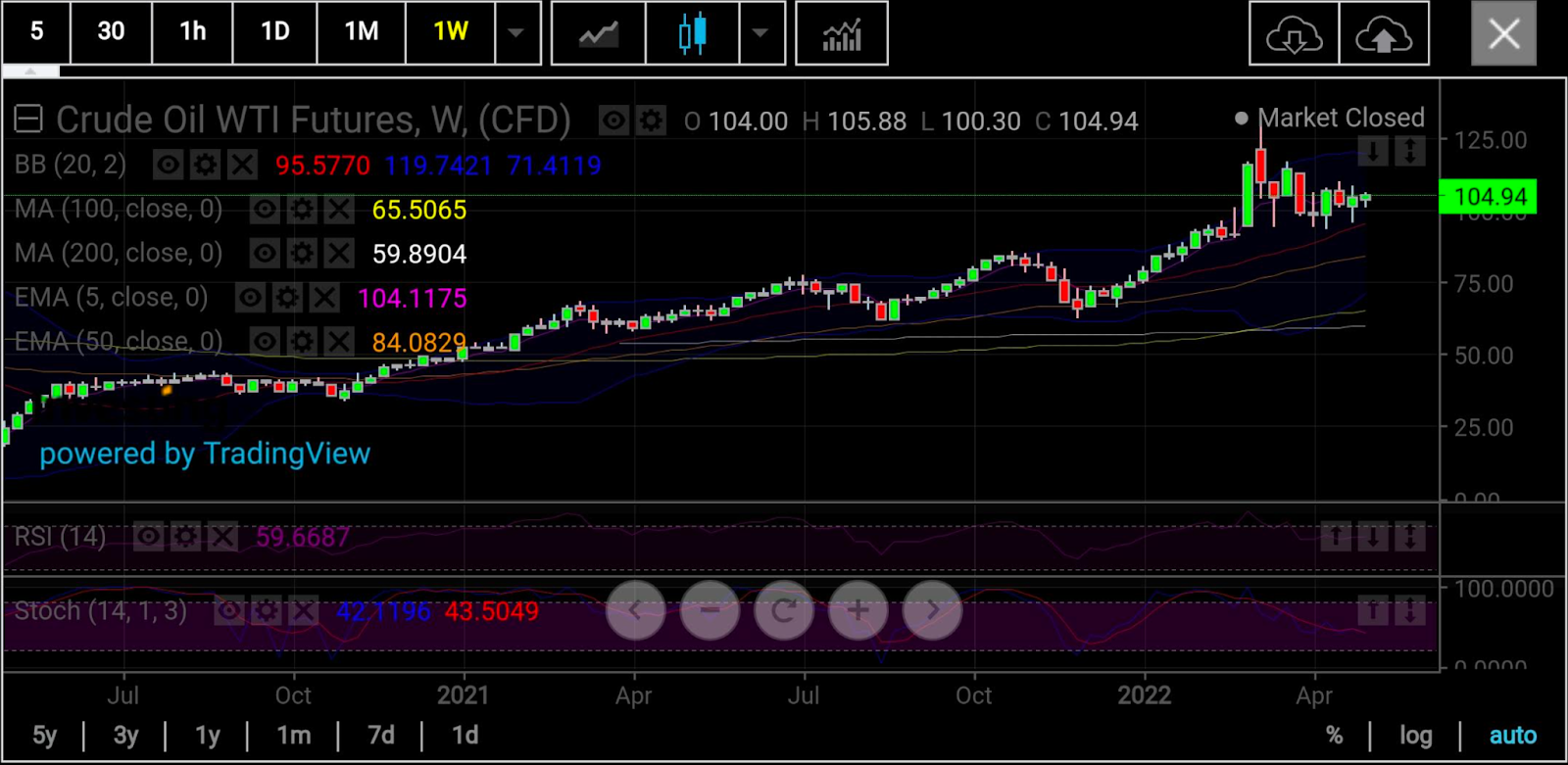

Think of $110-$95 a barrel as the new normal.

We’re referring to the trading range for US oil’s benchmark West Texas Intermediate crude, known more popularly by its three-lettered abbreviation: WTI.

While London-traded Brent serves as the global benchmark for oil, it’s also a premium product to WTI, and is, thus, a better reflection of the high prices of which oil is capable.

WTI, more appropriately, captures the lows, and its bottom might remain at $95 a barrel while its upside could be capped at $110.

That was WTI’s range for last week and it could be the parameter within which the US crude benchmark operates for some time—unless, of course, the European Union calls for a complete ban on Russian oil, which might significantly raise the lows, or a ceasefire pact is achieved in Ukraine, which could cause the bottom to dramatically drop.

