- Earnings season is winding down, with the Magnificent 7 tech giants mostly exceeding expectations.

- In this piece, we will analyze their performance and future outlook using InvestingPro.

- Meanwhile, Nvidia is the only one left to report, so we will take a look at what to expect from the chipmaker.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

These past few weeks have been a whirlwind of earnings reports, with all but one member of the Magnificent 7, namely NVIDIA Corporation (NASDAQ:NVDA), stepping up to the plate:

- Apple (NASDAQ:AAPL)

- Amazon (NASDAQ:AMZN)

- Microsoft (NASDAQ:MSFT)

- Tesla (NASDAQ:TSLA)

- Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG)

- Meta Platforms (NASDAQ:META)

Let's dive into their performance and what it might mean for their future using InvestingPro's analysis of post-earnings impact and current analyst estimates.

Apple

Apple exceeded expectations in its quarterly earnings report, boasting an EPS of $1.53 compared to the anticipated $1.50, alongside revenue reaching $90.8 billion against the expected $90.32 billion.

Notably, the announcement of a colossal $110 billion share buyback plan garnered significant attention.

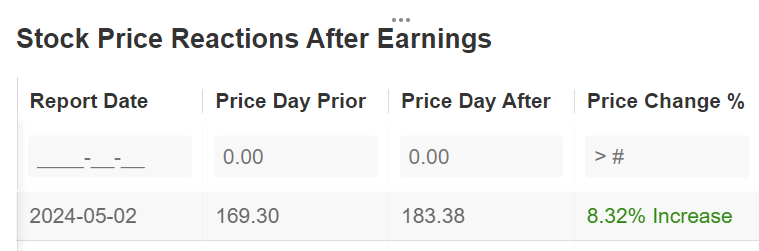

Despite Warren Buffett's Berkshire Hathaway (NYSE:BRKa) selling 13% of its Apple stock, causing a minor dip in yesterday's trading, the overall market response to the report was overwhelmingly positive, with a robust 8.32% uptick.

Source: InvestingPro

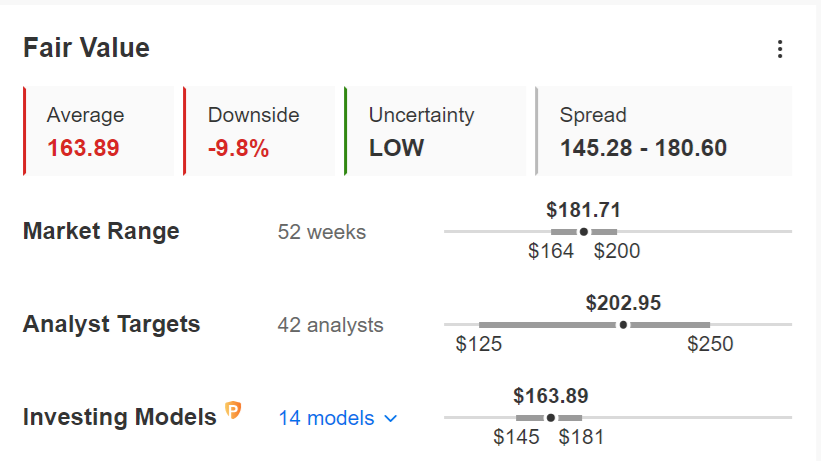

However, valuations remain high based on the 14 mathematical models developed by InvestingPro.

