In this NEAR Protocol (NEAR) price prediction 2024, 2024-2030, we will analyze the price patterns of NEAR by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

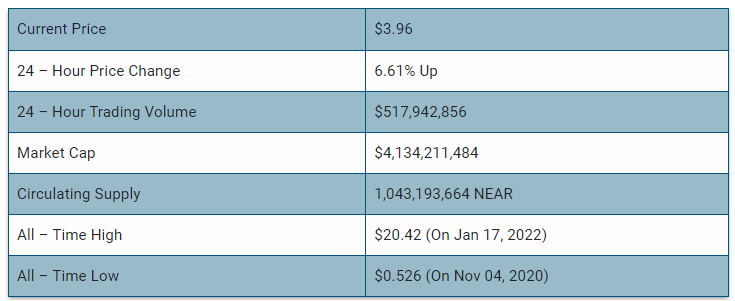

NEAR Protocol (NEAR) Current Market Status

What is NEAR Protocol (NEAR)

The NEAR protocol is a decentralized application platform designed for the use of Internet applications. The network runs on a Proof-of-Stake (PoS) consensus mechanism called Nightshade, which is designed to provide scalability and stable rates. Its native token is NEAR.

NEAR Protocol is focused on creating a developer and user-friendly platform. To accommodate this mission, NEAR has incorporated features like human-readable account names as opposed to only cryptographic wallet addresses, and the ability for new users to interact with dAppas and smart contracts without requiring a wallet at all.

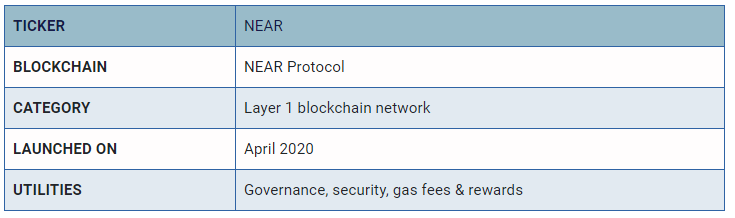

NEAR Protocol 24H Technicals

NEAR Protocol (NEAR) Price Prediction 2024

NEAR Protocol (NEAR) ranks 26th on CoinMarketCap in terms of its market capitalization. The overview of the NEAR Protocol price prediction for 2024 is explained below with a daily time frame.

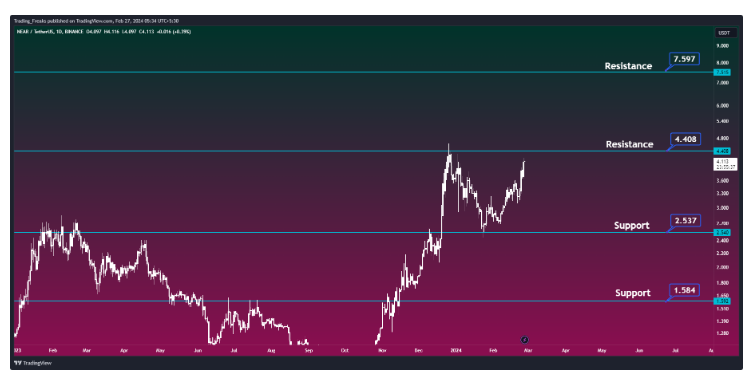

In the above chart, NEAR Protocol (NEAR) laid out the Rounding Bottom. The Rounding Bottom, signifies a long-term reversal in price trends, typically observed after extended downward movements lasting weeks to months. Distinguished from the cup and handle pattern, the rounding bottom lacks a temporary downward handle. Its initial slope indicates excess supply, pushing prices down, but a shift occurs as buyers enter at lower prices, boosting demand. Once the rounding bottom forms, a breakout signals a new upward trend, suggesting a positive market reversal and a shift from bearish to bullish sentiment.

At the time of analysis, the price of NEAR Protocol (NEAR) was recorded at $4.055. If the pattern trend continues, then the price of NEAR might reach the resistance levels of $4.407 and $7.659. If the trend reverses, then the price of NEAR may fall to the support of $3.156 and $2.519

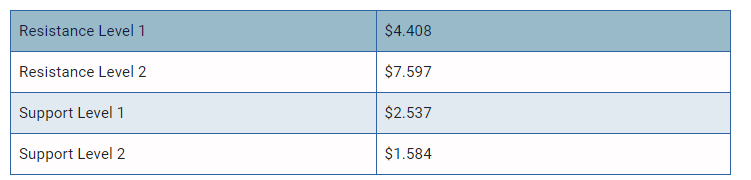

NEAR Protocol (NEAR) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of NEAR Protocol (NEAR) in 2024.

From the above chart, we can analyze and identify the following as the resistance and support levels of NEAR Protocol (NEAR) for 2024.

