I saw an article published this past week, which attempted to outline 9 “black swans” which the author surmised would kill the rally we have been seeing of late. As the author noted, “black swan events are inherently unpredictable but it's important to be prepared for the worst.” And, most of the scenarios presented were global events.

So, I would like to take a moment to provide my thoughts.

First, black swans do not kill a market. And, before you jump down my throat, allow me to explain.

While an event may be completely unforeseeable, it does not mean that an unforeseeable event will actually cause a market decline. Moreover, even though an event may not be foreseeable, market declines are reasonably foreseeable.

For those that know their market history, you would recognize the accuracy in my statement. There have been many foreseeable and unforeseeable events which have not caused the commonly expected reaction in market direction. Moreover, there have been many market declines which have been foreseeable, for which no events have been blamed, or for which a blame was later assigned.

Furthermore, simply because one attempts to outline those possible events which they believe could be foreseeable, a market decline may or may not occur due to an event that the author, you or I are unable to foresee at this point in time.

Allow me to explain further.

Let’s start by examining a scenario wherein one of the author’s events do indeed occur. While the author surmises that it would cause a market decline, I am about to prove to you that a careful look at market history would suggest this proposition to be untrue.

There is a common misconception among the masses that when a significant, dramatic event occurs, such as the assassination of a President, a terrorist attack, or the collapse of a financial institution, that the occurrence causes people's mood to turn negative and the market to decline.

However, as John Casti proffers in his book Mood Matters:

“the only problem with this “everybody-knows-it” belief is that there is not a single piece of actual evidence to support it. Just like a few centuries ago when everybody “knew” the Earth was flat, the alternative that perhaps it really isn’t flat was simply dismissed out of hand as the ravings of a crank or madman.”

Casti then goes on to prove his thesis based on stock market data at the time of the Kennedy assassination and other “shocking” events. He concludes that the “only kind of feedback that the data supports is an ultra short-term emotional reaction to the surprise factor of the event.”

In fact, he cites a report on this exact issue written by Mark Jickling of the Congressional Research Service of the US Library of Congress in September of 2001, who came to the exact same conclusion. And, many others have come to identical conclusions based upon their independent studies of market history.

In a 1988 study conducted by Cutler, Poterba, and Summers entitled “What Moves Stock Prices,” they reviewed stock market price action after major economic or other types of news (including major political events) in order to develop a model through which one would be able to predict market moves RETROSPECTIVELY. Yes, you heard me right. They were not even at the stage yet of developing a prospective prediction model.

However, the study concluded:

“Macroeconomic news . . . explains only about one-fifth of the movements in stock market prices.” In fact, they even noted that “many of the largest market movements in recent years have occurred on days when there were no major news events.” They also concluded that “[t]here is surprisingly small effect [from] big news [of] political developments . . . and international events.”

They also suggest that:

“The relatively small market responses to such news, along with evidence that large market moves often occur on days without any identifiable major news releases casts doubt on the view that stock price movements are fully explicable by news. . . “

As two examples of which you may already be aware, do you realize that there is still no commonly agreed upon explanation for the 1987 stock market crash or the Flash Crash of 2010? But let’s move on. In August 1998, the Atlanta Journal-Constitution published an article by Tom Walker, who conducted his own study of 42 years’ worth of “surprise” news events and the stock market’s corresponding reactions.

His conclusion, which will be surprising to most, was that it was exceptionally difficult to identify a connection between market trading and dramatic surprise news. Based on Walker's study and conclusions, even if you had the news beforehand, you would still not be able to determine the direction of the market only based on such news.

In 2008, another study was conducted in which they reviewed more than 90,000 news items relevant to hundreds of stocks over a two-year period. They concluded that large movements in the stocks were NOT linked to any news items:

“Most such jumps weren’t directly associated with any news at all, and most news items didn’t cause any jumps.”

To drive this point home further, many of you are probably thinking that the 9/11 terrorist attack is a clear example of how the market reacts to the news. Yet, I have challenged thousands of people to point to me on a non-labeled or dated chart of the S&P 500 where the most important negative event of the past 80 years is evident on the chart.

Back in April, I presented a keynote address at the MoneyShow in Las Vegas. During the question and answer segment of the presentation, an older gentleman asked me a question as to whether I believed that the cessation of fighting in Ukraine would cause the market to rally.

Being trained in law school, I answered his question with my own question. I asked him if he knew what happened to the market the day that Russia invaded Ukraine. Of course, he confidently responded that the market had gone down. You should have seen the shock on his face when I told him that the market began a 10% rally on the exact day that Russia invaded Ukraine.

Another glaring example was the October 2022 CPI report. On Oct. 12, pundits were telling us that if the CPI report they expected to be published the morning of Oct. 13 was worse than expected, then we would see a 5% or worse decline in the market.

