- The S&P 500’s rally highlights growing optimism about future Fed rate cuts and a potential shift in policy.

- Key technical levels are in play today, with traders eyeing both support and resistance zones closely.

- Economic data and Fed commentary today will offer fresh insights into the trajectory of US growth and rate expectations.

- Kick off the new year with a portfolio built for volatility and undervalued gems - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

Sentiment remains positive after S&P 500's big rally on Wednesday. This week’s inflation data has reinforced the market’s belief that the Fed may adopt a more accommodative stance in the not-too-distant future, rather than keeping policy on hold until the latter stages of the year.

This optimism was reflected in money market pricing, which returned to levels seen before the latest nonfarm payroll report. Let’s see if rate expectations will change significantly again in the coming weeks as investors react to fresh data and welcome the return of Donald Trump as President. Today, investors will be eying retail sales and jobless claims data, as well as some Federal Reserve commentary.

S&P 500 key levels to watch

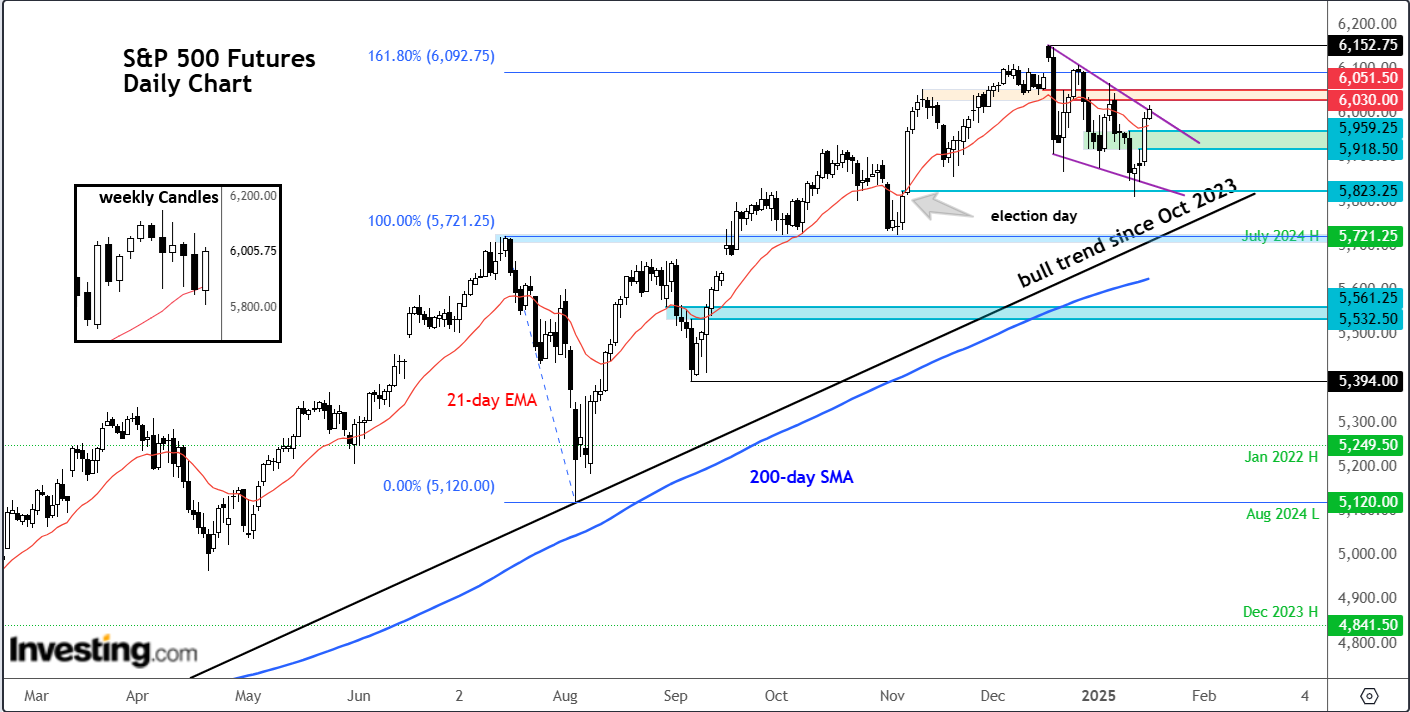

Below we have the daily chart of the S&P 500 Futures. Following the big rally on Wednesday, the index ended right below the resistance trend line of what looks like a falling wedge continuation pattern circa 6,000, before extending its gains slightly in early European trade on Thursday.

A lot of the technical damage that had been incurred in the previous week was made good. Once again, there was very little downside follow-through after yet another bearish signal. Last week’s large bearish engulfing candle (see inset) is now almost completely engulfed by a bullish candle after the election gap was filled and the dip was bought.

Keep an eye on the resistance trend of the falling wedge pattern, which was being tested at the time of writing. The lower highs observed in recent weeks mean we can’t be too complacent about expecting continued buying pressure. In this sort of market, taking it from one level to the next is key. One shot, one kill, if you will. With that in mind, it is important to take profit if you are looking for bounce trades at key support levels below market, levels that were formerly resistance.

Among the key support levels to watch now, 5959 is an important one, having been a strong resistance last Friday when the robust jobs report caused markets to drop. Below this level, Tuesday’s high of 5918 comes into focus, which will need to hold in light of the big breakout we observed on Wednesday. A decisive break below this level would be bearish.

In terms of the next resistance levels to watch, well the area between 6030 and 6051 is now in focus, where previously the index had found both support and resistance.

What will traders be watching for today?

On the macro front, attention is turning to the US jobless claims and retail sales later today for further clues over the health of the US economy and the outlook for Fed rate cuts. Meanwhile, with the earnings season kicking into higher gear, there will be lots of company news in the next few weeks. Bank of America Corp (NYSE:BAC) and Morgan Stanley (NYSE:MS) will be posting their earnings results today.

In Europe, the sentiment was boosted by the luxury goods maker Compagnie Financiere Richemont (OTC:CFRUY) soaring nearly 20% after it reported a jump in jewelry sales. The tech sector also outperformed after a bullish outlook from Taiwan Semiconductor Manufacturing (NYSE:TSM) raised hopes of strong AI spending. Let’s see if the sentiment will follow through in the US trading once Wall Street opens.

Geopolitically, a significant breakthrough emerged as a US official confirmed a Gaza hostage and ceasefire deal, set to take effect on January 19. The agreement outlines a six-week initial ceasefire phase, during which Israeli forces will gradually withdraw from central Gaza. This phase also includes provisions for the return of displaced Palestinians to northern Gaza, marking a critical step toward stabilizing the region.

In monetary policy discussions, Fed’s Williams (a voting member) commented that the recent rise in bond yields doesn’t reflect a major shift in inflation expectations and noted it wasn’t surprising. Adding to this perspective, Fed’s Goolsbee (a 2025 voter) emphasized ongoing progress in addressing inflation, suggesting that the Fed remains cautiously optimistic about its ability to manage price pressures effectively.

***

How are the world’s top investors positioning their portfolios for next year?

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Click here to discover more.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.