- The debate over whether we are in a recession is not material to monetary policy or market action.

- Another term that is broadly agreed upon, but even less useful, is the Non-Accelerating Inflation Rate of Unemployment (NAIRU).

- However, the Fed pays close attention to NAIRU—so that nonsense label matters.

There is an old riddle that I remember from a kids’ joke book I checked out from the Fort Worth Public Library when I was about 6 years old:

Q: How many legs does a dog have, if you call his tail a leg?

A: Four. Calling a tail a leg doesn’t make it one.

Although that was in a riddle book, it has always stuck with me as being much more profound than “what is black, white, and red all over?”

Calling a tail a leg doesn’t make it one. It almost has a Zen koan feel to it. A thing is what it is. You may call it something else; you may even perceive it to be something else, but neither words nor perceptions change reality.

That riddle percolated back into my memory last week when we entered the absurd, albeit predictable, debate about whether or not the U.S. is in a recession or not.

Arguing about definitions is weird. Whether we call this a recession or not, it will not affect monetary policy because there is no separate playbook that comes out when the label for the part of the business cycle changes. Whether we call this a recession or not, it won’t change any votes in the midterms—people don’t vote based on whether the economy is currently labeled “recession” or “expansion”; they vote on the basis of how they feel.

In the most famous polling formulation, “Is the country heading in the ‘right direction’, or is it on the ‘wrong track'?” And, of course, there is much wisdom in Truman’s definition:

“A recession is when your neighbor loses his job; it’s a depression when you lose your job.”

Part of the reason this is a contentious debate is that both sides have reasonable points. Those who say that we are in a recession by the traditional rule of thumb are correct: because the NBER Business Cycle Dating Committee won’t actually rule on when the recession began until probably a year from now, it’s not unreasonable to ask for a more available heuristic and ‘two consecutive quarters of negative growth has the benefit of being easy to calculate and highly correlated with the official (but very delayed) definition.

On the other hand, those who say that we may not actually be in a recession, regardless of the two negative quarters of growth, also have a point. Perhaps spending is soft because people feel poorer since they didn’t get a stimmy check recently, even though we are close to full employment by most measures. So on a cash flow basis, people should be optimistic, then it’s plausible to suggest that the recession might not be here (yet).

In fact, I think that’s basically what President Biden meant when he said, in his inimitable what-the-hell-did-he-say style:

“One year, even though you didn’t have the job you had now, even though you didn’t get a raise that year — the difference between having a job and having a 5% raise or … whatever it happens to be, in the face of inflation, the price of the pump … you know, it’s like, ‘Whoa, I feel worse off.’ I didn’t get a check for 8 grand from the government, among other things.’ Does that make sense to anybody, or is it just me?”

Again, it doesn’t really matter whether the sign says “recession” or “expansion”. This isn’t an airplane lavatory that is either occupied (and, therefore, not much use to me at the moment) or not. The economy is devilishly complex, and this cycle is, in absolute fairness, unlike any other we have ever had.

That being said, I have maintained for a while that we are almost certainly going to have a recession—in the sense of the unemployment rate going up, corporate earnings going down, etcetera—because whenever energy prices skyrocket and the Fed raises interest rates aggressively, we always do. I don’t know if this is a tail, or a leg, right now.

Taking A Step Back

More importantly, it doesn’t matter for the topic at hand, which is inflation. This is another statement about which people earnestly argue. Still, unlike the “recession definition” debate, there is only one reason to expect a recession to result in lower inflation (aside from things like gasoline prices—tightly linked to economic activity). That reason is that we were told that is how it works.

There is almost no evidence that, in fact, that is how it works, and a riot of counterexamples.

The earnestness of belief in the subject manifests in some amusing ways. One of my favorites is the concept of NAIRU, or the Non-Accelerating Inflation Rate of Unemployment (also called the Natural Rate of Unemployment), which is an absurdity that economists continue to insist on maintaining. It is another one of these myths where it seems like it should make sense—it just doesn’t work.

The idea is that there is some number of unemployed people that is a minimum, and that minimum isn’t zero because there are people changing jobs, careers, geographies, etc., and so there is some friction you can’t get rid of. And then some people are unemployed because while they could work, they haven’t found the right job and are looking. So when the economy is really booming, and you’ve used up all of the normal slack in the economy, employers have to bid these people off the sidelines, which causes wages to ratchet upward, which in turn causes inflation to accelerate.

That is, except for the fact that the available evidence shows that wage inflation follows price inflation. Oh, and also, we don’t know where NAIRU is. Do you know how economists estimate NAIRU? Well, they look and see where the unemployment rate is when inflation begins to accelerate. If inflation starts to accelerate when the unemployment rate is at 5%, then voila! That is NAIRU. But if inflation starts to accelerate in the next cycle at 3%, then voila again! NAIRU declined for some reason.

