- The S&P 500 is poised to challenge a crucial resistance level later this week

- Last week's labor market data was mixed, with some indicators suggesting that the economy is slowing down

- Meanwhile, Disney stock could rebound if Hollywood strike ends

September is typically a volatile month for US stocks, historically the worst-performing. Looking at data from 1964 to 2021, September has seen an average return of -0.5% for the S&P 500, with only 47% of those periods ending positively.

Whether this historical trend holds true this year largely depends on the Federal Reserve's policies, with their next decision scheduled for September 20.

Additionally, concerns loom about the possibility of a recession in the US, particularly following disappointing unemployment data released recently, along with revised figures for previous months indicating a slowdown in job growth.

Despite a brief dip in major US indexes on August 24th, which formed a bullish hug pattern on daily charts, the end of the month saw consecutive upward sessions.

This upward momentum highlights the strength of buyers in maintaining the overall uptrend. As for the S&P 500, it appears that buyers are poised to challenge a crucial resistance level located just above 4600 points later this week

Source: Investing.com

Breaking through the mentioned area would pave the way for buyers to target historical highs around the 4800-point mark.

Assuming there are no further interest rate hikes, which seem more uncertain after Friday's data, the primary scenario is an attempt to reach these historical highs.

However, if the index were to descend below the critical support level at 4330 points, it could provide an opportunity for a deeper correction with a target near 4200 points.

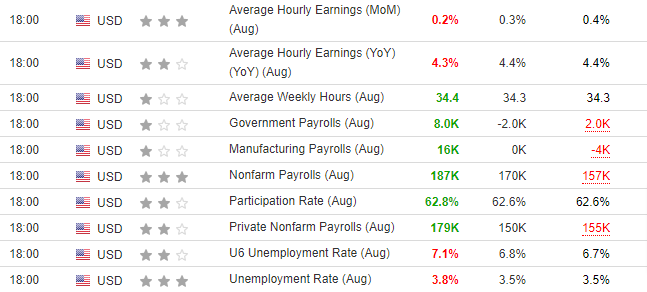

The recent data from the US labor market, released last Friday, has garnered significant investor attention. Of particular note is the unemployment rate, which has reached 3.8%, the highest it's been in over a year.

Additionally, average hourly earnings have fallen slightly short of expectations, and the nonfarm payrolls have dropped below 200,000

Source: Investing.com

These data theoretically argue against an interest rate hike and should, in theory, weaken the US dollar. However, it's important to note that the labor market situation is not that bad.

Average wages are still on the rise, unemployment remains below 4%, and there has been an increase in the participation rate, indicating more people are actively employed.

This makes it difficult to predict what the Federal Reserve will choose to do at its upcoming meeting, especially after isolated weaker data readings.

Disney Stock a Buy After Recent Declines?

As for Walt Disney Company (NYSE:DIS), it currently faces the largest Hollywood strike in over 60 years, with actors and screenwriters being the two main labor groups involved in the dispute. While the demands of the strikers represent a small fraction of the major studios' total revenues, reaching an agreement seems unlikely at the moment.

In Disney's case, the strike impacts approximately $72 million annually, which accounts for just 0.088% of its yearly revenues. While these numbers might seem manageable, the stock price may struggle to regain momentum until an agreement is reached. Currently, Disney's stock price is testing its 2020 lows.

Source: Investing.com

If a resolution is reached, there is a strong likelihood of a rebound in Disney's stock price. The new CEO, Bob Iger, has introduced a recovery plan aimed at achieving substantial cost reductions of $5.5 billion.

In comparison, the strikers' demands represent a minuscule amount in the context of these cost-saving measures.

***

Disclaimer: This article is for information purposes only; it is not intended to encourage the purchase of assets in any way, and does not constitute a solicitation, offer, recommendation, opinion, advice or investment recommendation. We remind you that all assets are considered from different angles and are extremely risky, so that the investment decision and the associated risk are specific to the investor.