- Kamala Harris's rising momentum in the presidential race could pose significant risks for DJT investors.

- The lockup period that prevents insiders from selling the stock is ending in September.

- Investors must weigh whether to hold on or cut their losses with a big downside in the offing for the stock price.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

Kamala Harris’s entry into the presidential race could spell trouble for Donald Trump's most fervent supporters on two fronts.

Politically, the vice president's growing momentum might shift the odds against Trump’s bid for the White House.

Financially, investors who bet on Trump’s media empire - specifically Trump Media and Technology Group (NASDAQ:DJT), which owns the social media platform Truth Social - could face significant losses.

Trump's ability to sell his entire stake - 114 million shares valued at $2.3 billion as of August 29 - after the mandatory lockup period for insiders ends in late September poses a significant risk for those invested in the stock.

His potential decision to sell may spark a huge decline in stock if there aren't enough buyers to step in and buy at lower levels. Since the failed assassination attempt in July, Trump Media stock's value has almost halved.

With Harris’ growing influence and Trump's seemingly diminishing prospects, the stock faces the prospect of further declines as some believe the stock's price could be closely tied to Trump's presidential hopes.

Investors holding DJT shares now face a tough decision: stick with Trump and hope for a turnaround or cut losses now.

Fair Value Suggests Potential Downside

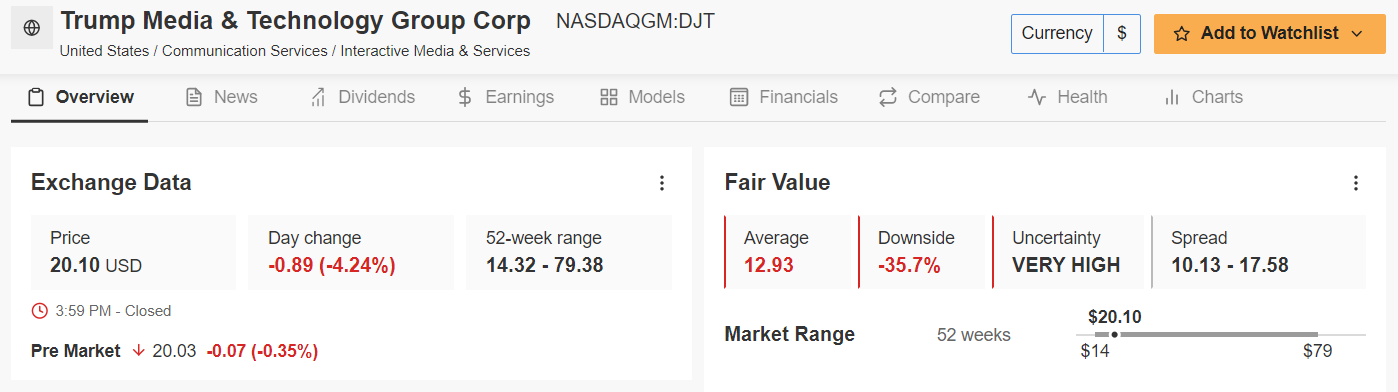

InvestingPro's data underscores the high risk for those invested in DJT. Despite the stock's current downtrend, InvestingPro's Fair Value analysis suggests a potential further decline of 35.7%, based on six investment models tailored to DJT’s unique profile.

Source: InvestingPro

However, uncertainty remains very high, as shown by the trend chart over the past year, with the stock swinging wildly recently.

Source: Investing.com

The company’s financial health offers little reassurance, with a benchmark index rating it at just 1 out of 5. The recent attempt to introduce in-app streaming on Truth hasn’t shown signs of turning the tide either.

Unlike platforms like Facebook and Instagram, owned by Meta Platforms (NASDAQ:META), Trump Media and Technology Group is struggling to find its footing.

The latest financial reports reveal a company in turmoil, with losses exceeding $16 million in just three months. While the company claims to have $344 million in cash and no debt, its future remains tightly bound to Trump’s fortunes and his decision to sell the stock or hold on.

In this scenario, investors need more than just analysis - they need faith, the same unwavering faith that Trump’s supporters have always placed in their leader.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.