- With markets fighting to stay above this year's lows, Q4 could also be a weak one for the S&P 500

- A prolonged bear market such as the one we are facing imposes significant financial and psychological pressure on investors

- However, we must remember that the S&P 500 has always rebounded strongly from bear markets in the long run

- 1931: -43.8%

- 2008: -36.6%

- 1937: -35.3%

- 1974: -25.9%

- 1930: -25.1%

- 2022: ...

The ninth month of 2022 closed off as the ninth month of a painful bear market. Now, with the S&P 500 hovering dangerously near yearly lows, the odds that the downward trend will continue in Q4 remain elevated.

The fact that the bear market has lasted for so long now—along with the underperformance in the bond market—certainly imposes financial and psychological difficulties for investors, especially inexperienced ones.

Yet, except for bonds, one could argue that we are still in a context of absolute normality (and let's also remember that bonds had been trending up along with the stock market in recent years).

In fact, I'll let you in on a secret; if we didn't have bear markets, the stock market would not be offering the average compounded return of 8-9% per year.

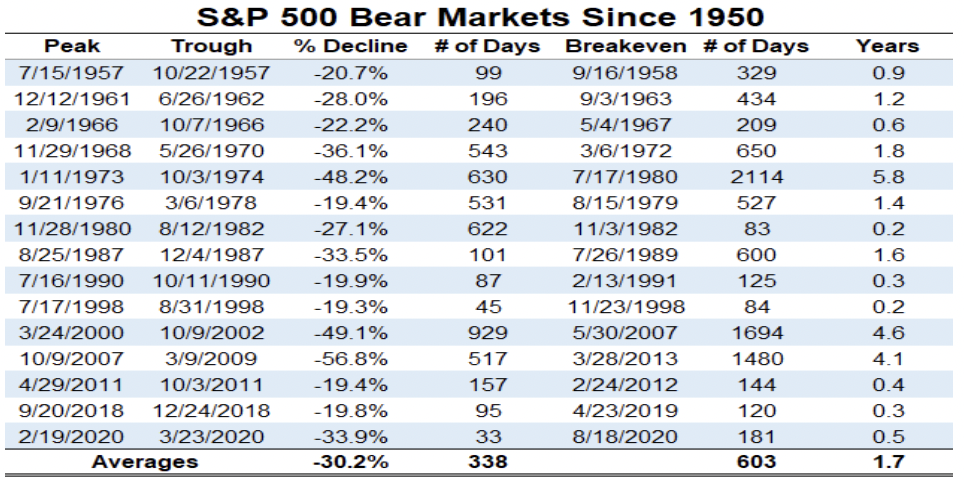

As shown in the chart above, historically, the S&P 500 falls on average -30.2% over the course of 338 days in a bear market. Counting since the beginning of the year, we are currently at about -25% during 270 days, in line with previous cases in history.

Since we have a bear market that curiously started on the first days of the year, it is easy to compare it with other single-year historic performances, namely:

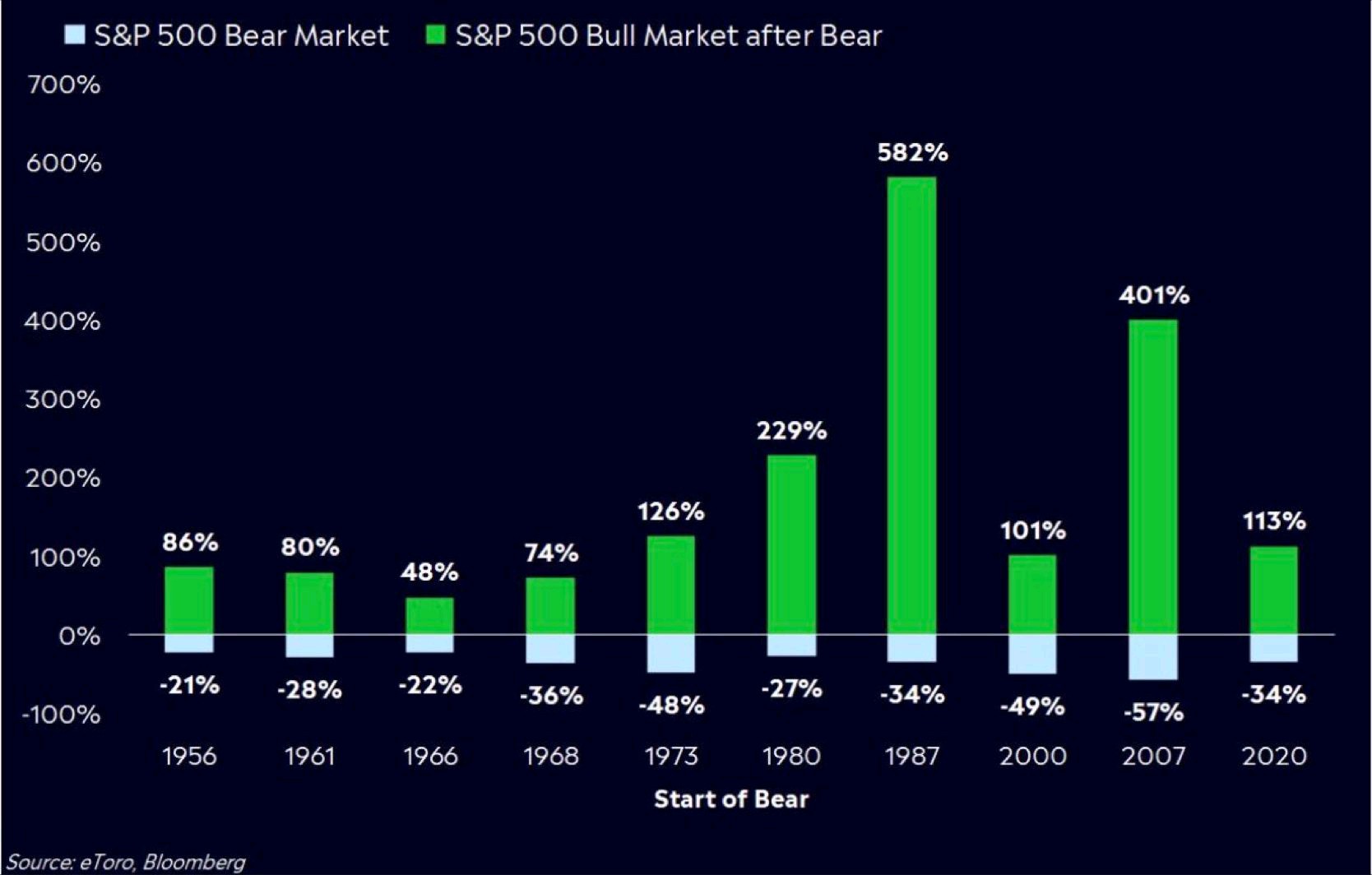

But the most interesting point is the statistic shown in the chart below:

Source: eToro, Bloomberg

After prolonged declines, the market has always rebounded strongly, averaging a positive performance in the long run. Hence, it will be critical when (not if) the markets restart rise to be found present and well invested.

"Francis, but liquidity is finite." This is an objection that has been made to me in several analyses. Now, again, it is always an issue of strategy and planning.

I started at the end of 2021 with liquidity at 30%—because objectively, valuations were unsustainable. Therefore, I was more cautious.

As the declines began, I started to give myself targets and use my cash on strategic assets (which I intend to hold for many years). Now I am still at about 15 percent liquidity, and I have given myself very personal targets if we keep falling (see picture).

How did I choose these specific targets? Simply by looking at past bear markets. Therefore, the next entry, at -31%, coincides with the average of declines in the initial chart.

I remember that probably the fourth quarter of the year could also be weak, and so this element, in my opinion, is one of the last ones yet to be priced in the current bear market.

The important thing is always not to be unprepared and to plan for scenarios at a sensitive time like this. Then when the right time comes, you will find yourself well-positioned to reap the fruits of your investments.

Disclosure: The author is long on the S&P 500 and will buy more positions should the index continue to drop.