- Big Tech stocks face scrutiny despite mixed earnings.

- In this piece, we examine which tech stock could be the best bet after the reports.

- Analysts highlight Alphabet's significant growth potential.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Big Tech is at a critical juncture on Wall Street. Despite some companies reporting better-than-expected quarterly results, the market has been tough on the stocks that have fueled the stock market's rise in recent years.

Investors are demanding more from these tech giants, known as the Magnificent 7, particularly in light of the high valuations they have achieved. There's a growing concern about the impact of artificial intelligence expenditures, which could potentially reduce future earnings.

Who’s Up and Who’s Down Post Quarterly Reports

With NVIDIA (NASDAQ:NVDA) set to report its earnings on November 14, the tally for the Magnificent 7 following the latest reports stands at 3 to 3.

As per the latest data available at the time of writing, the losing stocks include Microsoft (NASDAQ:MSFT) (-5.44%), Meta Platforms (NASDAQ:META) (-5.49%) and Apple (NASDAQ:AAPL) (-3.52%).

In contrast, Alphabet (NASDAQ:GOOGL) (+1.51%), Amazon.com (NASDAQ:AMZN) (+1.58%), and Tesla (NASDAQ:TSLA) (+11.41%) surprised the markets positively. Notably, Elon Musk's company achieved outstanding results, accelerating when many anticipated another slowdown.

However, even among the gainers, uncertainties persist. Amazon and Tesla face increasing competition from their Chinese rivals, Google is grappling with various antitrust issues in the US, and stringent European competition regulations pose challenges for many American tech giants.

Investment Outlook for Big Tech

In light of these results and future prospects, which Big Tech stocks should investors consider for the future?

Quarterly reports provide an excellent opportunity to analyze not just the last 90 days but also how companies are likely to perform in the coming months.

Many analysts leverage all published data to update their ratings on stocks. Utilizing tools from InvestingPro, we can quickly overview broker expectations for the Magnificent 7 over the next 12 months.

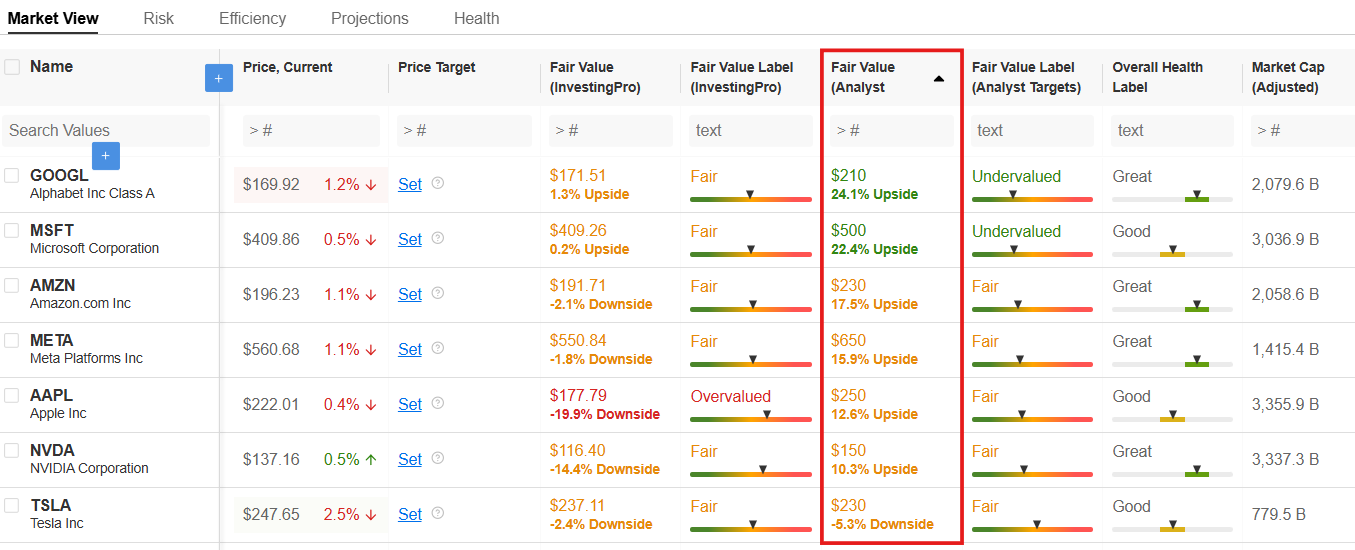

By creating a dedicated watchlist, we can compare the stocks effectively. And here is the result:

Source: InvestingPro (Data as of November 5, 2024)

As shown in the image above, following the latest earnings reports, analysts identify Alphabet as the stock with the highest growth potential over the next 12 months.

Analyst Predictions and Price Targets

According to the 48 experts covering the stock, GOOGL shares are projected to rise by 24.1%, increasing from $169.40 on November 4, 2024, to $210 within a year.

Microsoft ranks second with a potential upside of 22.4% (Target Price at $500), while Amazon ranks third with a Target price of $230 per share, indicating a 17.5% increase from $196.12 on November 5.

This is followed by Meta (+15.9%), Apple (+12.6%), and Nvidia (+10.3%).

Conversely, Tesla is the only Wall Street Magnificent expected to decline in the next 12 months, with a target price of $230, reflecting a 5.3% decrease from $248.18 at the market close on November 4, 2024.

Overvaluation Concerns

From a fair value perspective, as assessed by InvestingPro using over 12 recognized financial models tailored to each stock's characteristics, most of the stocks appear fairly valued, with values ranging from +1.3% for Alphabet to -2.1% for Amazon.

However, Nvidia, with an intrinsic value of $116.40 (-14.4%), and Apple, with a fair value of $177.79 (-19.9%), are deemed overvalued.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.