- Powell’s speech led to a sharp decline in markets

- Fed Chair seems to suggest that Fed still using ‘anchored inflation expectations’

- Shrinking balance sheet is needed but market illiquidity might forestall effort

There’s nothing quite like a 1,000-point drop in the Dow to clear your sinuses.

After a mostly quiet week, Fed Chairman Powell delivered five days’ worth of volatility with his speech on Friday. We all knew that the market would react violently; only, no one knew in which direction. In the event, it was down. And the reason the markets reacted in the direction they did boils down to these five words in Powell’s speech: “until the job is done.” The Chairman made clear that the FOMC is determined to bring down inflation, and not to reverse course (as the market pricing had indicated would happen in 2023) even if it hurts.

Or at least, that’s what he wanted to sound like. But here is my question: when is a hole finished?

A man is digging a hole. His mate asks him how long it will take, since they had plans to go for beers. The man answers “I am going to dig until the hole is finished.” What does that mean? Is the hole finished when it is deep enough? When it is wide enough? Deep or wide enough for what? Does ‘finishing the hole’ include moving all of the excavated dirt elsewhere? The answer has literally no content. “Until the job is done” is something your father tells you when you’re doing a chore he gave you. It isn’t an instruction, it’s an admonition.

“Keep digging. I’ll tell you when to stop.”

In the context of inflation, when is “the job done”? When inflation levels out at 2.25% on CPI for a year? When it first reaches 2.0% on core PCE? When it has declined at least 2% from the high on headline inflation? On core inflation? “Until the job is done” is every bit as much a weasel-phrase as “transitory” was a weasel word. It means nothing unless you define the terms.

Frankly, I’m not sure the Fed knows at what point the job will be done. Powell seemed to give some hints, but they were almost as useless. Consider this:

“The second lesson is that the public's expectations about future inflation can play an important role in setting the path of inflation over time. Today, by many measures, longer-term inflation expectations appear to remain well anchored. That is broadly true of surveys of households, businesses, and forecasters, and of market-based measures as well. But that is not grounds for complacency, with inflation having run well above our goal for some time.”

This is interesting, because it’s just not true. Moreover, in the last year, there has been recognition in some quarters—including at the Federal Reserve Board itself—that it isn’t true. The most compelling takedown of the notion that inflation expectations matter was last September’s paper by Jeremy B. Rudd of the Federal Reserve Board, in which he concluded that:

“A review of the relevant theoretical and empirical literature suggests that this belief rests on extremely shaky foundations, and a case is made that adhering to it uncritically could easily lead to serious policy errors.”

So why is this in Powell’s speech? Unfortunately, the Chairman basically admits that the Fed continues to rely on mean-reverting models (the assumption of mean reversion is largely based on the idea that inflation will return to the level of expectations over time) when he says “If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will.” Again, as the Rudd paper documents persuasively (and I’ve been arguing for years) state, the evidence of that is very shaky.

Having this in the speech, though, gives the Fed something of an escape hatch. They don’t have to wait for inflation to come all the way back before they declare ‘the job is done’; a sufficient decline in inflation, coupled with continued “anchored expectations,” probably would be enough for them to stop hiking rates. While many news outlets also enjoyed Powell’s channeling of Clubber Lane in Rocky III when he said “…higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” the newsworthy piece is that he also said, “We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply.” This implies the Fed will respond to recession, because that’s what “bringing demand into better alignment with supply” would look like. Which is exactly what they’ve been saying for the last week or two they didn’t care about.

So for now, we know that they will continue tightening until the job is done. Whatever the hell that means.

Taking a Step Back…

The problem with inflation, of course, isn’t that inflation expectations are too high or supply constraints. The overarching problem is that the stock of money (M2) is 41% higher than it was at the end of 2019, and the price level is only 15% higher. The difference, unless money velocity stays permanently impaired, must be closed either with tremendous real growth (unlikely) or a much higher price level. Or, the Fed needs to decrease not the rate of money supply growth (which is down to about 1% over the last few months, although bank credit is still expanding at a 10% rate) but the level of the money supply. In principle, they could get there if they continue shrinking the balance sheet via Quantitative Tightening for a few years.

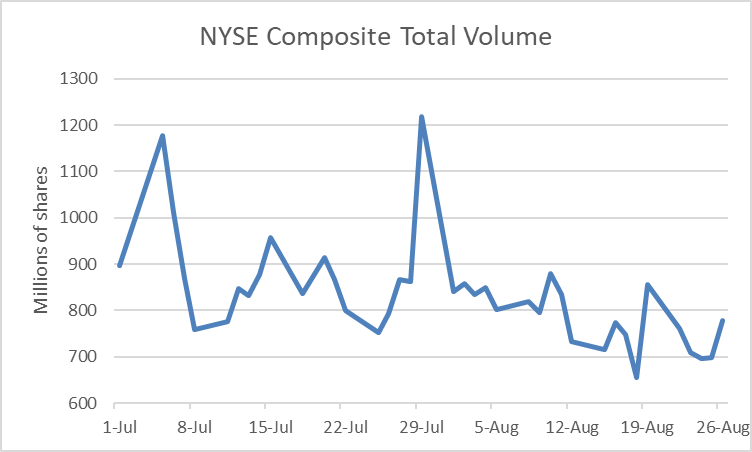

The problem with doing that is that in the process they will be pulling liquidity out of the system—not just monetary liquidity but transactional liquidity. One of the most striking things to me about Friday’s selloff was that it occurred on fairly low volume. Normally, a 3-4% selloff would be associated with a surge in volume. But Friday’s volume was lower than the prior Friday’s volume. The chart below shows NYSE composite volume in millions of shares. You can’t really see that anything interesting happened on Friday.

Source: Bloomberg

Now, technical analysts will tell you that volume reinforces the signal from price. A selloff or an advance on low volume is less significant than the same movement on high volume. That may be true. But to have that big a move on low volume also means that liquidity was pretty bad. It should require a lot of “force” to push a market 3%, but on Friday it did not.

We hadn’t previously seen such a sign of illiquidity in equity space, but this has been building in fixed-income land for a while. My final chart below shows the government liquidity index in black (higher numbers are less liquid conditions) against the Fed’s balance sheet, inverted, in blue. I have a big heavy red line at the point where the balance sheet peaked.

Now, this probably doesn’t mean that continued balance sheet shrinkage will lead to a complete inability to trade. But if there’s any significance to the seeming relationship between balance sheet shrinkage and liquidity, then the Fed might find itself having to stop the balance sheet shrinkage long before it has any impact on the level of the money supply. And, as I noted above, that means the only way out is for the aggregate price level to converge to a much higher level. It will have to keep doing that, until the job is done.

Source: Bloomberg

Disclosure: My company and/or funds and accounts we manage have positions in inflation-indexed bonds and various commodity and financial futures products and ETFs, that may be mentioned from time to time in this column.