George Orwell once said about social hierarchy: “All animals are equal, but some animals are more equal than others.” This is equally true about financial markets, with some markets more important than others.

So what makes a market important?

Size obviously matters, but it's not the only factor. For example, the currency market, by far the biggest market in the world (with daily turnover of $4 trillion), is usually a follower rather than a leader in terms of its relationship with other markets.

As a macro investment strategist, I value information content more than anything else. For me, the most important markets are those that best help me decipher the broader narrative and consensus imbedded in asset prices.

With so much focus at the moment on what the Fed will do about rising inflation, I am following the US inflation-indexed government bond market more closely than any other. All you need to know about this market is that when you buy an inflation-indexed bond, the coupons you get are the product of the so called “real yields” plus the actual inflation at the time of the coupon payment dates.

There are four reasons why real yields of long-term US government bonds are so extremely important to the global financial markets:

- The pricing of all financial assets requires a risk-free rate, the return of a risk-free asset.

- The pricing of assets with long-term cash-flows needs a long-term risk-free rate.

- Because investors are only interested in real (after inflation) returns, they only care about the real risk-free rate.

- Given the size of US markets and the dollar’s reserve currency status, the long-term US real risk-free rate is often accepted as the long-term real risk-free rate for the world.

Because monetary policy works through long-term interest rates and real interest rates, real yields on long-term government bonds tell us a lot about whether the market expects future monetary policy to be loose or tight.

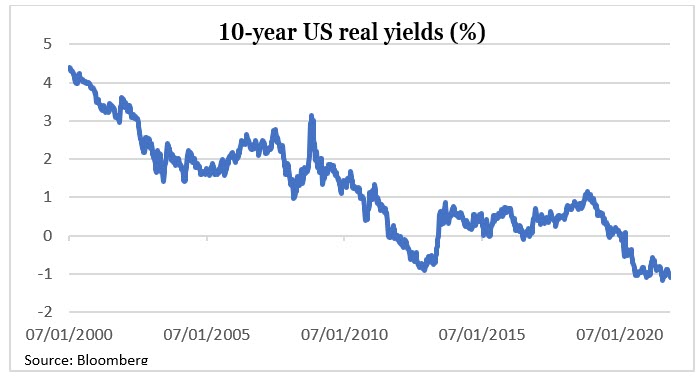

Judging by the fact that the 10-year US real yield (the real yield on a 10-year maturity inflation indexed government bond) is currently at minus 1.1%, not far from its all-time low (see below chart), we can safely say that the market thinks the Federal Reserve will maintain a very loose monetary policy for as far as the eye can see.

This is the reason why investors have been buying stocks hand over fist. They are assuming that the punch bowl will not be taken away anytime soon.

But what about inflation? Doesn’t the market know that consumer price inflation hit a 30-year high last month (6.2%)?

There is a saying on Wall Street: “Don’t fight the Fed.” What it means is that you don’t second guess the US central bank, you accept what you are told by them. And right now, the Fed is telling us that inflation will be “transitory” (the code word for “No Need to Act”).

Below are the three most important take-aways from Federal Reserve Chairman Jerome Powell's press conference last week:

- “The inflation that we’re seeing is really not due to a tight labor market.”

- “We don’t see troubling increases in wages, and we don’t expect those to emerge.”

- “There is still ground to cover to reach maximum employment both in terms of employment and terms of participation.”

Given maximum employment is one of the Fed’s two mandates, Powell is basically saying that he is not in a hurry to raise interest rates.

It makes no difference to the market that what Powell said is not supported by the data. Wages are growing at 4.9%, the highest in twenty years (see below chart). Unit labor costs are going up at a rate of 4%, the highest in thirty years. The number of businesses reporting that vacancies are difficult to fill is at an all-time high.

Having watched the Fed for twenty years while I was working on Wall Street, I have learned that the central bank is neither infallible nor are their policies foolproof.

However, what Powell said is so detached from reality that I cannot believe his statements stem from mere ignorance. Could there be another reason for his incredible dovishness?

Well, it so happens that Powell’s term will end in two months, and US President Joseph Biden is set to announce his nomination for the next Chair of the Fed any day now. What if Powell has decided that to get a second term he needs to convince the President of the United States that he would not do anything to spoil the party? Is it possible that he is actually less dovish than he sounds?

I suspect another factor behind the current extremely low long-term real yields is the market expectation that Lael Brainard, a super dove backed by the progressive wing of the Democratic Party, has a decent chance for the top job at the Fed.

The bottom-line: the immediate outlook for real yields and for the stock market is riding on whom Biden will nominate as the next Chair of the Federal Reserve.

Who will Biden go with? In my view, the answer is quite simple.

Biden is facing huge problems at home and abroad. His party just lost a huge election in Virginia; his social spending bill is in trouble; his negotiation with Iran is stuck; his call to the Saudis last week to boost oil output fell on deaf ears.

In my view, Biden needs someone who can sail through the Senate confirmation process smoothly. Right now, Powell has much stronger bipartisan support than Brainard in a 50/50 Senate.

So yes, I think Biden will nominate Powell. If I am right, we should see real yields go up.

Given the recent correlation pattern between real yields and other markets, I have been recommending to the subscribers of my blog to sell short the iShares TIPS Bond ETF (NYSE:TIP), buy the USD, and go long the VIX via the iPath® Series B S&P 500® VIX Short-Term Futures™ ETN (NYSE:VXX).

These trades are not for novices nor for the faint-hearted. For them, I would suggest exercising great caution in the next few weeks due to increased risk of a repricing of long-term risk-free rates.

If I am right, Financials will outperform Tech and Utilities will outperform Consumer Discretionary. And cash will outperform everything else.