- The Swiss franc currency pair has exhibited continued weakness after a brief stabilization period, attributed to the Swiss National Bank's unexpected interest rate cut in March.

- The proactive stance of the Swiss National Bank accelerated the depreciation of the Swiss currency, diverging from the conservative policies of other major institutions.

- Despite the dovish shift in Swiss monetary policy, technical analysis suggests potential opportunities for traders in currency markets.

- Invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Today's analysis will center on the Swiss franc currency pair, which has shown continued weakness in recent days following a brief period of stabilization.

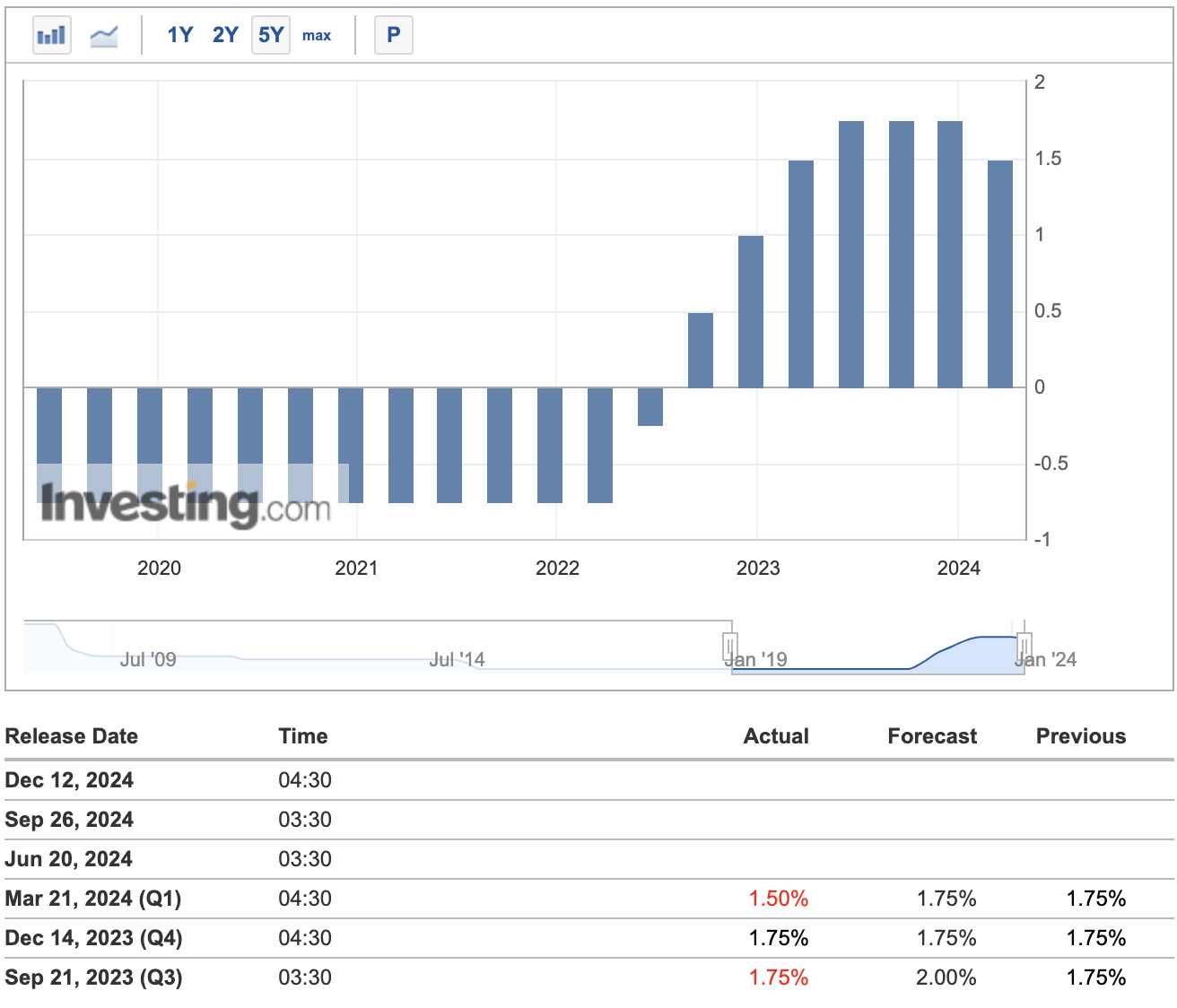

In March, the Swiss National Bank caught markets off guard by lowering interest rates by 25 basis points and expressing willingness to take similar actions in the future if necessary.

This proactive stance from the central bank significantly accelerated the depreciation of the Swiss currency, setting it apart from the conservative monetary policies maintained by most other major institutions worldwide.

The dovish shift in Swiss monetary policy remains apparent in the currency market, offering potential opportunities from a technical analysis standpoint. With that in mind, here are three compelling technical setups for those looking to score profits trading the CHF.

1. AUD/CHF - Strong resistance Ahead

The AUD/CHF currency has persisted in an upward trajectory following a period of localized consolidation. The currency has successfully breached a series of resistance zones clustered around the significant threshold of 0.6 Swiss francs per Australian dollar.

Buyers are encountering limited resources to sustain the current momentum due to the nearby supply zone just above the 0.61 level.

The robust supply reaction witnessed in June last year indicates the challenge bulls may face in overcoming this area without encountering resistance.

This scenario presents opportunities for short-term positioning, particularly for anticipating a swift counterattack from the supply side. However, the broader upward momentum signals a prevailing northward direction.

Should a more significant pullback occur, attention should be directed towards former resistances, now turned support levels, for potential price reactions.

2. EUR/CHF About to Breakout Higher

Over the past two months, the EURCHF currency pair's quotes have been shaping an inverted head-and-shoulders pattern, distinguished by an elongated head segment. Despite this elongation, the overall structure remains intact.

The recent breakout above the neckline signals a path for broader upward movements, aiming towards the next target around the 1:1 parity level.

The bullish scenario is currently dominant, yet it's important to monitor potential reversal signals, particularly around the 0.9840 level.

A breakout below this level would signal the negation of the described formation regarding the reversal of the trend.

The primary support level, validated by a robust demand response, stands at 0.9570.

NZD/CHF: Strong Bullish Momentum

The breach of the pivotal resistance level around the 0.55 price region offers an avenue for buyers to prolong the ongoing momentum. There remains considerable room for advancement, with the next notable resistance area situated around 0.5670.

The potential testing of current support levels around the 0.55 area presents an intriguing opportunity for contemplating a long position.

Wednesday's upcoming Central Bank of New Zealand meeting holds significant importance for currency pairs involving the New Zealand dollar. The prevailing market consensus anticipates interest rates to remain unchanged, especially with above-target inflation persisting, thus advocating for the maintenance of a restrictive monetary policy.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $9 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

-

Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

-

Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

-

And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - claim your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.