This article was written exclusively for Investing.com

- In the energy space, coal has been a four-letter word

- Metallurgical coal a critical ingredient for steelmakers

- Coal price trend is bullish

- All commodities could be heading a lot higher; coal is no exception

Coal has a long history as an energy commodity. The combustible black or brownish-black sedimentary rock is formed as rock strata called coal seams. It's mostly composed of carbon with variable amounts of other elements, including hydrogen, sulfur, oxygen, and nitrogen.

Coal forms when dead plant matter, submerged in swampy environments, undergoes the geological forces of heat and pressure over hundreds of millions of years. The plant matter transforms from moist, low-carbon peat to coal. Coal falls into four main categories; anthracite, bituminous, sub-bituminous, and lignite. The leading uses of coal are for electricity generation, steel production, cement manufacturing, and liquid fuel.

Many people believe that diamonds start as coal, but this is not true. While coal takes hundreds of millions of years to form, diamonds take billions. The precious stones occur much deeper in the earth, in its mantel, around 150 kilometers below the earth’s crust.

Meanwhile, metallurgical coal or coking coal is a grade that is an essential fuel for blast furnaces that make steel. Metallurgical coal is low in ash, moisture, sulfur, and phosphorous content and is typically bituminous. The demand for this type of coal is lifting the price of the hydrogen-deficient hydrocarbon. Coal, natural gas, and petroleum are all fossil fuels that form under similar conditions.

In the energy space, coal has been a four-letter word

Over the past years, environmentalists have waged war against fossil fuels. The “existential threat” caused by climate change has spurred the development of alternative energy sources to replace crude oil, natural gas, and the dreaded coal. For environmentalists, coal was the first hydrocarbon to become a four-letter word. Natural gas has replaced coal in US power generation, and eventually, another cleaner fuel will take the place of natural gas.

Meanwhile, coal still is a critical ingredient in electricity production in many areas of the world. The two most populous countries with almost 2.8 billion or over a third of the world’s population, China and India, continue to consume coal to generate power. However, the Chinese and Indians are likely to move away from coal consumption over the coming years as pollution levels, and pressure from other nations, drive them to alternative energy sources.

Metallurgical coal a critical ingredient for steelmakers

Aside from coal’s role in power generation, the energy commodity is a primary ingredient for steelmakers. Coal and iron ore are critical in steel production. Steel is the world’s most important engineering and construction material.

