The US stock market has been undergoing internal rotations lately. We anticipated potential rotations to the more cyclical areas like Energy and Materials, as opposed to the Tech/Growth areas that Goldilocks has favored for most of the last year (also as anticipated, a year ago).

Yet the stock market as a whole is at high risk, as we have been parroting week after bullish week. That’s the nature of a manic bull phase. Bullish with risk increasing. But due to these internal rotations it is best to make a stand against sectors you feel will swing out of favor rather than against the broad S&P 500. The reason? Why, its very broadness. Its diversified composition, assuming internal rotations continue.

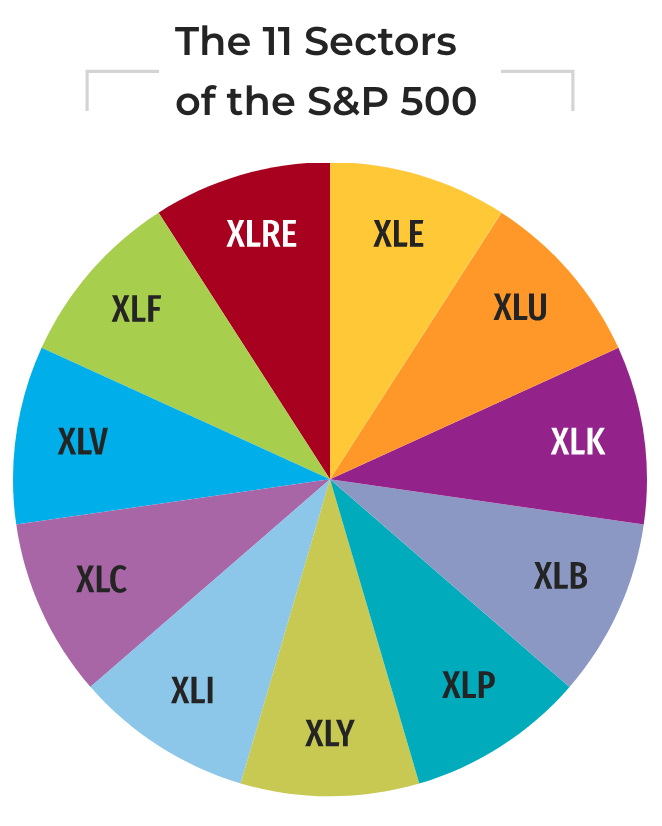

Here is the sector breakdown of the S&P 500 per the SPDRs, which allow for granular sector selection rather than ‘one size fits all’ broadness.

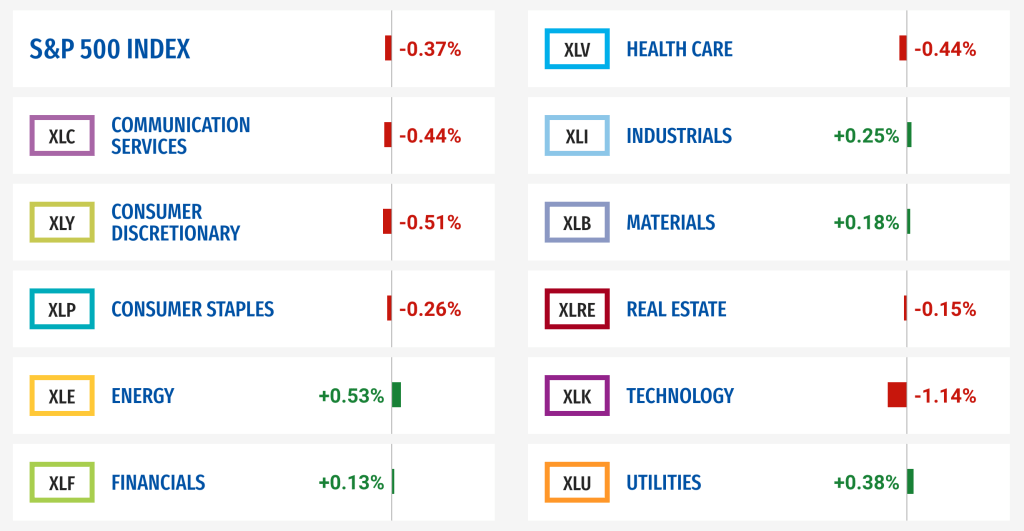

Here is a look at the sectors included along with today’s performance (irrelevant to this article, but interestingly aligned with the article’s theme on a micro view of one day).

I am short one of the market sectors shown above, per yesterday’s NFTRH Trade Log. That sector is Technology, which has been fading leadership per this public post. Worth a shot, says I. But as noted above I am also long Energy and Materials (although in a high risk market I am married to nothing).

The issue is whether the government in power can hold this mess together into the presidential election. I normally do not introduce politics into my analysis, but have done so quite a bit lately due to work presented in NFTRH that shows the Fed hawkish (but not really) and the Biden administration holding its cards close to the vest with former Fed chief Janet Yellen in the side car.

The Yellen connection especially hints of coordination with the Fed. It goes something like this: The Fed remains tight on the Funds Rate but is monetizing bonds out the back door. Wouldn’t want to get too tight in an election year, now would we? Meanwhile, the administration still holds stimulative cards like the Semiconductor CHIPS Act and whatever Green initiatives it may pursue in its back pocket.

While the Semiconductor sector is a wild card (and one that I have long been bullish on), areas like Energy, Materials and Industrials are considered highly cyclical and responsive to fiscal stimulation as well as inflationary market signaling (when market participants are not cowering before the Great and Powerful Fed of Oz).

Bottom Line

I’d anticipate a market correction of some note before a final and potentially bullish drive into Q4 and the election. However, this pig could also just keep rotating its way to November. If you plan to be actively bearish, it is best to take a serious look at the macro at any given time and decide what sectors stand to be cycled out and what sectors perhaps stand to be cycled in.