- Pre-contract expiry squeeze sends Henry Hub gas over $9, before retreat

- Russia slashing gas delivery to Europe heightens demand for US LNG

- Rally in US natural gas may have some way to go

Natural gas futures surged to a seven-week high above $9 in Wednesday’s session. But that’s only half the story in what’s possibly the most exciting space in energy right now.

The oil play has been demystified to quite an extent since the early days of the Ukraine invasion. We have a fairly good idea now of how many Russian barrels are impacted by sanctions and how Moscow has still managed to dump these on China and India at rock-bottom prices.

We also know that US demand for gasoline isn’t as price-proof as bulls in the trade would like us to believe.

But natural gas is proving to be a different game altogether, its enigma growing by the day.

After months of panic that US gas-in-storage could be as much as 15% short of five-year norms going into the 2022/23 winter, the tables suddenly turned with the Freeport LNG crisis. The explosion at the Texas-based liquefied natural gas plant on June 8 suddenly idled about 2.0 billion cubic feet (bcf) per day of gas supply. Gas futures on New York’s Henry Hub that seemed headed for $10, a level unseen since 2008, made stunning U-turn, crashing almost 30% by early July on news that Freeport won’t be fixed until October.

Then came the Russian “put” for US LNG.

Moscow’s state-owned Gazprom (MCX:GAZP)—a useful tool for the Kremlin in its proxy battle with Europe over Ukraine—squeezed the gas flow on its Nord Stream pipeline to the continent to 20% of capacity, citing maintenance issues that were a little too contrived for the EU to believe. While Europeans are more tolerant to heat waves than their American cousins, winter is a common denominator for both, with just as much fear across the EU of storage tanks having too little to provide warmth in the event of a brutal freeze early next year.

Europe’s already pressed need for US LNG has been further amplified by Gazprom’s latest maneuvers, sending gas prices on Europe’s TTF benchmark exchange to levels not seen since early March and are nearly six times higher than a year ago. In yesterday’s session on New York’s Henry Hub, the expiring front-month contract in August soared to $9.41 per million metric British thermal units before plunging back down to finish at $8.55 for its first lower in four sessions.

As industry portal naturalgasintel.com observed, volatility and front-month contract squeezes are common before expiry. What makes this one different—the lower close aside—is that the movement to the upside could be far from over, it said, adding:

“The demand drivers that had sent futures to the doorstep of a $9.00 settle on Tuesday remain firmly intact. These include intense summer heat and mounting global calls for American LNG. More rallies may lie ahead as a result.”

Analysts at Gelber & Associates, a Houston-based gas markets consultancy, concurred with that view, saying Wednesday’s rally to $9.75 before the nearly 75 cent pullback by the end of the trading day may only be the beginning, adding:

“While it is possible that this was a shooting star, today will need to settle even lower to provide potential confirmation, and even so, this move may not be significant enough to stop the major uptrend witnessed over the last month of trading.”

“Relatively modest day-over-day fundamental changes suggest that today’s pullback in price is largely a reaction to an overstretched market.”

Sunil Kumar Dixit, chief technical strategist at skcharting.com, said a bullish weekly stochastic reading of 75/62 for Henry Hub’s new front-month calls for a retest of the June high of $9.66. But volatility could bring gas below the 5-day Exponential Moving Average of $8.34, and eventually the 100-Day Simple Moving Average of $7.02, Dixit said.

Rystad Energy analyst Karolina Siemieniuk also weighed in, saying Asian countries were ramping up demand for the super-chilled LNG as well as they sought to fill their own storage tanks, intensifying the competition for US product. Added Siemieniuk:

“The uncertainty and confusion over Russian flows and their disruption is not going away soon and will therefore continue to support and push up gas prices.”

“The uncertainty and confusion over Russian flows and their disruption is not going away soon and will therefore continue to support and push up gas prices.”

US gas production, meanwhile, topped 97 billion cubic feet per day on Wednesday, according to Bloomberg estimates, putting output near 2022 high.

Gas producers in the United States have struggled to sustain that level this summer, and output has held closer to 95-96 bcf per day much of the season. Analysts at Bespoke say output needs to hold at 97 bcf, or perhaps higher, to match exceptional summer demand and enable utilities to also inject gas into storage for the coming winter.

Bespoke also says the current month is on pace to be the fourth hottest July on record and, based on the mid-range weather forecast, next month could rank among the five hottest August on record. The outlook calls for widespread highs in temperature, from the 90s and 100s Fahrenheit, through at least Aug 3rd, building on heat waves that canvassed the Lower 48 states in both June and July.

Hence, the outage at Freeport versus the Russian “put” for US LNG is creating one of the most enigmatic plays in energy, unmatched possibly by even the nuances in oil.