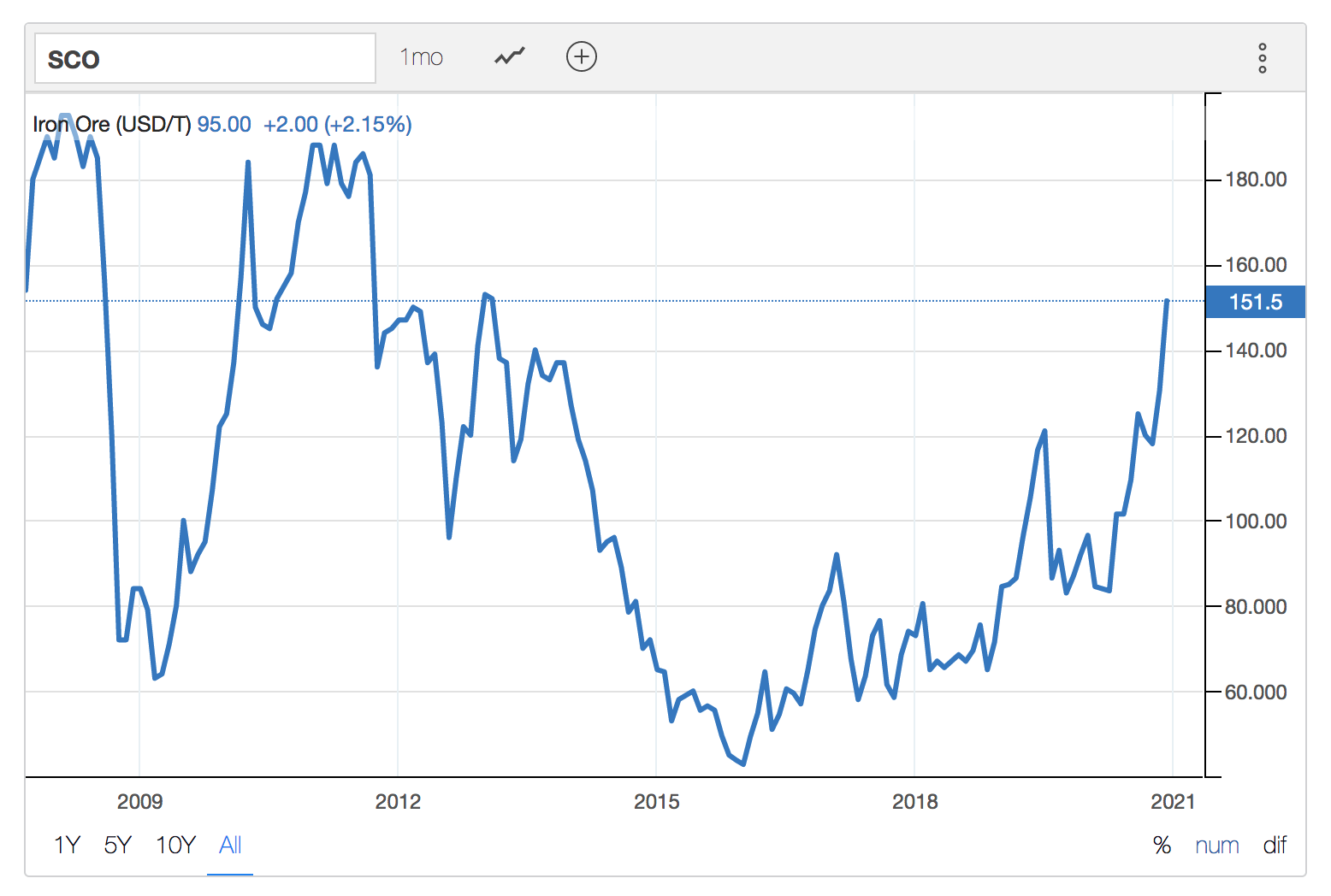

Steel demand has been rising. Over the past years, shortages of iron ore and rising steel demand have pushed the price of iron ore higher.

Source: Tradingeconomics.com

The chart shows that iron ore prices have been making higher lows and higher highs since late 2015. Production problems in Brazil have contributed to increasing prices, which were at the highest level since 2013 as of the end of last week.

The rise in the price of iron ore, increasing demand for steel from China, and the potential for a US infrastructure rebuilding program in the coming years have been pushing the requirements for metallurgical coal higher.

Coal price trend is bullish

Coal prices declined from 2018 until April 2020, when crude oil hit rock bottom. The falling price and move away from coal for environmental reasons caused production to decrease.

Commodity prices tend to move to levels on the downside where production falls; demand picks up, inventories decline, at which point prices turn higher. Coal appears to have dropped to the bottom of its pricing cycle in 2020 and has turned the corner to the upside.

Source: Barchart

The long-term coal chart for delivery in Rotterdam shows that the trend of lower highs and lower lows that began in 2008 remains intact. However, after falling to a low of $38.45 per ton in April 2020, the price has been recovering and was trading at the $66.50 level at the end of last week. The short-term trend in coal has turned higher. While the chart reflects the price action in thermal coal, metallurgical coal prices have also been rising.

All commodities could be heading a lot higher; coal is no exception

The falling US dollar, which declined to its lowest level since April 2018, is a bullish factor for commodity prices. Since the dollar is the world’s reserve currency, it is the benchmark pricing mechanism for all commodities.

The unprecedented level of liquidity from central banks has pushed short-term interest rates to historic lows. Quantitative easing has put a cap on rates further out along the yield curve. Low interest rates support raw material prices as they lower the cost of carrying inventories.

Meanwhile, government stimulus that increases the money supply causes rising inflation. The bottom line is that monetary and fiscal policies have created a potent bullish cocktail for commodity prices, and coal is no exception.

Supply shortages because of low coal prices over the past years is only exacerbating the situation as the demand for steel rises. In the aftermath of the global pandemic, a surge in economic activity could make the situation worse and continue to push coal prices higher.

While coal remains a four-letter word and the world will move towards cleaner energy sources, the rally in the coal price seems set to continue in 2021.

Diamonds may not come from coal, but an investment in the fossil fuel could bring some sparkle to your portfolio.