In my last update on the S&P 500, using the Elliott Wave Principle (EWP), I found:

“SPX 3886.75 remains the dividing line in the sand. If the S&P 500 manages to rally above that level without dropping below last week’s low [the October 13 low at SPX 3491], the index completed five waves lower from the mid-August high. We then must content ourselves with a slightly unorthodox impulse wave, but as said, “the markets do not owe us anything.” I will then look for a multi-month rally to the SPX 4350-4650 target zone. Conversely, a drop below SPX 3491 tells me that the last fifth wave to ideally SPX 3240-3345 has started following an ideal Fibonacci-based impulse pattern. From there, the anticipated multi-month rally can then start.”

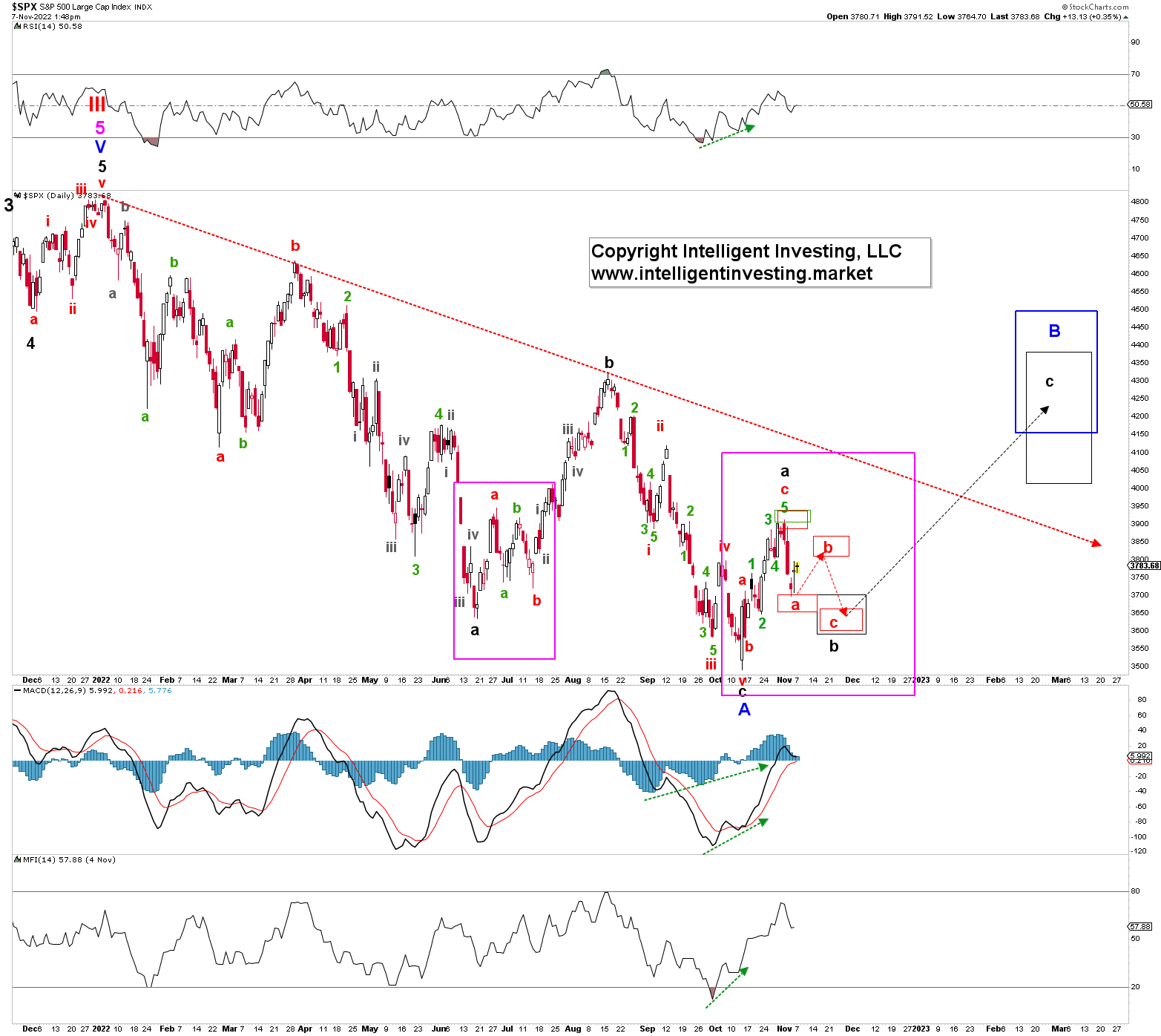

The index did not drop below SPX 3491. Instead, it rallied above SPX 3886.75 on Oct. 28. See Figure 1 below.