Worsening economic fallout from China’s COVID 2.0 shutdowns could also deepen the bottom for WTI.

Charts courtesy of skcharting.com

I’m not alone in my observations about WTI’s downside. David Vecchio, who blogs on the DailyFX platform, also notes that while the US crude benchmark has swung higher after testing former triangle resistance-turned-support, it remains within the wide range carved out over the past two months. In his Apr. 28 post, Vecchio wrote:

"There’s little reason to think that continued volatility within the recent range will die down unless the Russian invasion of Ukraine ends.

"Energy markets are getting bid once again as reports have emerged that the European Union is inching closer to a deal to ban Russian oil imports. The prospect of constrained supply at a time when OPEC+ is falling short of production estimates is helping provide a boost for oil prices, which are recovering from the bottom side of their two month trading range.

Vecchio concludes by saying that for the most part, traders should anticipate "continued volatility within the recent two month range; the multiple percentage point moves within the range effectively means that crude oil prices are moving fast, but going nowhere."

The highest WTI went in the past two months was the Mar. 8 peak of $130.50 that came right after the Ukraine invasion. The lowest was during the week ending Apr. 8, when it went to $92.93.

While the gap between the highs and lows stood at more than $30 in the early days of the Ukraine war, it has wavered at between $12 and $10 lately, making a continued $15 range highly plausible.

Sunil Kumar Dixit, a regular contributor of commodity technicals to Investing.com, says bulls in WTI were unwilling to cave into more bearish pressure last week after the US crude benchmark fell to $95.28, prompting its rebound to the week’s high of $107.99 before it closed at $104.69.

“While the weekly Stochastic and Relative Strength Index of WTI are positioned in a sideways range with neutrality, wild swings will continue to cause volatility over the next week."

The US crude benchmark, he said, is "very likely to retest the $101 - $98 support area, where buyers may resurface to resume the main bullish momentum aiming for $105 - $108 resistance.

"If this $105 - $108 resistance area attracts enough buyers, expect momentum to ride higher to $109 - $113 and even extend to $116."

But he also cautions that failure to sustain above the $105 - $108 resistance zone can trigger sell-off to again retest the $101 - $98 level.

Critical support sits at the 100-Day Simple Moving Average of $92.65, which is a red flag for a bigger correction toward the 200-Day SMA of $83.40, Dixit adds.

“All things being equal, WTI’s simple range for now seems to be $110 at the upside and $95 at the lower end,” said John Kilduff, founding partner at New York energy hedge fund Again Capital.

“Think of it as the new normal to the previous $60-$75.”

In Monday’s session, WTI rebounded from a $100 low on the day to finish in just-positive territory as investors awaited direction from meetings due later in the week by the Federal Reserve and OPEC+—two very different organizations with very different objectives.

The Fed is likely to impose a 50-basis, or half-percentage, point rate hike at the conclusion of its May policy meeting on Wednesday—its first hike of such magnitude in over 20 years—as it aims to quell the worst U.S. inflation in four decades.

Within that mission of the central bank lies the challenge of what to do with this year’s 40% inflation in crude prices, which is a result of the supply deficit caused by the sanctions on Russian oil—an event outside the Fed’s control.

OPEC+, led by the 13-member Saudi-controlled Organization of the Petroleum Exporting Countries and 10 other oil producers steered by Russia, holds its monthly meeting a day after the Fed’s.

While OPEC+ says that it is concerned with the stability of crude supply, it is also keen to ensure that a barrel stays at or above $100.

Aside from the price of oil being at 14-year highs, US inflation is also being fed now by record wage and labor market growth. The Fed might have to clamp down on spiraling wages and demand for workers as well if it is to complete its job of fighting inflation.

If the job market slows down as a result of the Fed’s actions, there could be repercussions for the oil market because of the nexus between the two.

Phil Flynn, energy analyst at The Price Futures Group in Chicago, said the biggest downside threat to oil “is the possibility of a recession.”

US economic growth in the first quarter has already come in at minus 1.4%, and just another negative quarter is needed between April and June to reach the technical definition of a recession. According to Flynn:

“At this point the Fed has an incredibly tough job to do. If the Fed shows no sign of wavering from reducing their balance sheet, raising interest rates and signaling a more aggressive move in the future, then oil prices may sputter."

But as determined as the Fed is to break the back of US inflation, OPEC+ is to ensure that oil prices never again see the lows witnessed during the coronavirus breakout of 2020.

If push comes to shove, OPEC+ is likely to cut crude production further to ensure prices don’t fall too far from where they are today.

With the approach of summer air travel and US road trips, it might be hard to keep oil below $100 a barrel as much as it might be difficult to prevent it from testing the highs of the Ukraine conflict, which was almost $140.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.