- US dollar has broken out ahead of Powell's speech

- Meanwhile, EUR/USD is eyeing a trend reversal

- USD/JPY's rally has fizzled out

Throughout the first half of the week, the US Dollar index maintained relative stability. However, as US economic data began to exhibit signs of decline, the greenback shifted lower.

Wednesday introduced notable volatility to the FX market, primarily triggered by disappointing PMI data in the US. Nevertheless, the dollar's decline was somewhat offset by even weaker PMI data emerging from both the Eurozone and the UK.

Thursday ushered in a more optimistic outlook. Unexpectedly strong unemployment benefit applications, totaling 230K, and a 0.5% increase in core durable goods orders for July provided insights into the economy's resilience. These positive indicators bolstered the dollar's strength.

Now, as the week nears its conclusion, the currency has regained momentum and initiated an ascent in anticipation of a hawkish speech by Jerome Powell at the Jackson Hole Symposium.

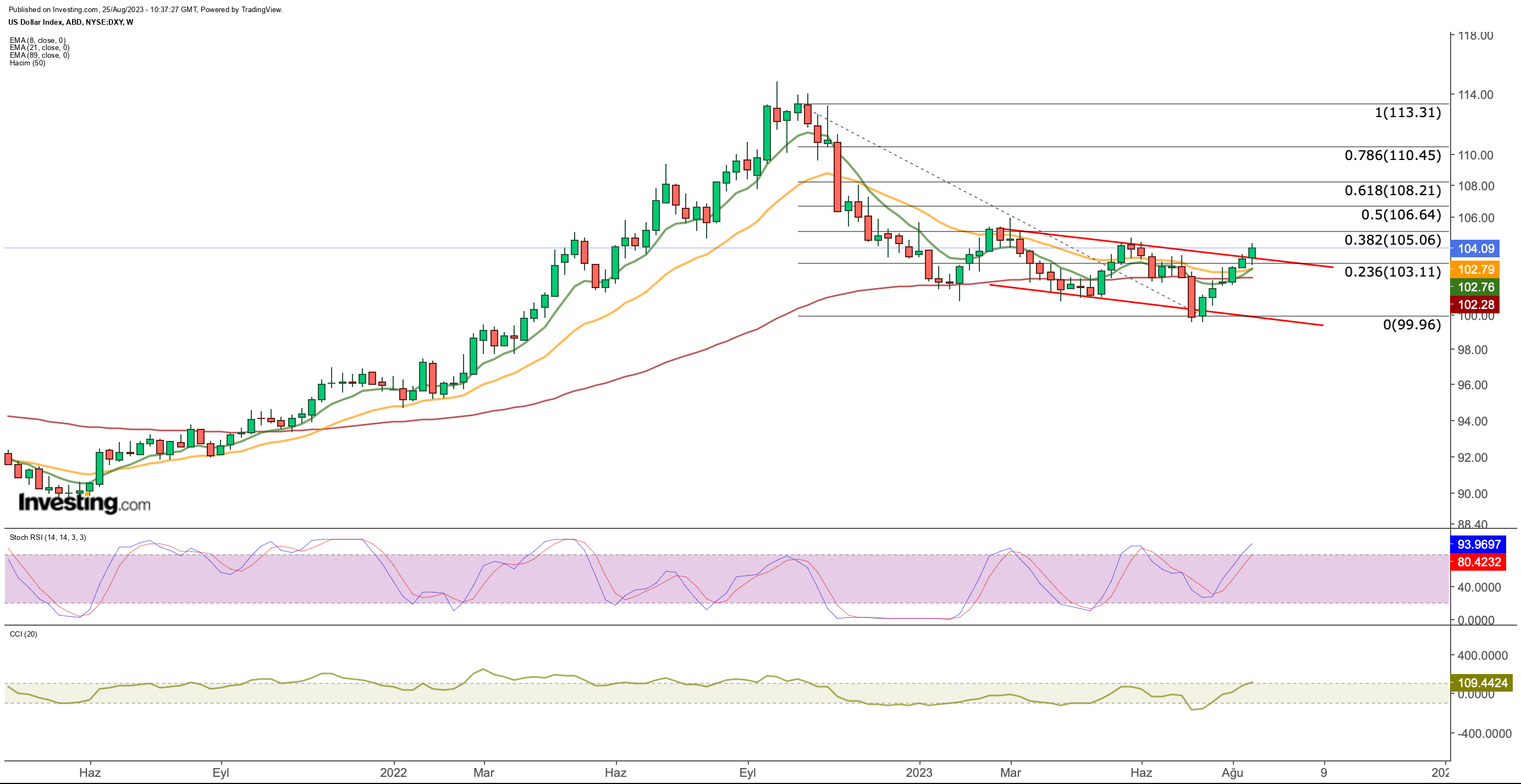

Dollar Index Technical Picture

Throughout the week, the DXY (Dollar Index) mainly traded within a tight range of 103.3 to 103.5. However, this range was broken yesterday as the DXY surged into the 104 territory.

