- You can follow Warren Buffett's successful investing approach in InvestingPro's Ideas section, gaining insights into his consistently outperforming strategy.

- The platform provides in-depth insights, including Health Scores, Fair Values, and more for each stock.

- In this piece, we'll see how we can use tools available on InvestingPro to pick stocks that meet Buffett's criteria.

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

Warren Buffett's investing philosophy has consistently garnered admiration, with his notable skill in identifying stocks that embody long-term value. Over time, he has constructed a financial empire grounded in sound investment principles.

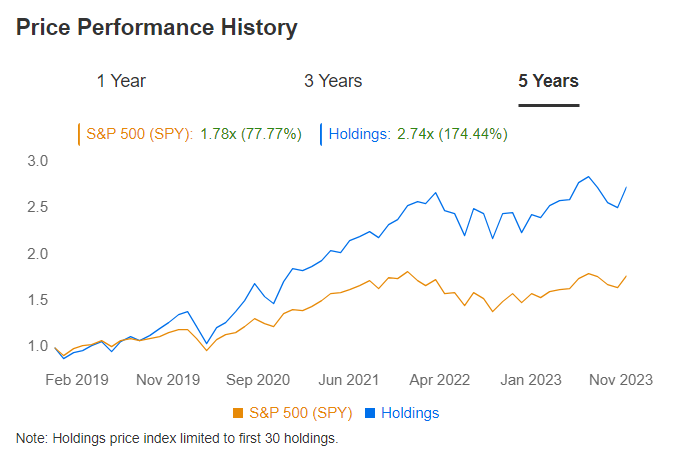

By navigating through the InvestingPro platform and accessing the Ideas section under "Warren Buffett," we gain insights into how his approach has consistently outperformed even the S&P 500.

Source: InvestingPro

Despite his historical success, Warren Buffett has consistently displayed a cautious approach, especially during periods of economic uncertainty. Berkshire Hathaway (NYSE:BRKb)) has noticeably bolstered its cash reserve, reaching $157 billion. This strategic move positions the company to capitalize on potential market opportunities while also signaling a sense of caution in the face of potential volatility.

In the last quarter, Berkshire Hathaway closed or reduced some of its open positions, a strategic maneuver that can be easily tracked on InvestingPro. By navigating to the "Warren Buffett" portfolio, selecting "Ranking Tables," and applying the filter "Biggest Sells," users can gain insights into the recent adjustments made by Buffett and his team.

Source: InvestingPro

He permanently closed his positions in Activision Blizzard (NASDAQ:ATVI), General Motors (NYSE:GM), Celanese (NYSE:CE), Johnson & Johnson (NYSE:JNJ), Procter & Gamble (NYSE:PG), Mondelez (NASDAQ:MDLZ) and United Parcel Service (NYSE:UPS).

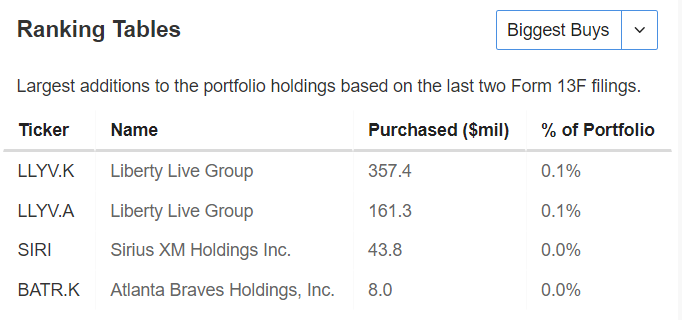

On the InvestingPro platform, in the "Ranking Tables" section we changed the filter to "Biggest Buys".

Source: InvestingPro

New holdings in the portfolio include Liberty Media (NASDAQ:LLYVK), Sirius XM Holdings (NASDAQ:SIRI), and Atlanta Braves Holdings (NASDAQ:BATRK).

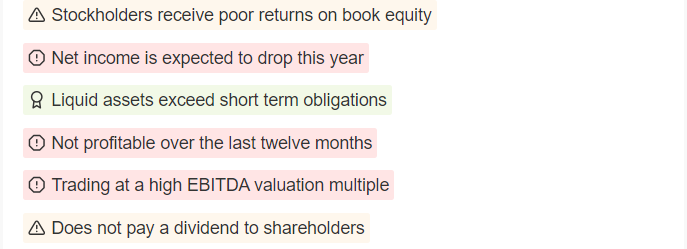

By clicking on the individual stocks we can see their company profile and Key Statistics (ProTips), their Fair Value, their financial health, and lots of other information.