Source: InvestingPro

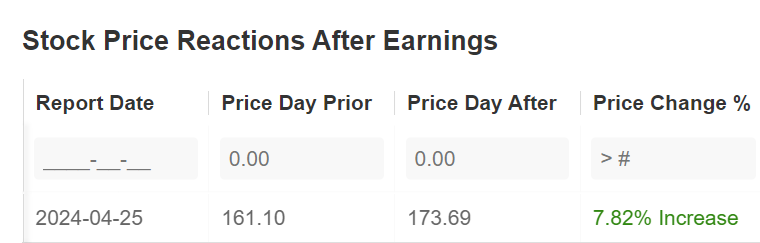

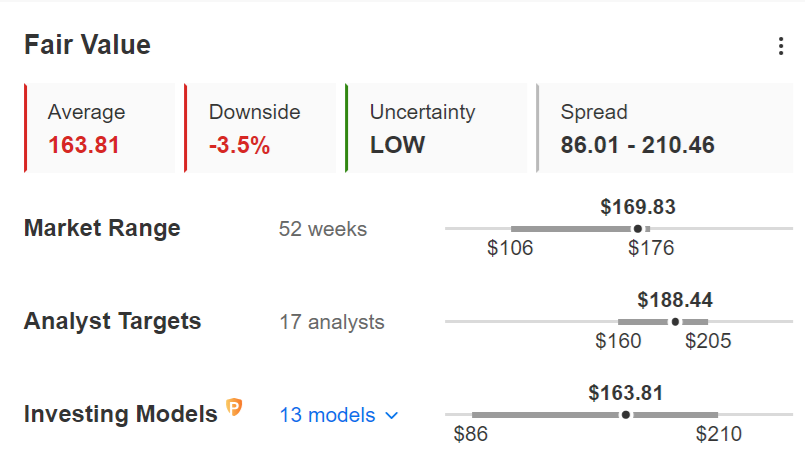

Tesla

This quarter, Tesla delivered a pleasant surprise to investors. Despite widespread expectations of a significant downturn, the stock experienced a notable rebound. Remarkably, this occurred despite the quarterly results showing a negative performance.

The resurgence can be attributed to the reintroduction of affordable vehicles and the groundbreaking partnership with Baidu (NASDAQ:BIDU) to manufacture self-driving cars in China, a move that caught analysts off guard, dubbing it the "Musk effect."

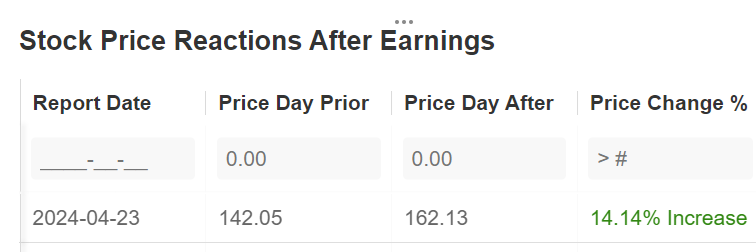

Investors responded enthusiastically to the quarterly report, driving the stock up by over 14 percent.

Source: InvestingPro

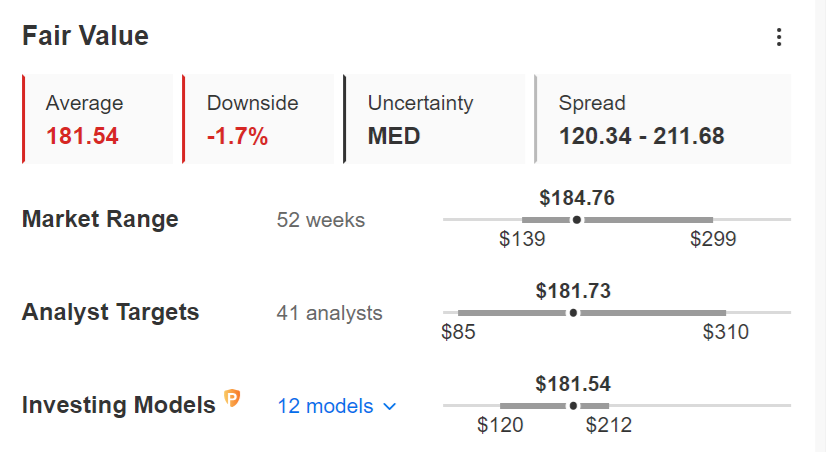

However, even here the stock seems in line with current prices, as we can see from its estimated fair value

