- Beverage giant Coca-Cola shares up by 21.7% in the past 12 months

- On Feb. 8, KO stock hit a record prior to releasing solid Q4 figures

- Long-term investors could consider buying Coca-Cola stock at pullbacks

Shareholders of Coca-Cola (NYSE:KO), the largest non-alcoholic beverage maker in the world, have escaped the rout that has taken over broader markets. So far this year, KO stock is up 3.3%.

By comparison, the Dow Jones Industrial Average—the 30 component mega cap index that includes KO—is down 3.9% year-to-date. And shares of Coca-Cola’s long-term competitor PepsiCo (NASDAQ:PEP) have declined 4.3% since January.

Yet on Feb. 8, KO shares went over $62 to hit an all-time high. The stock’s 52-week range has been $48.97-$62.33, while the market capitalization stands at $264.2 billion.

Recent Metrics

The company released Q4 and full-year 2021 metrics on Feb.10. Overall, results were better than consensus estimates. The top line increased 9% organically and came in at $9.5 billion. Still, for the quarter, adjusted EPS decreased by 5% to 45 cents.

Wall Street was pleased that net revenues were ahead of 2019 and that Coke Zero Sugar achieved double-digit growth. Coca-Cola also saw gains in both at-home and away-from-home channels.

Coffee sales increased by 17% as well. Readers are likely to know that the group owns the Costa Coffee chain in the UK. Stores started reopening during the quarter.

For 2022, management expects organic revenue growth of 7% to 8%. Comparable EPS growth, on the other hand, should be 5% to 6%, slightly lower than analysts’ estimates. The company warned that higher commodity costs would affect earnings.

Post-earnings, KO stock has been volatile, mainly swinging between $59.50 and $62.50. The stock closed at $60.91 on Feb. 15.

Next Move In Coca-Cola Stock?

