- Nvidia will publish its quarterly results after the closing bell today.

- Higher-than-ever expectations mean the chip maker has no margin for error.

- Models and analysts indicate limited upside potential to NVDA after a 92% rally this year.

- Subscribe to InvestingPro for less than $9 a month and learn which stocks to buy and which to shun, whatever the market conditions!

Tech giant Nvidia (NASDAQ:NVDA) is getting ready to step into the earnings spotlight today after the market closes.

The chipmaker is reporting results later than most major tech companies typically report, but anticipation remains higher than ever nonetheless.

Analysts believe Nvidia's results could have a ripple effect on the entire market. Strong financial performance from the AI powerhouse could fuel a continued rally in tech stocks.

Nvidia's dominance in the AI space is undeniable. Its powerful chips are instrumental in driving cutting-edge technologies like Google)'s Gemini language model and OpenAI's ChatGPT chatbot.

A stellar earnings report could further solidify Nvidia's position and send a positive signal to the broader technology sector.

Nvidia has no room for error amid higher-than-ever expectations

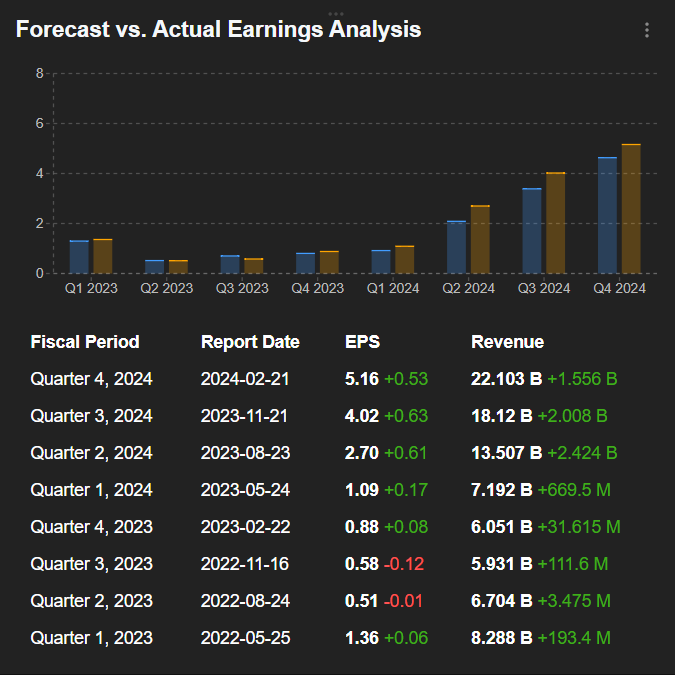

Concerning consensus forecasts for tonight's results, analysts are expecting an average EPS of $5.58 according to InvestingPro data, i.e. almost 5 times higher (+411% ) than in the same quarter last year.

Source: InvestingPro

- Sales are forecast at $24.59 billion, up +242% year-on-year.

- Analysts have also raised their EPS estimates by 308.43 % over the past 90 days.

However, there are whispers that the figures will be even better than this official consensus predicts. In a note published last Sunday, analysts at Evercore ISI called it "Wall Street's worst-kept secret" that Nvidia will beat expectations on both earnings and sales.

It's true that for some time now, Nvidia has accustomed investors to exceeding expectations, sometimes by a wide margin. The company has exceeded EPS and sales expectations for the last 5 consecutive quarters.

Source: InvestingPro

In other words, figures in line with consensus (or an overshoot on EPS and a disappointment on sales, or vice versa) could be taken as bad news and could send the stock tumbling.

Another risk to consider is the company's forecasts for the coming quarters. Indeed, cautious guidance could cancel out the positive impact of exceeding expectations.

Upside potential remains limited after rallying 92% this year

This is all the more true given that Nvidia shares are currently close to their all-time highs, up 92% year-to-date and 206% year-on-year, so it wouldn't take much to trigger a wave of profit-taking.

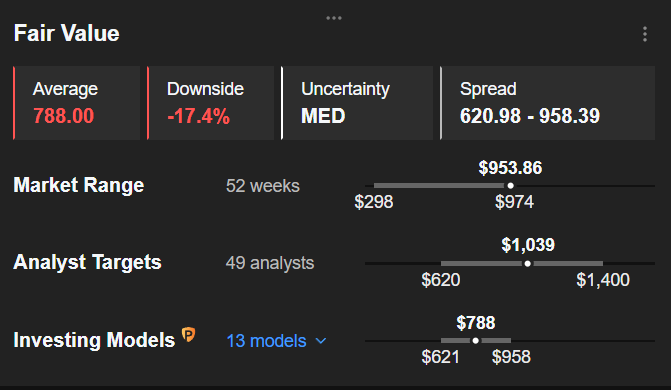

What's more, most valuation models consider the stock to be overvalued. The InvestingPro Fair Value, which uses several recognized financial models, puts Nvidia at $788, i.e. 17.4% below the current share price.

