- Consumer confidence is waning amid concerns over prolonged high interest rates by the Federal Reserve.

- Despite this, retail giants like Walmart have thrived, with Walmart's stock surging almost 32% in the past year.

- However, as rates remain high and consumer spending slows, can Walmart sustain bullish momentum?

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

U.S. consumer confidence is showing signs of decline as worries about the Federal Reserve keeping interest rates high for longer start to bite. This could pose a threat to the retail sector, which has been a key driver of the economy's recent growth.

Retail giants like Walmart (NYSE:WMT) have benefited immensely from Americans' strong spending habits. Over the past year, Walmart's stock price has soared 32%, pushing its market cap above $525 billion.

In its latest quarterly report, Walmart handily beat expectations. Between January and March 2024, the company reported:

- Revenue: $161.5 billion (up 6% year-over-year)

- Adjusted EPS: $0.60 (up 14.2% above estimates)

- Adjusted Operating Income: $7.1 billion (up 13.7% year-over-year)

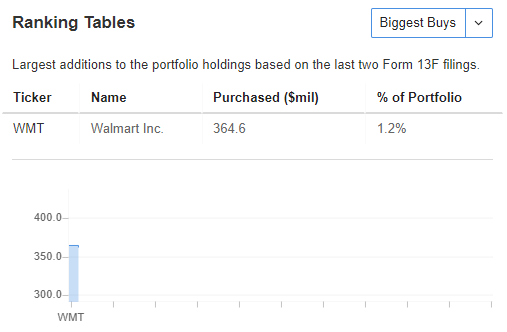

Even Bill Gates, known for his tech investments, seems to be bullish on retail. In the past two quarters, his only major investment has been in Walmart, snapping up $364.6 million worth of shares. (InvestingPro subscribers can view Bill Gates' portfolio here)

Source: InvestingPro, Bill Gates Portfolio.

However, with consumer confidence dipping, the question remains: can retail stocks like Walmart maintain their momentum as rates remain higher for longer and consumer spending starts to slow?

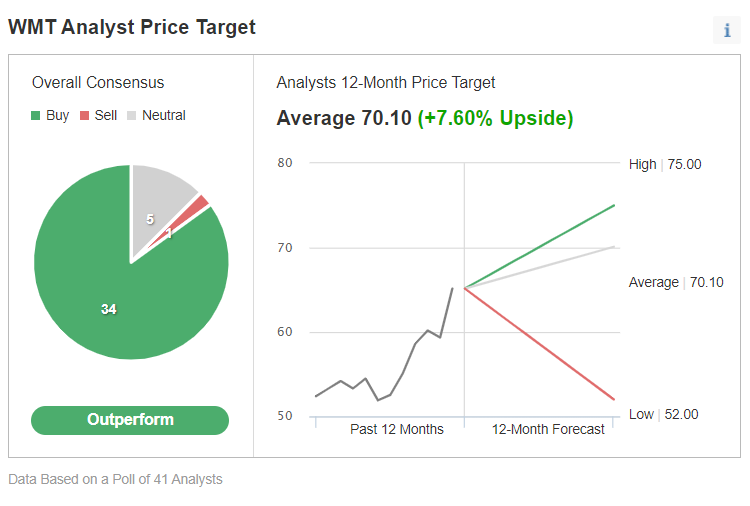

Analysts Remain Bullish on Walmart

Out of 41 surveyed, 34 recommend buying the stock, 12 advise holding, and only 1 suggests selling. The average target price sits at $70.10 per share, representing a 7.6% increase from the May 21st closing price.

Source: InvestingPro

This optimism is fueled by expectations of continued revenue and earnings growth.

Source: InvestingPro

One key reason for Wall Street's affection is Walmart's commitment to shareholder returns. As a dividend king, the company has raised dividends for 29 years straight, and it consistently buys back shares.

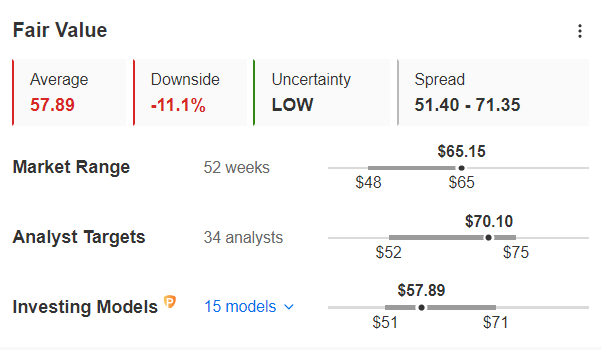

On the other hand, however, the RSI index suggests that the stock is in overbought territory, and based on InvestingPro's Fair Value, Walmart shares are slightly overvalued with an 11.1% decline projected from $65.15 at the close on Tuesday, May 21.

Source: InvestingPro

Walmart Director Sells the Stock, Should You Follow Suit?

On May 17, Walmart director Robson S. Walton, a prominent member of the company's founding family, sold a substantial number of shares, netting over $228 million at an average price of $64.5545 per share.

Although Walton remains a major shareholder through various trusts and limited liability companies, this significant transaction has garnered attention.

The reason behind Walton's decision to sell was not disclosed. However, the sale allowed him to capitalize on the recent stock rally, converting a portion of his holdings into cash.

This move could be interpreted as a strategic response to the current uncertainties surrounding the economy, particularly the Federal Reserve's monetary policy.

Stock's Long-Term Fate Depends on the Fed

Investors are increasingly focused on how the Fed will manage inflation and interest rates. The potential for monetary tightening poses risks to stock markets, as prolonged high rates could eventually dampen economic momentum.

In such a scenario, the exuberance could give way to a sudden market downturn, affecting both the broader economy and stocks like Walmart.

As the Fed navigates these economic challenges, investors must remain vigilant. The central bank's actions will significantly impact market dynamics, making it crucial to monitor monetary policy developments closely.

***

DISCOUNT CODE.

Take advantage of the MAY DISCOUNT click here to perform an in-depth analysis on Walmart and 180,000 other listed companies worldwide, and start investing like a PRO!

The link directly calculates and applies the discount of an additional 10%. In case the page does not load, you enter the code proit2024 to activate the offer.

You will get a set of exclusive tools that will allow you to better cope with the market:

- ProPicks: equity portfolios managed by a fusion of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 synthetic indicators based on financial data that provide immediate insight into the potential and risk of each stock.

- Advanced Stock Screener: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can dig themselves into all the details.

- And many more services, not to mention those we plan to add soon!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.