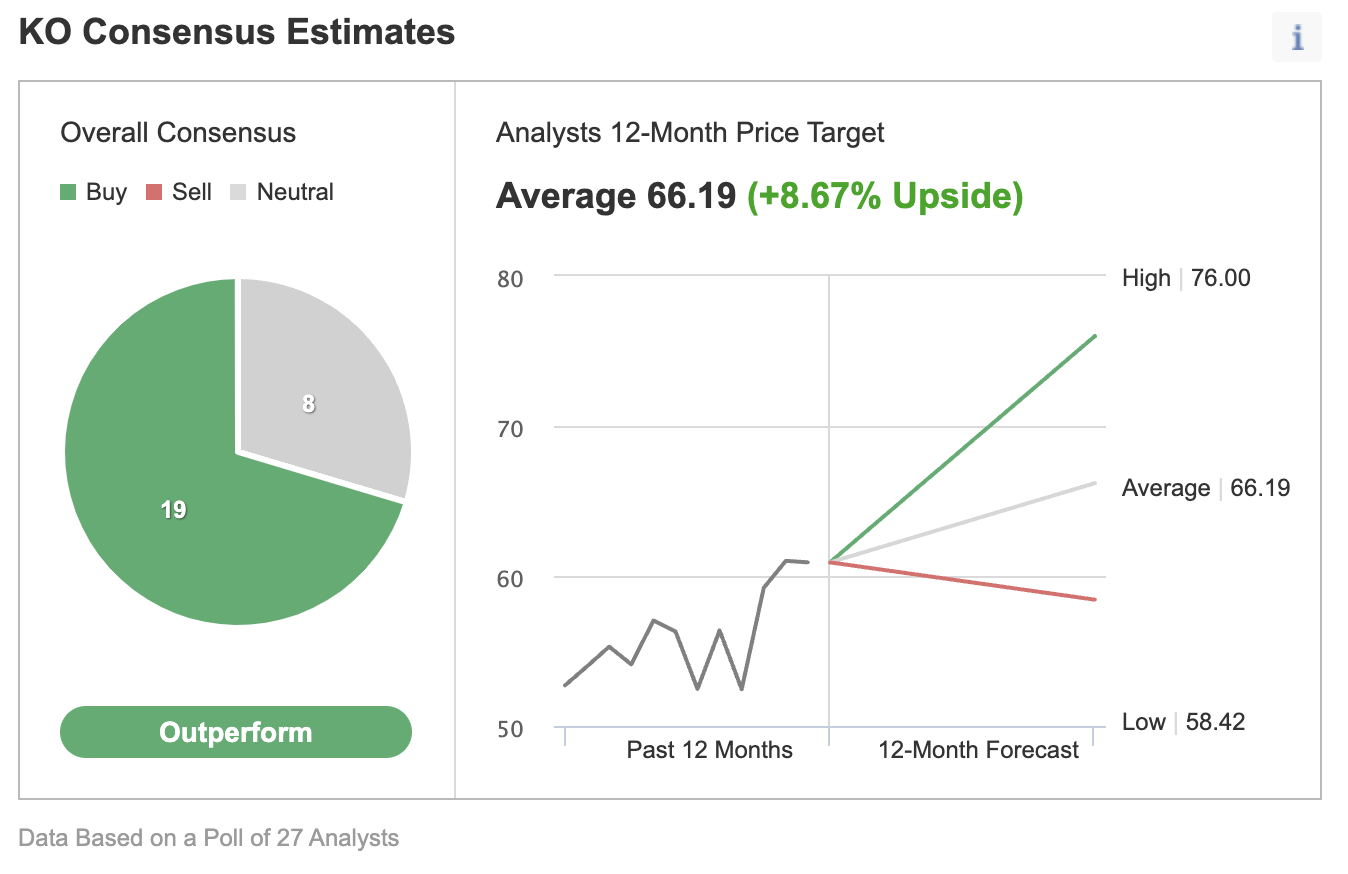

Among 27 analysts polled via Investing.com, KO shares have an “outperform” rating, with an average 12-month price target of $66.19. Such a move would imply an increase of almost 9% from the current level. The target range is between $58.42 and $76.

Source: Investing.com

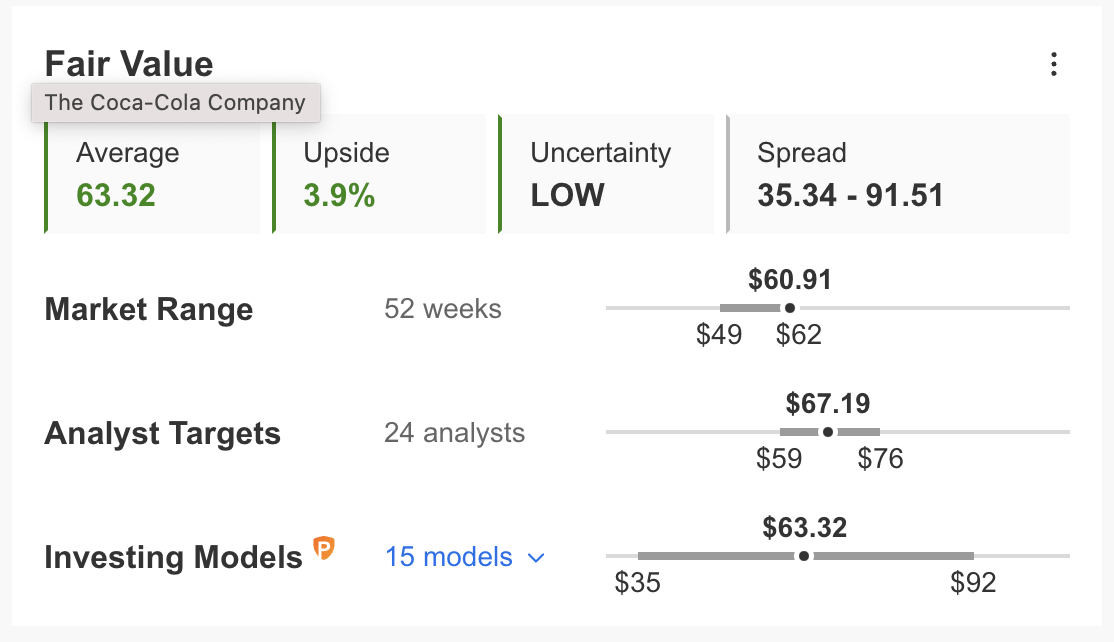

However, according to a number of valuation models like those that might consider P/E or P/S multiples, dividends or terminal values, the average fair value for Coca-Cola stock via InvestingPro stands at $63.32, or about only a 3.9% upside only.

