Fifteen years after its blockchain network launched, Bitcoin has gradually asserted itself as digital gold. Without the physical barrier of carrying the actual gold, Bitcoin’s digital nature of self-custody is further secured by its massive computing network.

Aligned with this perception, the monetary system keeps doing Bitcoin favors. For the first four months of fiscal year 2024, the Treasury Department reported a deficit gap of $532 billion, up 16% from a year-ago period. This is on top of the astronomical $34 trillion national debt.

In other words, Bitcoin continues to gain ground as a function of centralized money mismanagement. Over the last three months, the BTC price is now up 40% at $51.2k. However, classic stock traders can benefit from Bitcoin’s rise even more, courtesy of companies helping to secure the Bitcoin network.

Here are crypto stocks that tracked even better performance than Bitcoin, with one exception.

Iris Energy

Over the last three months, this Australian Bitcoin mining company is up 171%. Given the Australian government’s green push, Iris has redoubled its efforts to power its data centers with 100% renewable energy.

This includes land, electrical infrastructure, and proprietary data centers exerting 760 MW of power. As of the November update, Iris Energy is heading from October’s 5.6 EH/s to nearly double that at 10 EH/s Bitcoin mining output by Q2 2024. The company has a total operating capacity of 2,160 MW with Canadian and Texan facilities.

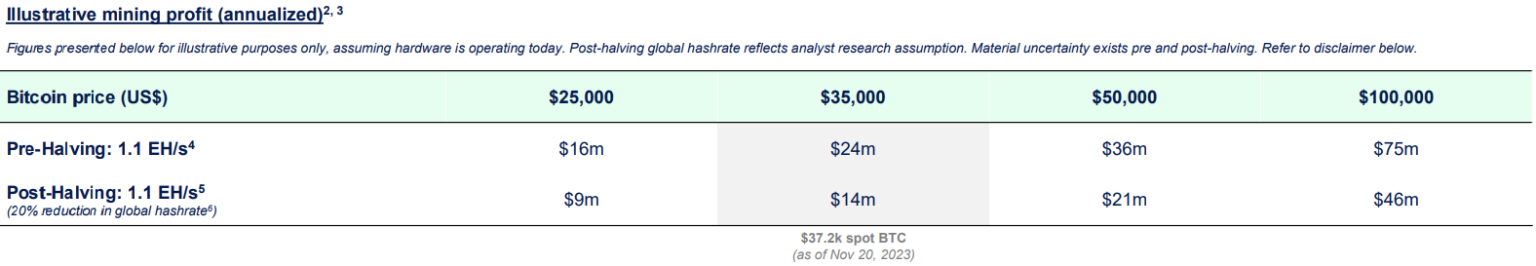

Some of this will go to generative AI and cloud computing after acquiring 248 Nvidia (NASDAQ:NVDA) H100 GPUs. Given Bitcoin’s scarcity, Iris Energy is considering continuing Bitcoin mining profits, even after the 4th halving this April.

Compared to the data center average of 1.58 power usage effectiveness (PUE), Iris runs under 1.1 PUE. In September, when the BTC price was in the $26k range, Iris reported 390 mined BTC with a mining revenue less electricity costs of $4.9 million.

Based on eight analyst inputs pulled by Nasdaq, IREN stock is a “strong buy.” The average IREN price target is $9.79 vs the current $8. The high estimate is $10 vs the low forecast of $9.5 per share.

Cipher Mining

Compared to the rapid IREN jump over the last three months, the CIFR stock is more aligned with the BTC price, outpacing the cryptocurrency by just 6%. Revolving around industrial-scale Bitcoin mining, the US-based Cipher Mining Inc (NASDAQ:CIFR) produced 371 BTC in January 2024, holding 1,132 BTC in total after selling 34 BTC.

The company’s mining capacity is 7.2 EH/s, as reported in the January operational update. Cipher Mining announced a 60 MW expansion that month with an additional purchase of 16,700 A1466 mining rigs from Canaan. This would place the company in a similar range as IREN in Q2 2024, at ~8.4 EH/s

Based on seven analyst inputs pulled by Nasdaq, CIFR stock is a “strong buy.” The average CIFR price target is $6.33 vs current $4. The high estimate is double that at $8, while the low forecast is above the current level at $5 per share.

Greenidge Generation Holdings

Focused on carbon-neutral Bitcoin mining in Dresden, New York, Greenidge is shifting to a new business model combining hosting and mining. Accordingly, GREE shares dropped 8% in the last three months, making them a buying-on-the-weakness opportunity.

In February, Armistice Capital agreed to fund Greenidge with $6 million to aid the transformation. For Q4 2023, the company reported its first profitable quarter in the last two years with operating income between $1.4 to $2.4 million.

Greenidge’s revenue of $19.7 was split between data center self-mining ($7.3M) and hosting ($10.7M). Its total capacity is 3.1 EH/s, of which 1.2 EH/s is delegated to cryptocurrency mining. During 2023, the company reduced its debt by $85.3 million, now at $68.7 million and $13.6 million in cash.

Based on two analyst inputs pulled by Nasdaq, GREE is a “strong buy.” The average GREE price target is $20 vs current $4 per share.

***

Disclaimer: Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.