That same day, on Oct. 12, I posted the following analysis for the members of ElliottWaveTrader:

"Thus far, the market has made several attempts at hitting the blue box support region on the 60-minute SPX chart. And, each time, divergences continue to grow. And, if you look at the 5-minute SPX chart, there is still opportunity to actually strike that support below as long as we remain below the smaller degree resistance noted. . . But, I think we will likely be much higher than where we stand today as we look out towards the end of October, or even into early November, depending on how long it takes the market to bottom out, and how fast the rally I expect takes hold."

In fact, before the market opened on the Thursday morning of October 13, and as it was hovering near the lows of the month, I sent out an alert to our members at 8:56 a.m. noting my expectations for a bottom being struck and that "This should now be the selling climax that completes the downside structure." The market bottomed within half an hour of my alert and rallied 6% off the morning low.

Later that day, I saw quite a few comments on Seeking Alpha which outlined the common confusion of market participants at the time:

"Am I the only one wondering what the heck is going on with this market? I feel like it makes no sense anymore.. Today made NO sense."

In fact, in Barron's article later that day, the author outlined the common feeling in the market that day:

"It was a massive rally, and one that came out of nowhere. And it's left market observers like yours truly wondering what the heck just happened. There wasn't any new data, no headline-making speeches, no event that occurred just after the open to spur such a move. It literally came out of nowhere-and left us grasping for possible reasons. "Today's market reversal was a head-scratcher," writes Oanda's Edward Moya. And he's not wrong."

As I have written and said more times than I can count, one must recognize that a news event may be a catalyst to a market move at times, yet the substance of the news event may not be determinative of the direction of the market move. And just two of the recent obvious examples we have seen include the Russian invasion and the October 2022 CPI report.

So, I'm going to repost the brilliant words of Bob Prechter from his seminal book The Socionomic Theory of Finance (a book which I strongly suggest to every single investor), as it is always worth repeating:

"Observers' job, as they see it, is simply to identify which external events caused whatever price changes occur. When news seems to coincide sensibly with market movement, they presume a causal relationship. When news doesn't fit, they attempt to devise a cause-and-effect structure to make it fit. When they cannot even devise a plausible way to twist the news into justifying market action, they chalk up the market moves to "psychology," which means that, despite a plethora of news and numerous inventive ways to interpret it, their imaginations aren't prodigious enough to concoct a credible causal story.

Most of the time it is easy for observers to believe in news causality. Financial markets fluctuate constantly, and news comes out constantly, and sometimes the two elements coincide well enough to reinforce commentators' mental bias towards mechanical cause and effect. When news and the market fail to coincide, they shrug and disregard the inconsistency. Those operating under the mechanics paradigm in finance never seem to see or care that these glaring anomalies exist."

You see, until the times of R.N. Elliott, the world applied the Newtonian laws of physics as the analysis tool for the stock markets. Basically, these laws provide that movement in the universe is caused by outside forces. Newton formulated these laws of external causality into his three laws of motion: 1 – a body at rest remains at rest unless acted upon by an external force; 2 – a body in motion remains in motion in a straight line unless acted upon by an external force; and 3 – for every action, there is an equal and opposite reaction.

Yet, as Einstein stated:

“During the second half of the nineteenth century new and revolutionary ideas were introduced into physics; they opened the way to a new philosophical view, differing from the mechanical one.”

However, even though physics has moved away from the Newtonian viewpoint, most financial market analysis has not.

We must begin to recognize that external events affect the markets only insofar as they are interpreted by the market participants. Yet, such interpretation has been guided by the prevalent social mood. Therefore, the important factor in understanding is not the social event itself, but rather, the underlying social mood which will provide the “spin” to an understanding of that external event.

Again, rather than coming up with some convoluted explanation to force some causal story, maybe it's time to recognize that news can act as a catalyst, but the substance of the news will not be determinative of the direction of the market move.

So, while we may attempt to outline the event risks we see in the market today, we must recognize that the market may still not react as we expect to those risks should an expected event come to fruition, as history has shown. Moreover, there could very well be other risks, which we are unable to foresee, that could catalyze a market move.

At the end of the day, I personally believe it to be a waste of time to attempt to prognosticate market movements based on expected events. History has proven this many times over, assuming we are willing to listen to and learn from history’s lessons. Yet, most of you reading this article will simply shrug and move on to the next expected news catalyst on your list or the next article, which will explain the “reason” why the market is going to move in one direction or another.

As Einstein was purported to have said, doing the same thing over and over while expecting a different result is the definition of insanity. Based upon Einstein’s definition, most market participants are insane. Do you wish to remain so?

As Daniel Crosby noted in The Behavioral Investor:

“trusting in common myths is what makes you human. But learning not to is what will make you a successful investor.”