Source: InvestingPro

Given the recent run-up in price, some investors could decide to cash out of KO stock. Therefore, we could witness volatility in the coming weeks.

We expect the stock to potentially drop toward $58, or even below, in the short run. Following such a potential decline, KO shares are likely to trade sideways for several weeks until they establish a base, possibly between $55-$58, and then start a new leg up.

Therefore, Coca-Cola bulls with a two- to three-year horizon who are not concerned about short-term choppiness could consider buying the stock around these levels for long-term portfolios. Others, who are experienced with options strategies and believe there could be further declines in KO shares, might prefer to try a bear put spread.

However, option strategies are not suitable for all retail investors. Therefore, the following discussion is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bear Put Spread On KO Stock

Intraday price at time of writing: $61.20

In a bear put spread, a trader has a long put with a higher strike price and a short put with a lower strike price. Both legs of the trade have the same underlying stock (i.e., Coca-Cola) and the same expiration date.

The trader wants KO stock to decline in price. However, in a bear put spread, both the potential profit and the potential loss levels are limited. Such a bear put spread is established for a net cost (or net debit), which represents the maximum loss.

Let’s look at this example:

For the first leg of this strategy, the trader might buy an at-the-money (ATM) or slightly out-of-the-money (OTM) put option, like the KO Apr. 14, 60-strike put option. This option is currently offered at $1.45. It would cost the trader $145 to own this put option that expires in about two months.

For the second leg of this strategy, the trader sells a KO put, like the Apr. 14, 57.5-strike put option. This option’s current premium is $0.75. The option seller would receive $75, excluding trading commissions.

Maximum Risk

In our example, the maximum risk will be equal to the cost of the spread plus commissions. Here, the net cost of the spread is $0.70 ($1.45 – $0.75 = $0.70).

As each option contract represents 100 shares of the underlying stock, we would need to multiply $0.70 by 100, which gives us $70 as the maximum risk.

The trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the Coca-Cola stock price at expiration is above the strike price of the long put (or, $60 in our example).

Maximum Profit Potential

In a bear put spread, potential profit is limited to the difference between the two strike prices minus the net cost of the spread, plus commissions.

So in our example, the difference between the strike prices is $2.50 ($60.00 – $57.50 = $2.50). And as we have seen above, the net cost of the spread is $0.70.

The maximum profit, therefore, is $1.80 ($2.50 – $0.70 = $1.80) per share, less commissions. When we multiply $1.80 by 100 shares, the maximum profit for this option strategy comes to $180.

The trader will realize this maximum profit if the KO stock price is at or below the strike price of the short put (lower strike) at expiration (or, $57.50 in our example).

Short put positions are typically assigned at expiration if the stock price is below the strike price (i.e., $57.50 in this example).

However, there is also the possibility of early assignment. Therefore, the position would need monitoring up until expiration.

Break-Even KO Price At Expiration

Finally, we should also calculate the break-even point for this trade. At that price, the trade will not gain or lose any money.

At expiration, the strike price of the long put (i.e., $60.00 in our example) minus the net premium paid (i.e., $0.70 here) would give us the break-even price.

In this example: $60.00 − $0.70 = $59.30 (minus commissions).

Bottom Line:

We regard KO stock as a solid long-term choice for most portfolios. However, there could soon be short-term profit-taking in shares. Therefore, a trading strategy as outlined above might be appropriate for traders with a bearish outlook on Coca-Cola stock.