As such, the index did not reach the ideal downside target zone of SPX 3230-3330, as I had first laid out in September.

Figure 1: S&P 500 daily chart with detailed EWP count and several technical indicators:

With the break above SPX 388.75, the multi-month counter-trend rally was confirmed. The index then topped and bottomed right inside the ideal green and red target zones last week. Counter-trend rallies, like the June-August rally, comprise three waves (a-b-c). In this case, I am looking for a blue W-B to complete next year.

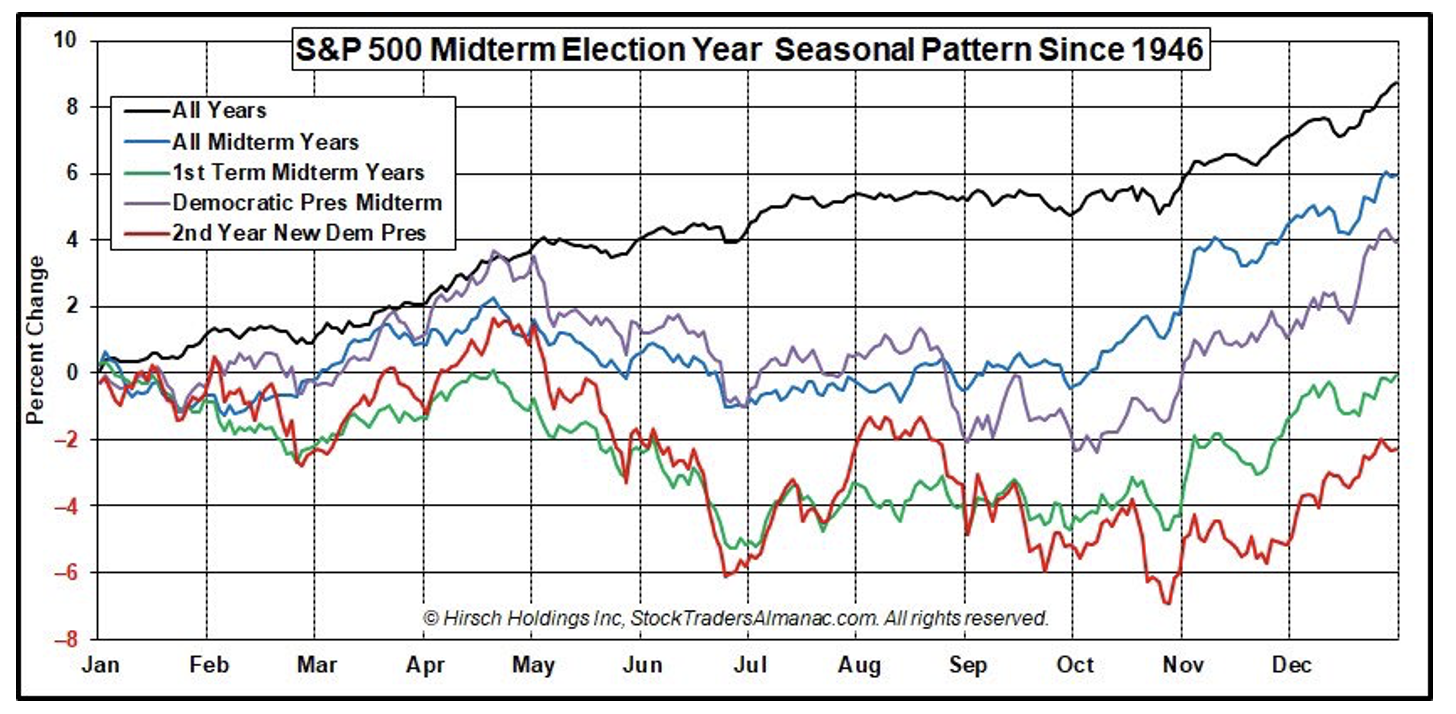

Since financial markets are fractal, W-B will consist of black W-a, b, c, with most likely W-b now under way. This black W-b, in turn, comprises three smaller red W-a, b,c. Red W-b upward is now most likely under way before red W-c -downward takes hold. The latest wave will complete black W-b, similar to the June-July price action (purple boxes). This pattern fits with the average seasonality of a mid-term year with a new Democrat administration. See the red line in Figure 2 below.

Figure 2 Midterm Election Year Seasonal Pattern Since 1946:

Thus, for now, I am looking at a short-term higher (red W-b), then lower (red W-c) before looking for higher prices again (black W-c). But please remember, counter-trend rallies are tricky because they represent overlapping price action— especially W-b of -B. So be ready to change positions quickly.