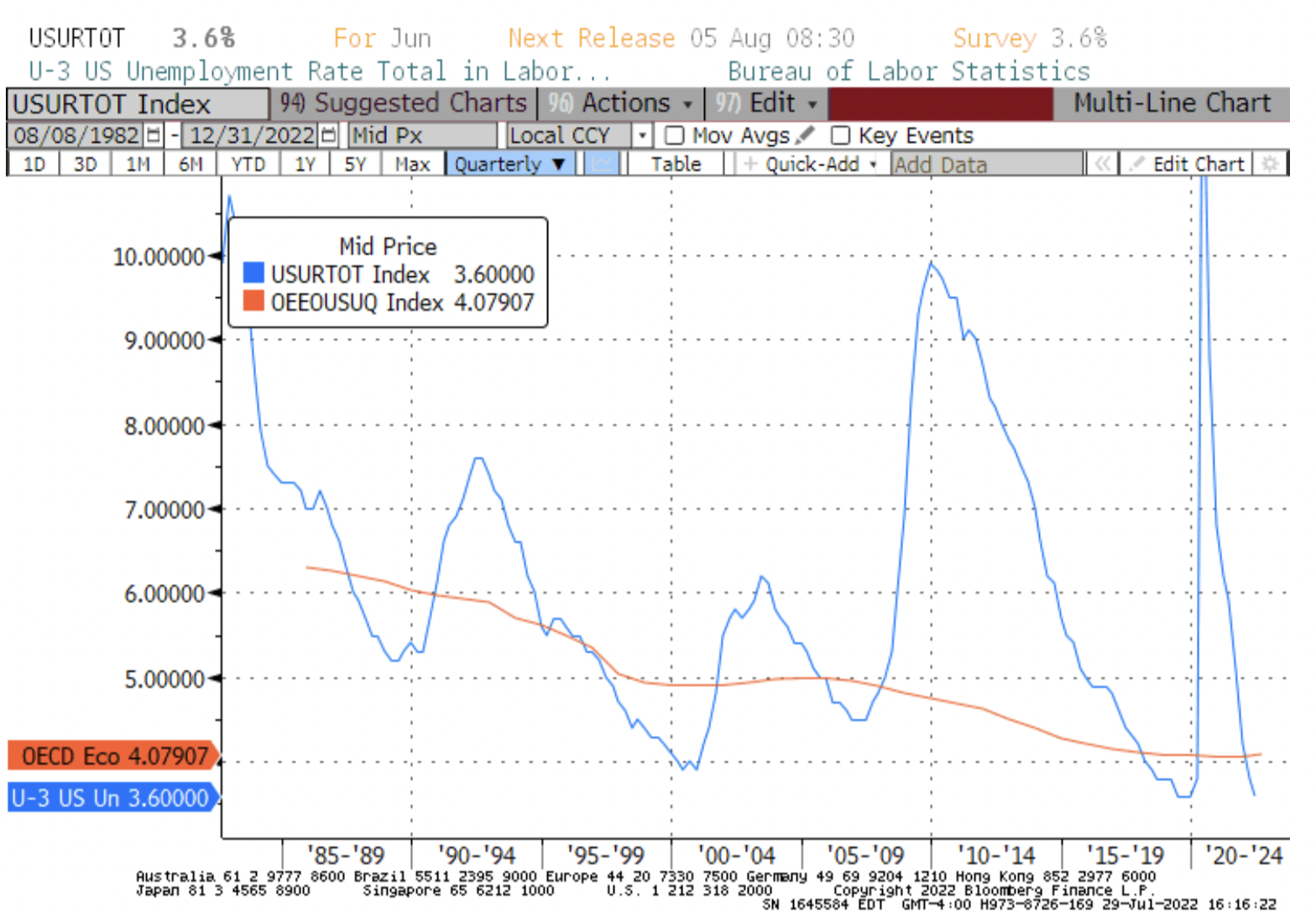

Here’s an illustration using the estimate of NAIRU from the Organization for Economic Cooperation and Development (OECD), in orange, against the actual unemployment rate, in blue.

NAIRU has been in continual decline because every time the unemployment rate went a little bit below the NAIRU estimate, we didn’t get any inflation, so economists scooched their estimates a bit lower (“scooched” is a technical term, meaning to nudge, as opposed to “scotched,” which means to get rid of it altogether.

As in, “We’ve scooched this for a while, and it doesn’t seem to work. Maybe it should be scotched.”)

But! In this case, inflation started surging long before the ‘Rate fell through the prior estimate of NAIRU. You can see that the OECD has responded by scootching the orange line slightly higher, and the longer inflation stays high, the more they’ll move their estimate of NAIRU up.

Why am I making a big deal about this?

For the same reason, I think the debate about the recession label is silly. A thing is what it is. Calling a certain level of Unemployment “Non-Accelerating-Inflation” doesn’t make it so. However, unlike with the recession label, the Fed does, in fact, have a different playbook when Unemployment is below or above NAIRU.

The OECD’s estimate, which is probably pretty close to the Federal Reserve’s estimate because these folks all party together, is 4.08%. Do you know when the US unemployment rate first declined below that level in this cycle? It was with the Employment report in January of this year. The Fed’s first hike? March. In January, inflation was already at 7%, and core inflation was at 5.5%. But the Fed believed it was all transitory until we got below NAIRU.

Right now, the unemployment rate is 3.6%, and it will begin to uptick soon—perhaps even with this Friday’s report. Once that number gets a little bit above 4%, the Fed will be done tightening. Because even though the theoretical underpinnings of NAIRU are questionable (to be charitable), the Fed believes that this tail is a leg, and they will behave accordingly.

***

Disclosure: My company and/or funds and accounts we manage have positions in inflation-indexed bonds and various commodity and financial futures products and ETFs, that may be mentioned from time to time in this column.