- NVIDIA's Q3 results showed a 94% revenue increase, surpassing expectations.

- Concerns include a slowdown in revenue growth and potential chip supply issues.

- A potential 17% stock decline is indicated, but long-term growth may present buying opportunities.

- Get ready for massive savings on InvestingPro this Black Friday! Access premium market data and supercharge your research at a discount. Don't miss out - click here to save 55%!

NVIDIA, the world's largest company by market capitalization, has been a reliable indicator of the rapid advancement of artificial intelligence.

The behemoth has consistently exceeded expectations for earnings per share and revenue - as it did in the third quarter of this year. However, this time, it failed to impress on its forward guidance, as the company anticipates a slowdown in revenue growth by several percentage points in the upcoming quarter.

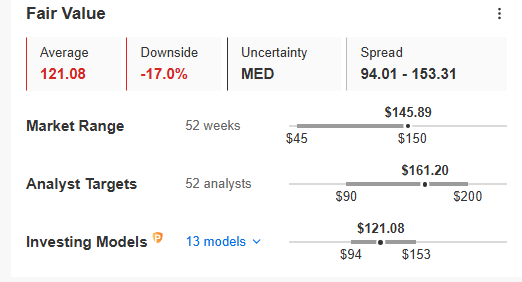

The InvestingPro tool indicates that the potential correction could be more substantial due to current extended valuation metrics.

Let's take a look at the main takeaways from the report to assess how the company's rock-solid financials look after yesterday's report.

Tradition Maintained: Forecasts Surpassed

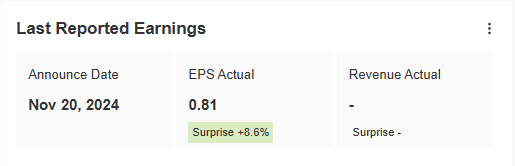

It's become a tradition for NVIDIA to surpass market expectations on key financial indicators every quarter.

This quarter was no exception. There were 32 upward revisions and only 2 downward, leading to an earnings per share of $0.78 and revenues of $35.1 billion, marking a remarkable 94% increase year-over-year in the latter.

Figure 1: NVIDIA's quarterly results for Q3, source: InvestingPro

Figure 1: NVIDIA's quarterly results for Q3, source: InvestingPro

The rest of the figures look equally impressive, led by data center revenue, which came in at $30.8 billion, up 6% from forecasts of $29.14 billion (+17% k/k and +112% y/y).

Also noteworthy was the gaming segment reporting revenues of $3.3 billion against forecasts of $3.06 billion. Almost to the point, analysts managed to estimate gross margins of 75% instead, but this does not change the overall picture of overall results.

Forward Guidance

The market appears concerned by the published forecasts for Q4, which indicate, among other things, a deceleration in revenue growth from 94% to 69.5%.

There may also be some concern about indications that the supply of Blackwell and Hopper AI chips due to go on sale later this year may have supply constraints due to capacity issues at key partner TCSM.

A corrective scenario is indicated by InvestingPro's fair value, which signals the possibility of a listing decline of up to 17%.

Figure 2: NVIDIA fair value index, source: InvestingPro

Is Nvidia (NASDAQ:NVDA) Still Worth a Buy? Levels to Watch

If the corrective scenario is indeed realized still should be a good opportunity to connect to the uptrend due to the fact that ultimately the data does not give grounds for a deeper plunge in the price.

Currently, the stock is moving within a price channel, the breakout of the bottom of which opens the way for an attack on the confluence of the upward trend line and the support level located in the price area of $130 per share.

Figure 3 Technical analysis of NVIDIA

If this area is broken out, then it will be possible to realize fair value, which coincides with the demand zone formed in early October this year.

Conversely, a breakout above the all-time high would signal the start of a new bull run, with a likely attempt to attack at least $160 per share.

Be sure to subscribe to InvestingPro now for up to 55% off as part of our Early Bird Black Friday sale!

***

Disclaimer: This article is for informational purposes only. It is not intended as a solicitation, offer, advice, or recommendation to purchase any asset. All investments should be evaluated from multiple perspectives, and it is important to remember that any investment decision and the associated risks are the sole responsibility of the investor. Additionally, no investment advisory services are provided.