- Hedge funds bought US stocks at their fastest pace since March last week

- Despite that, the focus of these trades could be shifting.

- Major funds exited Nvidia after its 730% rally, while Bill Ackman's Pershing Square bought Nike (NYSE:NKE), aiming to reverse its 27% decline.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

Last Monday, I explained why the ongoing market decline shouldn't cause alarm and provided a couple of reasons:

- While novice investors were pulling back, hedge funds were buying U.S. stocks at their fastest pace since March.

- Historically, since 1980, the S&P 500 has delivered an average return of 6% within three months after falling 5% from a recent high.

This pattern held true once again. The S&P 500 opened the week at 5,351 and closed at 5,543, surging a massive 3.9%.

Helping boost sentiment, on the macro front, Fed Governor Bostic downplayed recession fears, stating:

"[An interest rate cut] is coming, and if the economy evolves as I expect, everyone will be smiling more by the end of the year. A recession isn't in my forecast; the economy still has plenty of momentum."

However, looking ahead, this positive outlook doesn't guarantee that staying invested in the same stocks will continue to pay off.

Recent filings from major funds reveal that some have already begun taking profits in the crowded NVIDIA Corporation (NASDAQ:NVDA) trade, shifting their focus toward better-valued stocks.

With that in mind, let's explore three key trades that have been shaping the markets now.

1. Big Funds Cashed Out of Nvidia Following Rally

Nvidia has unquestionably been one of the top-performing stocks in 2023 and 2024, surging 730% since 2023, driven by the booming tech sector and the rise of artificial intelligence.

Given this rapid ascent, it was inevitable that the stock would eventually pause for a well-deserved breather, which it did from mid-July to August 8, allowing for some consolidation and renewed buying opportunities.

Hedge funds seized the opportunity to cash in on Nvidia’s record highs during the second quarter of this year.

Among those who sold Nvidia shares were prominent players like Stanley Druckenmiller's Duquesne Family Office, David Tepper's Appaloosa Management, Soros Capital, and Lee Ainslie's Maverick Capital.

Maverick Capital made only a modest reduction, trimming its Nvidia position by 2.866% after purchasing 464,000 shares in Q1 2023.

In contrast, Appaloosa Management offloaded 83% of its stake in the company, while the Bill & Melinda Gates Foundation completely exited its position in Q4 2023.

Tiger Global Management also sold its Nvidia holdings, and Soros Capital, which had been accumulating shares since 2019, sold during Q2 after its last purchase in Q1 2024.

Nvidia will release its next earnings report on August 28, with the market eyeing a potential price target of $140.67, up from Thursday’s close of $122.86.

2. Institutional Investors Bought the Nike Dip

Nike received a notable boost following the announcement that hedge fund Pershing Square, led by Bill Ackman, acquired a new stake in the company.

Pershing Square now owns approximately 3 million shares, representing a stake of about 0.19%.

Ackman last invested in Nike in late 2017, during a period when the company was losing market share in North America to Adidas (OTC:ADDYY). He exited his position a few months later in 2018.

Investors are hopeful that Ackman’s return as a shareholder might help reverse Nike's fortunes, as the company has faced challenges with strategic missteps and intense competition. Nike's shares have declined 27% so far this year.

The company will pay a dividend of $0.37 per share on October 1, with the ex-dividend date set for September 3. The annual dividend yield stands at 1.79%.

Nike's price-to-earnings ratio for the next 12 months is 24.26, compared to 36.75 for Adidas. The market has set a target price of $91.27 for Nike's stock.

3. Bavarian Nordic Surges

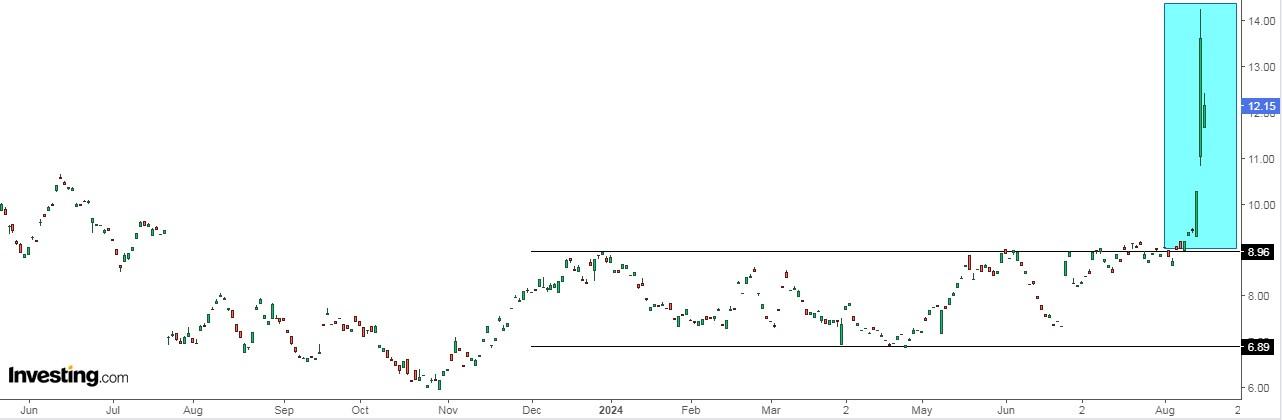

The World Health Organization's declaration of an international health emergency over monkeypox significantly boosted the shares of Bavarian Nordic, a Danish biotech firm renowned for its smallpox and poliovirus vaccines.

Bavarian Nordic produces the only vaccine approved for monkeypox in both Europe and the United States—Imvanex in the EU and Jynneos in the US.

The company's financial health is exceptional, earning it a top rating of 5.

Source: InvestingPro

Its stock market performance was already strong before the events of last week:

-

Last 10 years: +83.70%.

-

Last 5 years: +53.09%.

-

Last year: +68.28%.

***

This summer, up your investment game with the best financial markets tool for the retail investors.

Try InvestingPro today and take your investing game to the next level.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.