This movement, driven by an uptick in demand for the dollar, is advancing toward the peak observed in May. Notably, the index appears poised to breach the descending channel. Considering the downtrend of the DXY that has been in place since October 2022, there remains a valid possibility, from a technical perspective, for an uptrend towards the 108 level, which is situated above the Fib 0.382 value at 105.

Considering the downtrend of the DXY that has been in place since October 2022, there remains a valid possibility, from a technical perspective, for an uptrend towards the 108 level, which is situated above the Fib 0.382 value at 105.

Several technical factors support this potential rise. The DXY has been using the 8-day Exponential Moving Average (EMA) as dynamic support, and both the 8-day and 21-day EMA values have crossed above the 3-month EMA value over the past few months. This combination of moving averages suggests that the dollar's strength might persist.

Furthermore, a significant factor influencing the current bullish outlook is the impending speech by Federal Reserve (Fed) President Powell at today's Jackson Hole event. The upward movement of the DXY could be interpreted as investors pricing in a hawkish stance from Powell.

However, if Powell's statement indicates a commitment to tackling inflation and emphasizes the importance of data in upcoming periods, it could potentially trigger a reversal in the dollar.

EUR/USD

Despite repeated attempts throughout the week, the EUR/USD pair was unable to break free from its short-term downtrend. Eventually, the pair succumbed to the combined pressure of positive data concerning the US economy and Powell's speech. As a result, EUR/USD dropped below the crucial 1.08 threshold.

The significance of this weekly closure beneath the critical point cannot be understated. This point aligns with the Fib 0.786 level in the corrective movement that corresponds to the rise observed from May to July. The breach of this level has the potential to disrupt the pair's momentum within the year-long uptrend it had experienced.

From a technical standpoint, a breach below the $1.08 level could potentially lead to a corrective move towards the May support at $1.06. Should the pair descend further below this point, the downward momentum might persist, potentially extending the decline into the range of 1.03 to 1.05.

The possibility of a trend reversal appears to hinge on the tone of Powell's speech, with a more dovish stance possibly prompting this shift. Such a dovish stance could serve as a foundation for EUR/USD to anchor around the $1.08 support, potentially allowing the pair to remain in the current channel.

USD/JPY

The USD/JPY pair has been lingering near its highest point of 2023 for the past week. Interestingly, the dollar's strengthening against the yen seems to have stopped around the 146 mark.

What adds significance to this situation is that these current levels align with those where the Bank of Japan (BoJ) previously intervened in the USD/JPY exchange rate back in September of the prior year. It's understandable that investors are approaching this juncture with caution, which clarifies the presence of resistance at the 146 level.

Amid ongoing market speculation regarding the potential intervention by the Bank of Japan (BoJ) in the USD/JPY, the central bank has chosen to maintain its silence. Market analysts concur that a further strengthening of the dollar against the yen would not bode well for Japan's economy.

While Japan has deliberately abstained from raising interest rates to safeguard its economy, the persistently weak yen still exerts a negative impact on imports.

Although no definitive action has been taken by Japanese authorities thus far, the pace of the USD/JPY pair's ascent leading up to the upcoming monetary policy meeting in September could prompt the BoJ to consider a sudden intervention.

Should such intervention occur, it's notable that the pivotal juncture remains at the 146 yen level. Should the pair surpass this level, there's a potential for USD/JPY to progress towards the 150 range, which constitutes the upper boundary of its established trading channel.

In the event of potential intervention, it's plausible to witness USD/JPY breaching the lower channel limit, subsequently moving toward the 130 level.

USD/TRY

The USD/TRY currency pair experienced a significant decline following the Central Bank of the Republic of Turkey's (CBRT) decision to raise the policy rate to 25%, surpassing market expectations.

In a rapid move, USD/TRY plummeted by over 5% to reach 25.28 yesterday, retracing back to price levels observed in June. It's worth noting that the CBRT had initially taken a tightening stance in June when they raised the policy rate to 15%.

This move marked the first interest rate hike in a span of 22 months. However, the rate increase fell short of the anticipated 21% level.

This divergence from the market's expectations in June regarding the policy rate had consequences. Specifically, the Turkish lira continued to lose value against the US dollar, leading to a notable surge in the USD/TRY pair's value from 23.5 to 26.

Despite the fact that the rate hike in July also didn't meet expectations, the communication regarding a tightened policy and the central bank's stance towards achieving the year-end inflation target of 58% contributed to maintaining the US dollar at an average of 27 Turkish Lira (TRY).

The recent interest rate adjustment, coupled with the assertive commitment to an inflation-focused approach in the decision statement, proved effective. This has led the market to consider the Turkish lira as a potentially attractive option for yield, making it a candidate for carry trade strategies. This shift could potentially reverse the prolonged depreciation trend of the Turkish lira.

Anticipating the Central Bank of the Republic of Turkey's (CBRT) continued interest rate hikes in the upcoming periods seems likely, and such moves could serve as effective tools in the ongoing battle against inflation.

From a technical perspective, if a corrective movement initiates from current levels, it's plausible that USD/TRY could retrace to the range of 19 to 21 TRY. In this process, the first line of support is anticipated around 23.2 TRY.

***

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.