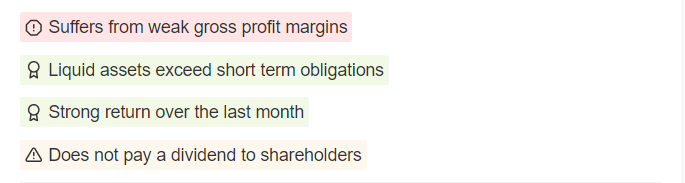

Liberty Live Group has an InvestingPro Health Score of 3/5 and a Pro Fair Value at 22.62 with a possible downside of 36% (overvalued).

Source: InvestingPro

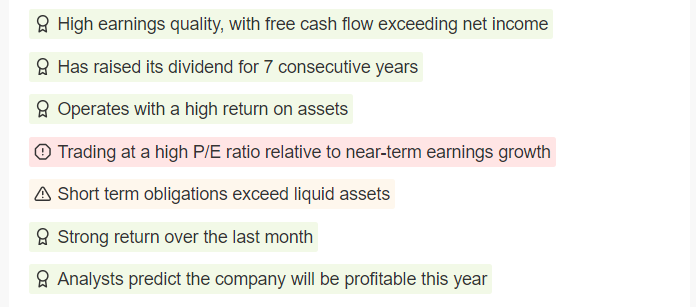

Meanwhile, Sirius XM Holdings has an InvestingPro Health Score of 3/5 and a Fair Value Pro at 6.76 with a possible upside of 38% (undervalued).

Source: InvestingPro

Atlanta Braves Holdings has an InvestingPro Health Score of 2/5 and a Fair Value Pro at 27.33 with a possible downside of 23.5% (overvalued).

Source: InvestingPro

Furthermore, in its most recent 13F quarterly report released on November 14, Berkshire Hathaway revealed the addition of a new stock. However, the company opted for confidential treatment with the SEC, refraining from officially disclosing the details of the new stock position(s). This was not the first time the fund adopted confidentiality treatment, In late 2020 Buffett was confidentially accumulating Chevron (NYSE:CVX) and Verizon (NYSE:VZ) stocks.

Many have speculated that Berkshire might have considered several stocks such as Morgan Stanley (NYSE:MS), BlackRock (NYSE:BLK) and Chubb (NYSE:CB), but not excluding a return in Goldman Sachs (NYSE:GS). In addition, Charles Schwab (NYSE:SCHW) Corp actually might be the stock of choice; shares are down 30 percent year-to-date.

Here's How InvestingPro Can Help You Find Stocks That Meet Buffett's Buying Criteria