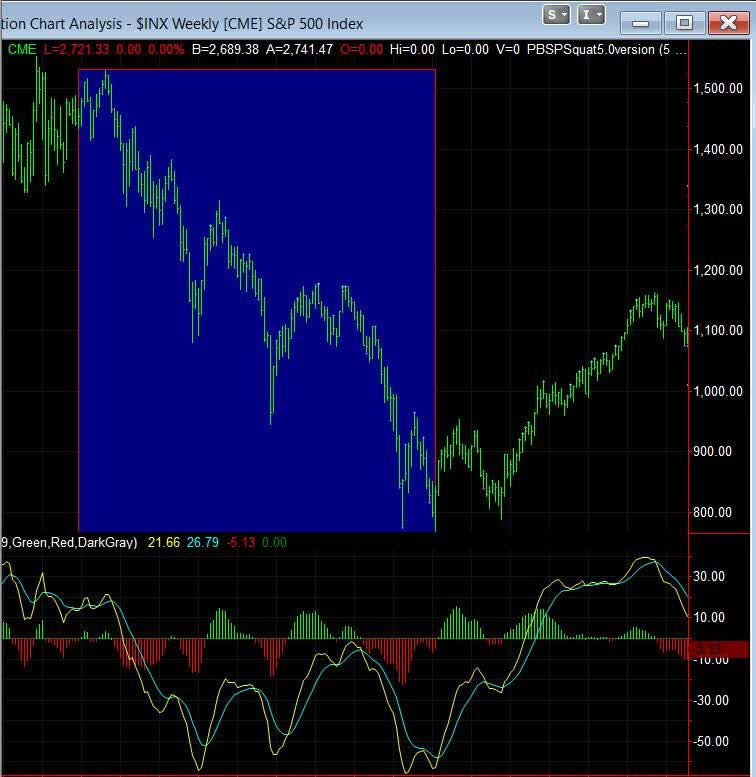

S&P 500's Correction

In the meantime, we have recently seen the market spike just over the resistance target we have been expecting to reach for many months and then reverse. Thus far, the market has been reacting well within our expectations. However, I have to note that the downside move we expected is not taking shape YET as an impulsive move down.

If you remember, I noted that an impulsive move down off the high would suggest that the market would potentially be setting up a crash later this year. However, a corrective move down would then have us looking higher again.

So, unless we see a strong break of the 4275-4315SPX region in the coming week, and if we continue to pullback correctively, then the market is setting up its next move towards the 4505SPX region. The pullback from there will determine if we are indeed next heading to 4800SPX, or if we will begin a larger degree decline.

Moreover, if the market should break down below the 4275-4315SPX region in the coming week, then I will be watching the structure very carefully, as it could set up a market crash later this year.

There are times when the market presents us with a very clear path. And, then, there are other times when the market shows us we are heading into a very important turning point, which tells us to reduce our risk and wait until the market makes its next intention clear. Currently, we are in the latter circumstance.

When I was in law school, I remember that when a law student viewed an exam as being very easy, it was quite clear that they did poorly because they did not see all the issues presented in the exam which needed to be addressed in the essay. Interestingly, I see the market right now in the exact same way.

There are many that are confidently bullish, and then there are many that are confidently bearish. So, I would even go so far as to say that if someone is confident in the next direction of the market at this time, then they are not clearly seeing the bigger picture or the issues on both sides of this battle. In other words, they are not seeing the risk to both sides of the market right now, as it is quite high on both sides of the tape.

It actually pains me when I engage in discussion with some of those that have been very bearish, and they are certain of the outcome of this battle. It is clear that they lack the knowledge or ability to see where they can be wrong in their assessment of the market. Consider that almost all of them have been looking down during this 27%+ rally since the October low while claiming, week after week, that the next shoe is about to drop. This has been their refrain for many months, and many lost opportunities.

But, for those of us that have the ability and tools to see the market objectively, we recognize that we have reached the decision point that we have been expecting for many months, and this summer will likely tell us which side emerges victorious.

As for me, I have no desire to join this battle, nor do I have a desire to place my money to work when I clearly see the risk to both sides of the tape. Yet, the market has provided very clear parameters to us to this point. But, for now, I would much prefer to let the bulls and bears battle it out, and I will gladly deploy my money on the winning side. Until then, cash is a reasonable position for me. But, I will add that the bulls have more to prove than the bears at this juncture.

In the bigger picture, my expectation was for a major bottom to be seen in October 2022 in the 3500SPX region, with an expectation to rally to 4300+ from there. As we approached the 4375-4433SPX region, I then advised them to raise cash and tighten the stops on all long positions they wished to retain until the market provided clarity regarding its next major move.

I am expecting such clarity will be seen in the coming month or two, which should set the tone for the rest of 2023 and potentially well beyond.