Source: InvestingPro

Analysts, though more optimistic, assign an upside potential of only 8.9% to the stock, with an average target of $1038.98. Beyond tonight's results, the question of Nvidia's continued growth in the longer term arises, as the competition gathers pace and catches up.

In addition to direct competitors AMD (NASDAQ:AMD) and Intel (NASDAQ:INTC), Nvidia will soon be facing competition from its customers, since most of its biggest outlets, such as Amazon (NASDAQ:AMZN), Meta (NASDAQ:META) and Microsoft (NASDAQ:MSFT), are currently working on their own AI chips.

Should we buy or avoid the stock ahead of results?

While it's not out of the question for Nvidia shares to make new highs if tonight's results exceed expectations, there are arguably better opportunities for investors interested in technology stocks and who adopt a medium-to-long-term investment horizon.

However, it's difficult to guarantee a rise in NVDA even if it exceeds expectations, given that expectations could be even higher than the consensus suggests.

Even the slightest disappointment could trigger a violent downward reaction, not just from Nvidia, but from the market as a whole.

Are you looking to invest in tech stocks likely to soar?

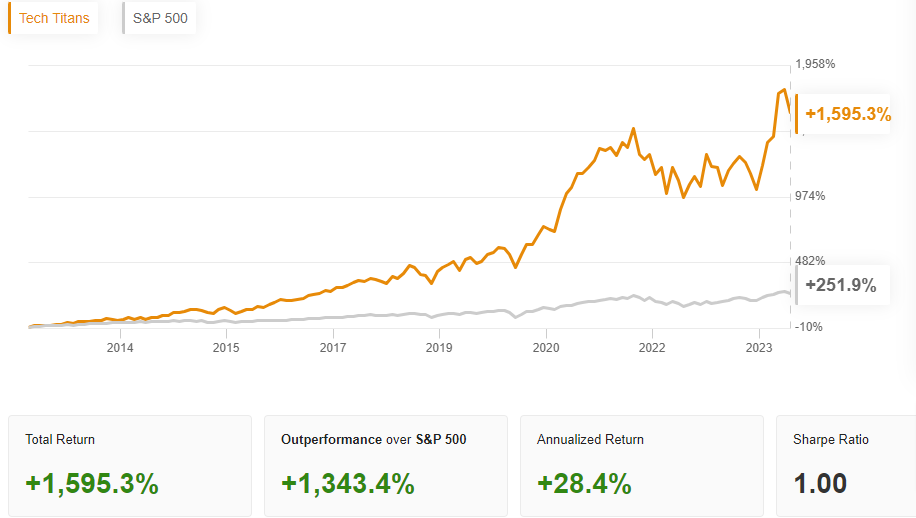

There are several options available to help investors identify the technology stocks most likely to "take over" from Nvidia and soar with them. One such option is InvestingPro's ProPicks Tech Titans portfolio.

Posting a performance of almost 1600% over a 10-year backtest, this strategy, which is re-evaluated every month, has already returned over 68% since its official launch in October 2023.

Note that the Titans of Tech strategy is offered alongside 5 other portfolios that are also significantly outperforming the market, as you can see below with their performance record since October 2023 (as of May 20):

- Outperforming the S&P 500: +31.96

- Outperform the Dow Jones: +19.66

- Best value stocks: +35.51

- Mid-cap ranking: +23.61%

If you'd like to take advantage of the ProPicks Tech Titans strategy and our 5 other AI-managed portfolios, plus a host of other tools, now is the ideal time to subscribe to InvestingPro.

For a limited time we're offering a -10% discount on 1- and 2-year subscriptions!

- Click here to take advantage of the special discount on the 1-year Pro subscription (which comes down to 8.1 euros per month).

- Or click here to sign up for a two-year subscription at the even more attractive price of 7.6 euros per month (less than 2 euros per week!).

You can also click here to learn more about InvestingPro and compare the Pro and Pro+ subscriptions in more detail. You'll also be able to take advantage of a -10% discount, but you'll need to manually enter the promo code "ACTUPRO" in the dedicated space at the last stage before payment.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.