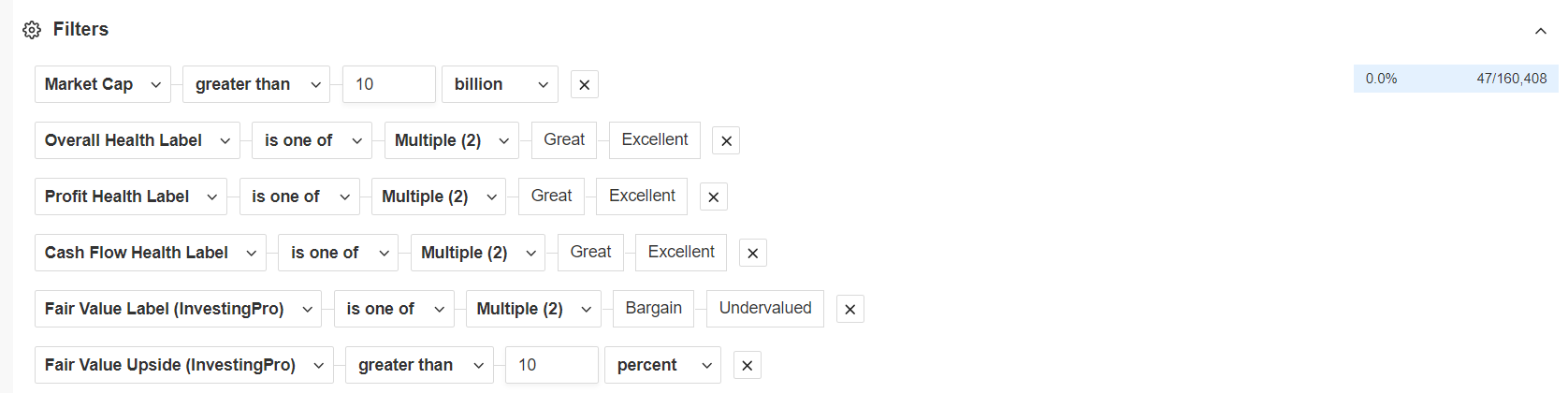

Using InvestingPro's "Stock Screener" tool we look for stocks that might qualify and be part of Buffett's portfolio, we use a methodical approach and filter through thousands of U.S.-listed companies to compile a watchlist of stocks that exhibit strong growth, solid profitability, healthy cash flows and an attractive valuation worth viewing:

Source: InvestingPro

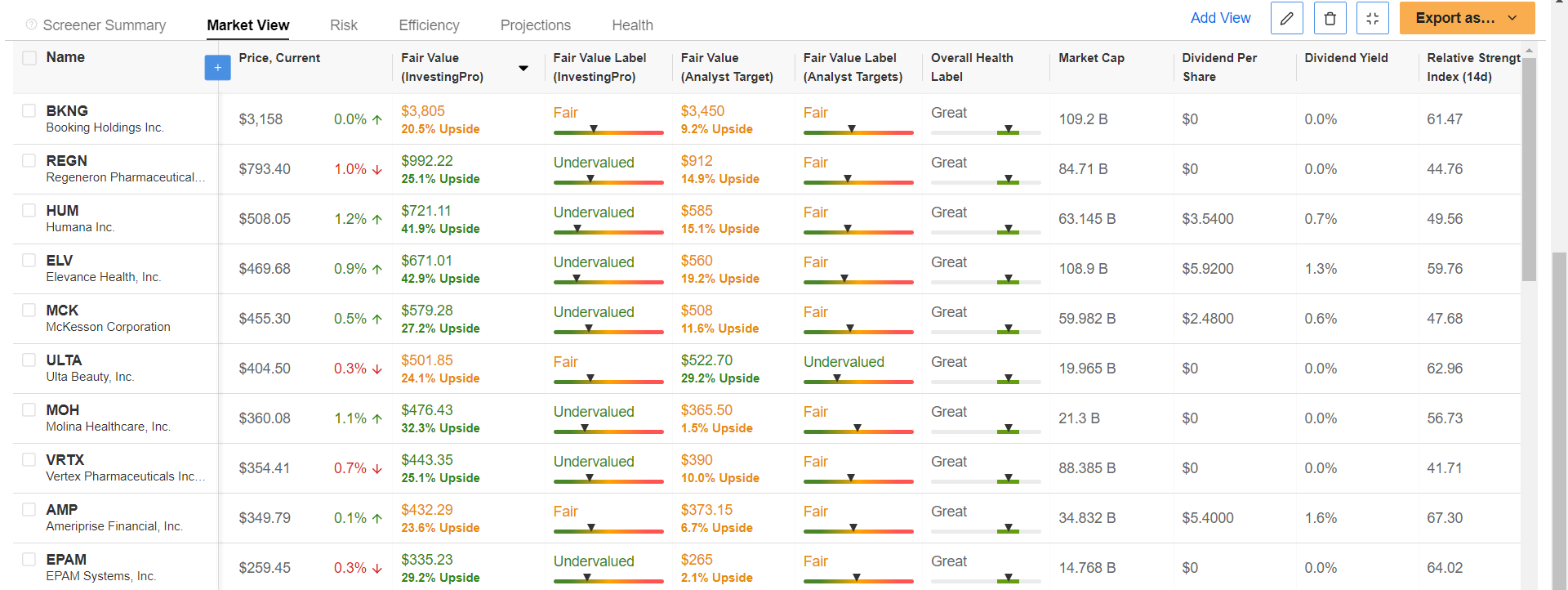

In my search for stocks with a robust financial health profile, I focused on those rated as "Great" or "Excellent." The InvestingPro team's extensive testing of the S&P 500 Index from 2016 revealed that companies with high scores consistently outperformed the market. To further refine my selection, I set a Fair Value threshold of at least 10 percent. After applying these criteria, 47 stocks emerged, and here are the top 10 among them:

Source: InvestingPro

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.