- Ongoing correction in the USD/JPY pair could be coming to an end

- This comes at a time when BOJ's Adachi has dismissed rumors of a monetary policy shift

- Meanwhile, the recent GDP revisions have boosted the US dollar; Could 160 be in sight for USD/JPY if uptrend resumes?

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

The USD/JPY currency pair is undergoing a correction in its long-term upward trend, primarily fueled by the periodic weakness of the US dollar due to disinflation and a potential Fed pivot in May.

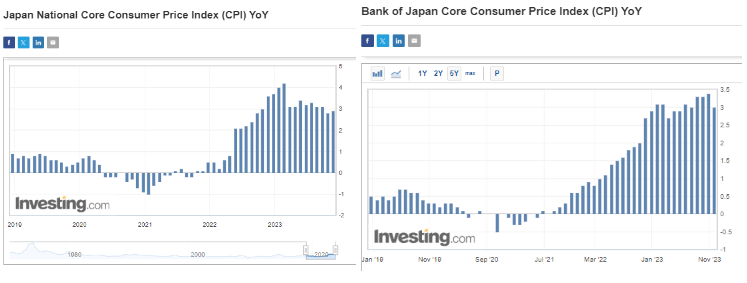

Meanwhile, Japan's inflation appears to be stabilizing around 3%, a factor that might not be compelling enough for the Bank of Japan (BOJ) to shift away from its ultra-loose monetary policy.

A recently published commentary by BOJ board member Seiji Adachi indicates a continuation of the ultra-loose monetary policy, suggesting that the ongoing move might be a mere unwinding of the previous upward trend.

Battling deflation has been a persistent challenge for the Bank of Japan since the late 20th century. The current strategy involves maintaining negative interest rates and controlling the yield curve on government bonds to stimulate inflation.

Although year-on-year consumer inflation presently stands at 3.3%, slightly above the target, it has stabilized since March after a decline from 4.2%.

Moreover, the latest core inflation reading for October, at 2.9%, fell below the forecasted 3.4%.

Considering the challenge of sustaining moderate inflation in the long term, the BOJ is likely to persist in its current approach, with potential adjustments such as the recent easing of yield curve control conditions.

This determination is reinforced by a statement from Seiji Adachi, dismissing the notion that Governor Ueda intends to deviate from the current policy under the existing macroeconomic conditions.

The US Economy Continues to Surprise Positively

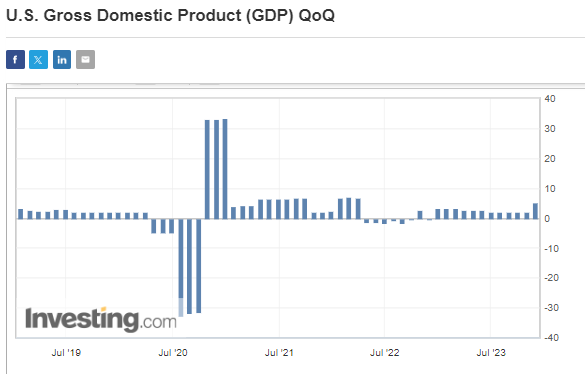

Yesterday, GDP data from the U.S. was released in the form of revised figures for Q3 of the current year. The readings confirmed the strength of the U.S. economy with 5.2% YoY (annualized data) thus placing it above forecasts of 4.9%

What does this mean from the point of view of the Fed's monetary policy?

This is rather positive news for the US dollar, as the Federal Reserve, seeing how strong economic growth remains, will potentially be less inclined to cut interest rates.

The key in this context will be the Q4 data, which, however, will most likely already be much weaker.

USD/JPY Technical View: Where Will the Correction End?

If a corrective movement is indeed occurring on the USD/JPY currency pair, it's essential to identify potential areas for both, a possible end or the continuation of the uptrend.

A crucial region to consider is a distinct support level at around 145 yen per dollar, coinciding with the potential termination point of the ABCD pattern.

The strength of this level is evidenced by the recent reaction, where demand strongly countered at every breakout attempt in the south direction.

However, if the sellers knock out the indicated support, then we will have an open path to descend to the area of even 140 yen. The signal for a continuation of the trend will be an exit above 150 yen per dollar.

Is it possible to reach a new all-time high at 160 yen? Absolutely, but for this, the BOJ must stand firm on its ultra-dovish policy, which should continue to put the yen's supply under pressure.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclosure: The author does not own any of the securities mentioned in this report.