- Electric cars are now outselling diesel cars in Europe

- Volkswagen has led the pack in new electric car registrations in Germany in the last few months

- But Tesla's rapid growth challenges the legendary German automaker

In recent years, the popularity of electric cars has surged across China, the United States, and Europe. This surge is attributed to the green revolution, which is particularly emphasized in the old continent.

While the European Union won't officially ban new internal combustion car sales from 2035, they're set to be 100% emission-free in terms of CO2 emissions, potentially giving a boost to the electric car market.

Amid the European competition for electric car sales dominance, Volkswagen (OTC:VLKAF) and Tesla (NASDAQ:TSLA) are the key players, with the unexpected shift in leadership favoring the German giant in its home market.

This sets the stage for an exciting battle in the years ahead, ultimately benefiting consumers as manufacturers strive to outdo each other.

Electric Cars Gain Momentum

With EU-level changes in the car market and increasing incentives for electric mobility, electric car sales are on the rise. The data underscore this trend - in June this year, electric car sales (15.1%) surpassed diesel units (13.4%) for the first time. Gasoline cars still hold the lead (36.2%), ahead of hybrids (24.3%).

This shift is particularly pronounced in the dominant German market, where 220,244 units were sold in the same month. Looking at the broader European market in the first half of the year, the Tesla Model Y emerged as the most popular model, selling 125,144 units with an impressive growth rate of +211.7%.

Meanwhile, the top 10 spots are firmly held by Volkswagen models: Volkswagen T-Roc (107,249), Volkswagen Tiguan (88,020), and Volkswagen Golf (85,730). This puts the German manufacturer ahead of its American counterpart in terms of units sold. However, if Tesla sustains its current momentum, a reshuffling of the ranks could be in the cards.

Volkswagen Stock Takes a Hit

Volkswagen's stock price hasn't had a smooth ride over the past couple of years, facing a range of internal and external challenges that have dampened investor sentiment. Currently, the supply side has hit new lows and is testing support levels dating back to October 2020, a critical juncture for the company's stock.

However, taking a broader perspective, aside from the spike experienced in the first half of 2021, the stock has essentially returned to the average range observed between 2015 and 2020, where share prices fluctuated between $100 and $185.

Remaining within this range is clearly not an optimal scenario. To witness a resurgence in growth, we need the upcoming quarters to demonstrate a sustained continuation of the positive sales trend, particularly within the electric car segment.

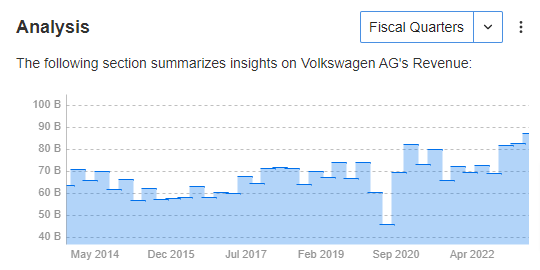

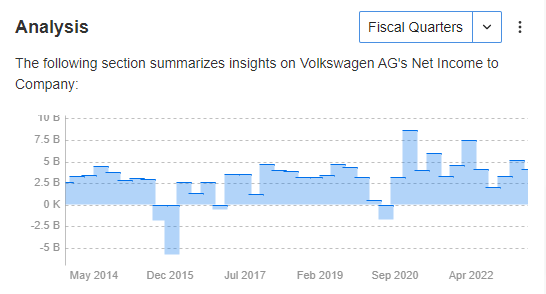

While the ongoing upward trajectory in revenue is indeed encouraging, the same level of momentum is notably absent in terms of net profits.

Source: InvestingPro

Source: InvestingPro

Tesla Stock's Correction Persists

Throughout the year, Tesla's stock price has been rebounding from a notably lackluster performance in 2022. It has managed to recoup over 50% from its peak last year. However, we are presently witnessing a period of descent.

Considering the prevailing dynamics of this downward movement, it appears more indicative of a corrective phase rather than a fresh downward impulse.

The current test of the $240 zone and the slightly lower support level has the potential to ease selling pressure and give the bulls some hope of a rebound.

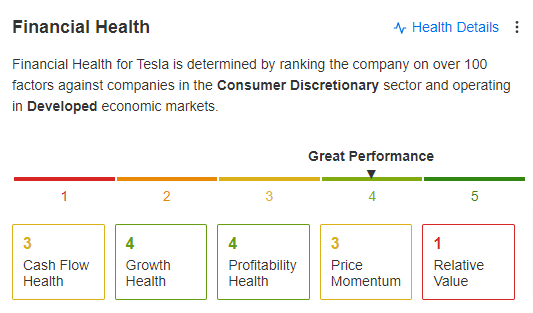

From a fundamental standpoint, earnings and revenues are maintaining relatively robust levels, a factor that contributes to the company's strong financial health rating on InvetstingPro.

Source: InvestingPro

Conclusion

The electric car market is growing rapidly in Europe, with Volkswagen and Tesla leading the way. The German manufacturer has seen its stock price take a hit in recent years, but it remains ahead of Tesla in terms of electric car sales in Europe.

If Tesla can sustain its current momentum, it could challenge Volkswagen for dominance in the years to come. The battle between the two automakers is sure to be exciting in the years to come.

***

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor's own.