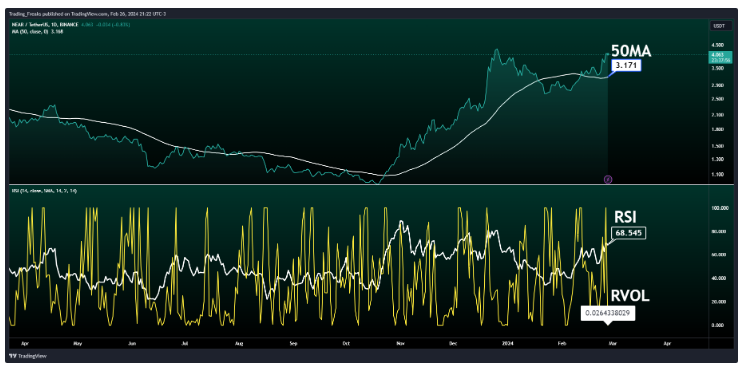

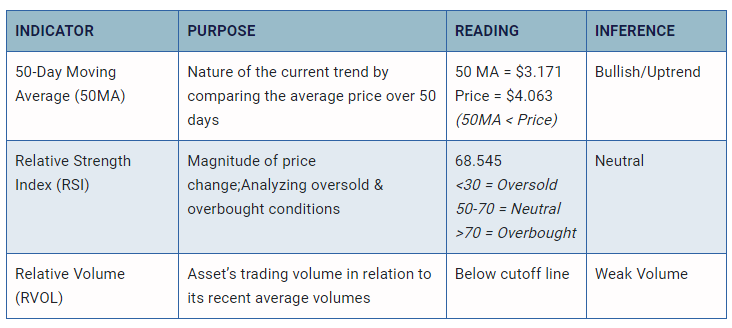

NEAR Protocol (NEAR) Price Prediction 2024 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of NEAR Protocol (NEAR) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current NEAR Protocol (NEAR) market in 2024.

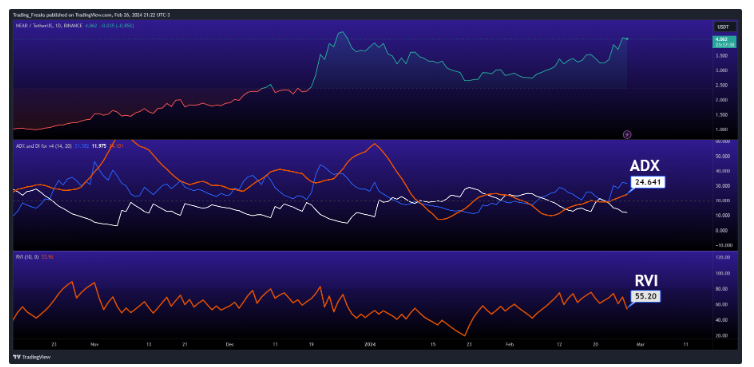

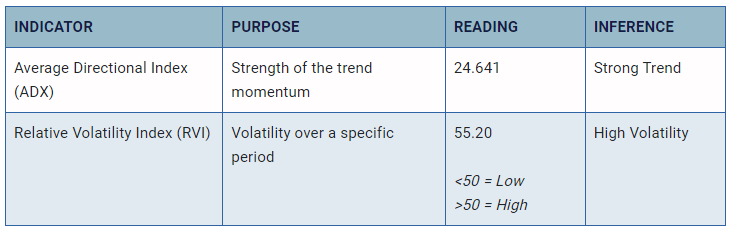

NEAR Protocol (NEAR) Price Prediction 2024 — ADX, RVI

In the below chart, we analyze the strength and volatility of NEAR Protocol (NEAR) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of NEAR Protocol (NEAR).

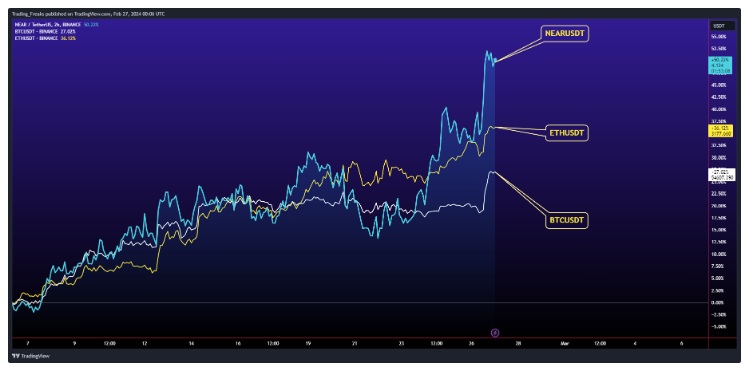

Comparison of NEAR with BTC, ETH

Let us now compare the price movements of NEAR Protocol (NEAR) with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, we can interpret that the price action of NEAR is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of NEAR also increases or decreases respectively.

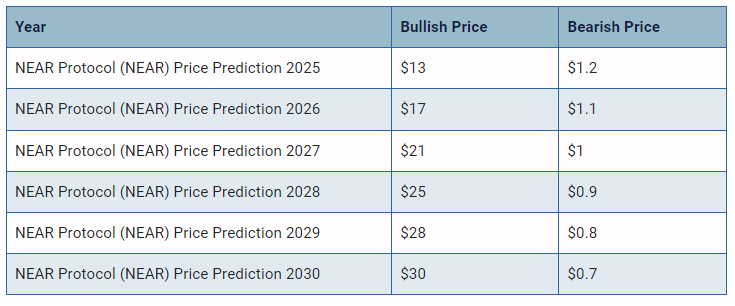

NEAR Protocol (NEAR) Price Prediction 2024, 2025 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of NEAR Protocol (NEAR) between 2024, 2025, 2026, 2027, 2028, 2029 and 2030.

Conclusion

If NEAR Protocol (NEAR) establishes itself as a good investment in 2024, this year would be favorable to the cryptocurrency. In conclusion, the bullish NEAR Protocol (NEAR) price prediction for 2024 is $7.597. Comparatively, the bearish NEAR Protocol (NEAR) price prediction for 2024 is $1.584.

If there is a positive elevation in the market momentum and investors’ sentiment, then NEAR Protocol (NEAR) might hit $10. Furthermore, with future upgrades and advancements in the NEAR Protocol ecosystem, NEAR might surpass its current all-time high (ATH) of $20.42 and mark its new ATH.

This content was originally published by our partners at The News Crypto.