- Walmart has cut its profit outlook three times this year, making investors nervous about owning its stock

- Walmart stock could remain under pressure if inflationary pressure persists and inventories remain high

- During periods of distress, Walmart shares have historically outperformed the S&P 500 by a considerable margin

The world’s largest retailer, Walmart Inc (NYSE:WMT), appears to be sailing in rough waters, hurt by a sudden shift in consumer spending patterns. The company has lost about 18% since reaching a record high of $160.77, dragged by a worse-than-expected earnings report in May.

Since February this year, the Bentonville, Arkansas-based retailer cut its profit outlook three times, driving investors increasingly nervous. The latest guidance came the past week when the company said its adjusted earnings per share would fall as much as 13% in the current fiscal year. Two months ago, the company said earnings per share would dip about 1%.

The root cause behind this diminishing outlook is the sudden change in US consumer behavior. Amid growing macroeconomic headwinds, retail buyers have been increasingly spurning big-ticket items and buying more groceries--where profit margins aren’t as attractive.

Furthermore, the company’s inventory surged to $61 billion in the quarter that ended on April 30, up from the $46 billion in the same time the previous year. Due to this accumulation, Walmart will be forced to offer discounts on its products, further pressuring margins.

A Buying Opportunity?

Walmart stock could remain under pressure if inflationary pressure persists and the U.S. economy slips into a recession. However, long-term investors should take this weakness as a buying opportunity, given the retail giant’s massive moat and ability to recover quickly from the economic weakness.

Consumer spending remains strong despite the heavy build-up in inventories and inflationary pressures. WMT comparable sales in the U.S. are set to climb 6% in the second quarter, which is higher than expected. The company has also made progress in clearing out inventories of consumer durables.

Cost pressures in the economy also provide Walmart a competitive edge to attract more cost-conscious customers. According to chief executive Doug McMillon, Walmart is in a solid position to win over more consumers, helped by its omnichannel focus, pushing digital penetration to record levels.

To attract cost-conscious consumers, Walmart launched a new program last week that will make it easier to shop for refurbished items from Apple (NASDAQ:AAPL), Samsung Electronics (OTC:SSNLF), and Whirlpool's (NYSE:WHR) KitchenAid. The restored merchandise will be available online and in some stores this fall.

The company is also on the right track to counter online retailers like Amazon.com (NASDAQ:AMZN) by successfully executing its own e-commerce strategy. Online sales are becoming a more significant contributor to reported same-store sales growth, as they expanded by 87% during the past two years.

During periods of distress, Walmart shares have historically outperformed the S&P 500 by a considerable margin. For instance, during the market crash of 2020, the stock continued to remain in positive territory as the broad market suffered. And during the recessions of 2002 and 2008, Walmart produced positive returns while the S&P 500 tumbled.

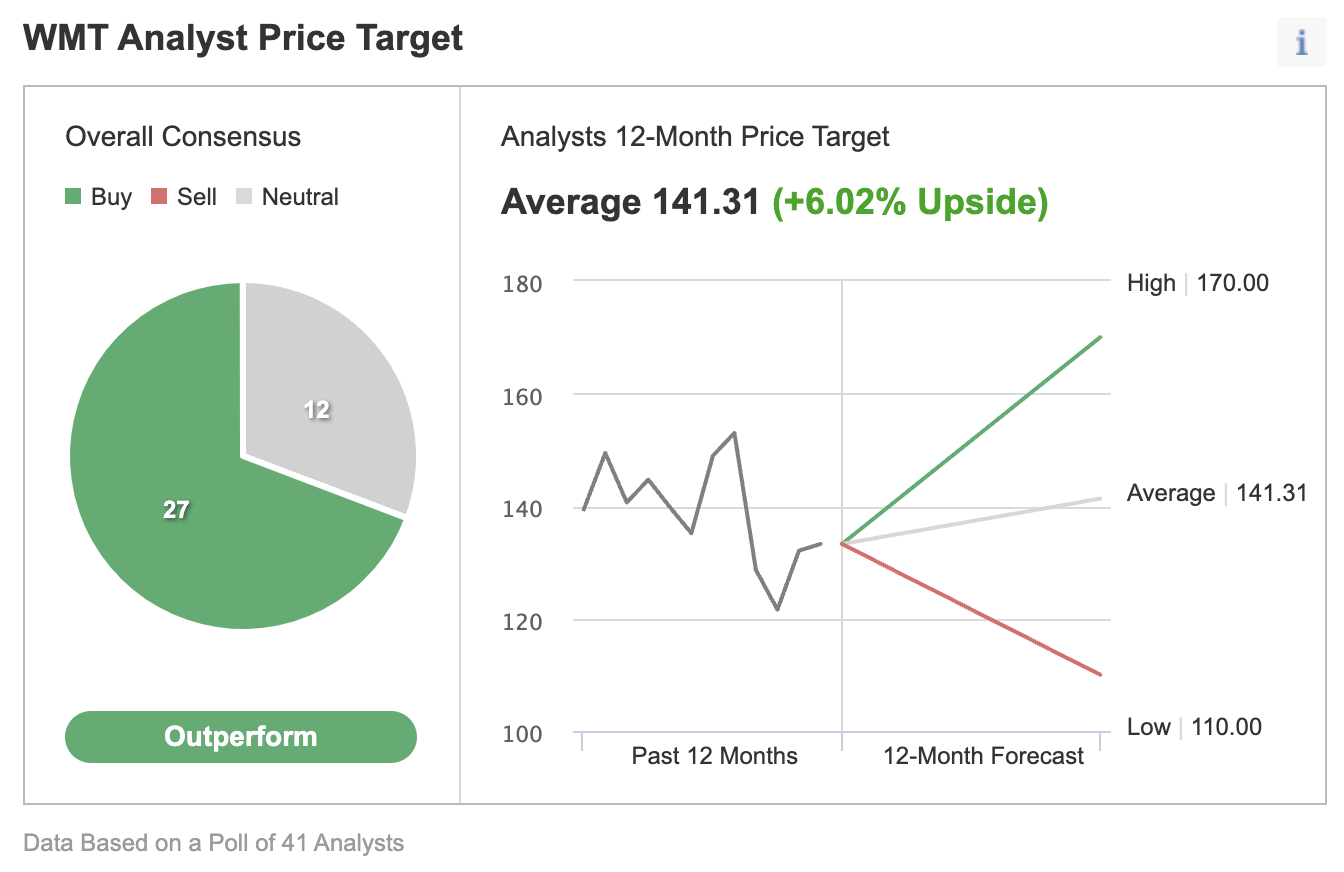

That is why many analysts remain bullish on the stock going forward. In a poll of 41 analysts conducted by Investing.com, 27 gave the stock an “Outperform” rating with a consensus 12-month average price target of $141.31, implying a 6% upside potential from the current market price.

Source: Investing.com

Analysts at Goldman Sachs wrote in a note to clients:

“We acknowledge the company’s improving profitability profile will now take longer to come to fruition (we estimate beginning in FY23), but we reiterate our Buy rating (on CL) for WMT given strong top-line trends supported by market share gains.”

The note added that cost pressures on Walmart are likely only temporary, and the company retains “solid visibility into the path towards improvement.”

Bottom Line

The current weakness in WMT is a buying opportunity for long-term investors. The company has a long history of recovering from downturns and pays a steadily growing dividend.

Disclosure: The writer is long on Walmart.