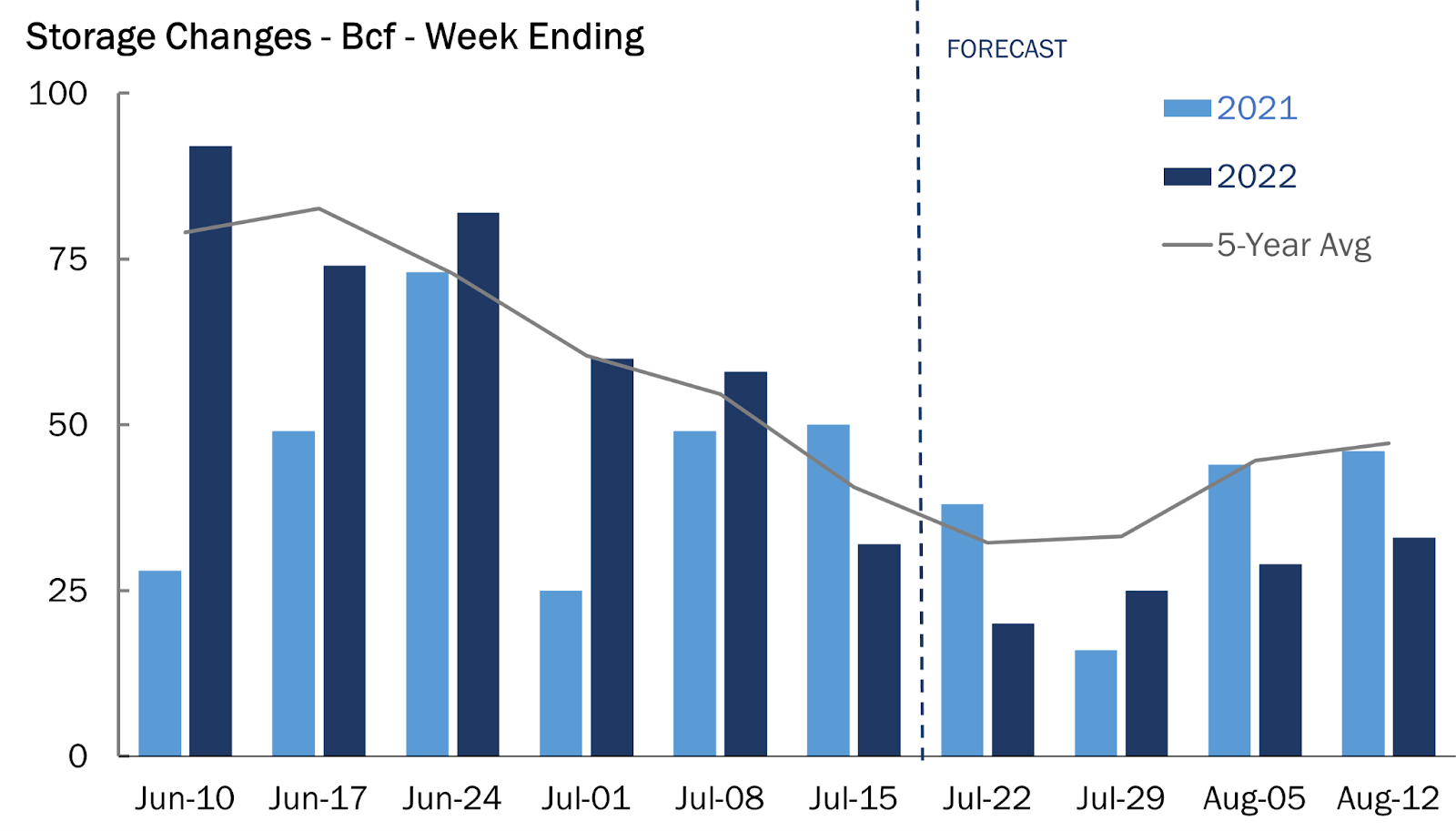

Ahead of Thursday’s weekly update on gas storage, the consensus by analysts tracked by Investing.com is that there was a likely addition of 22 billion cubic feet (bcf) during the week ended July 22.

Source: Gelber & Associates

That would compare with a build of 38 bcf during the same week a year ago and a five-year (2017-2021) average injection of 32 bcf. In the week ended July 15, utilities added 32 bcf of gas to storage.

The injection analysts forecast for the week ended July 22 would lift stockpiles to 2.423 trillion cubic feet (tcf), about 12.2% below the five-year average and 10.6% below the same week a year ago.

Reuters-enabled data provider Refinitiv said there were around 113 cooling degree days (CDDs) last week, which was much more than the 30-year normal of 89 CDDs for the period.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature, is above 65 degrees Fahrenheit (18 C).

The current heat may put a further strain on storage injections that the market is relying on to be hefty, in order to help mitigate the current storage imbalance ahead of winter, Gelber & Associates’ analysts said, adding:

“Unprecedented power demand due to ‘July Fry’ temperatures have kept storage injections below the 5-year average.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.