign buyers of US products would now be able to buy US goods much more cheaply. It would cause more inflation in the US, but it would take a large dollar decline to drastically increase US inflation since foreign trade is a smaller part of the US economy than it is for many other countries.

A much lower dollar, making US prices look lower to non-US customers, would help balance the US trade deficit. Yay!

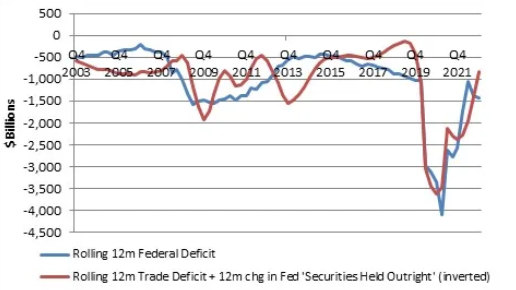

A tendency towards a balance of the trade deficit would have ancillary impacts. When the US government runs a fiscal deficit, it borrows from essentially two places: domestic savers and foreign savers. Foreigners, having a surplus of dollars (since they have trade surpluses with us), buy Treasuries, among other things.

If the trade deficit went down drastically, so would foreign demand for US Treasuries. That, in turn, would (unless the government started to balance its fiscal deficit) cause higher interest rates, which would be necessary to induce domestic savers to buy more Treasuries. Or, if domestic savers were not up to the task, the buyer of last resort would be…the Federal Reserve, which could buy those bonds with printed money. And that’s a really bad outcome.

Now, does any of this cause a collapse of the American system or spell an end to US hegemony? No. If policymakers respond to such an event by refusing to get the fiscal house in order, then things could get ugly. But it would be hard to blame that outcome on the end of the dollar as the medium of international trade – blame would more appropriately be directed at the failure of domestic policymakers to adjust in response.

In the end, it is hard to escape the idea that good or bad economic and inflation outcomes in the United States track mainly, one way or the other, back to domestic policy decisions. Whether the US economic system remains a dominant one is…fortunately or unfortunately…in our hands, not in the hands of foreign state actors.