Source: InvestingPro

Microsoft, Amazon

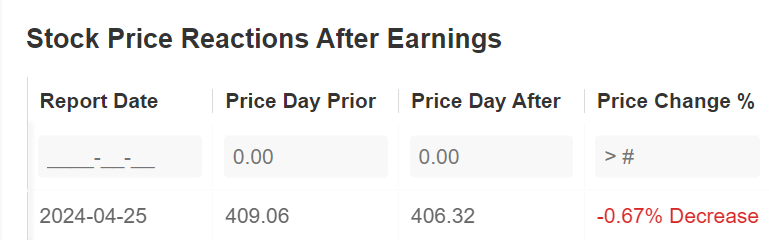

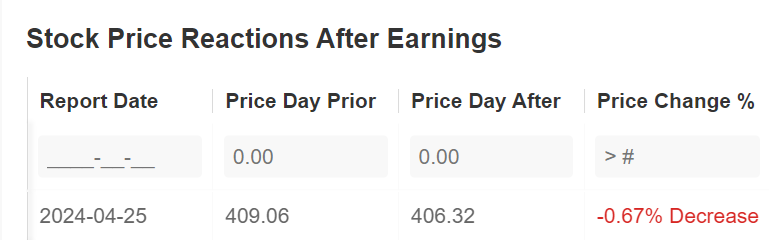

Microsoft and Amazon have quietly released better-than-expected earnings and turnovers recently. Despite this, the post-quarterly stock prices didn't see a positive boost, likely due to already high expectations.

Source: InvestingPro

Source: InvestingPro

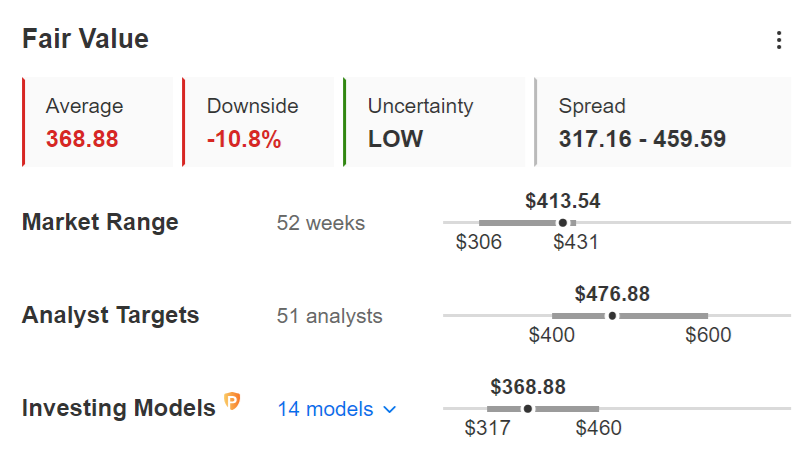

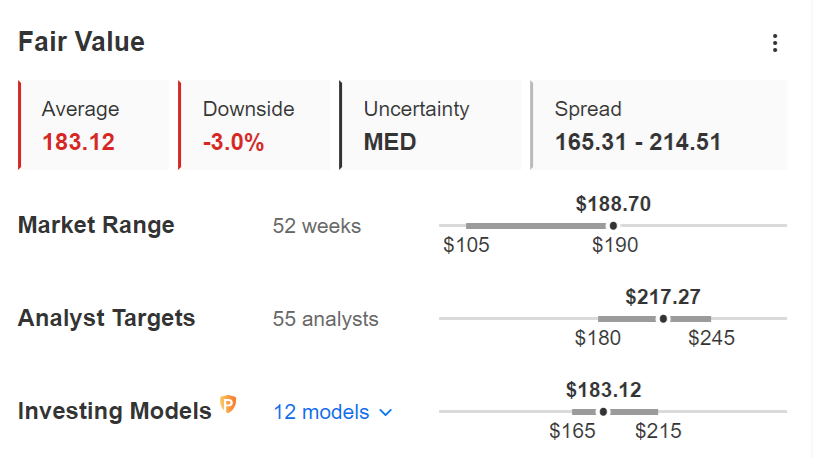

Both then are still overvalued according to estimated Fair Values.

Source: InvestingPro

Source: InvestingPro

Meta Platform

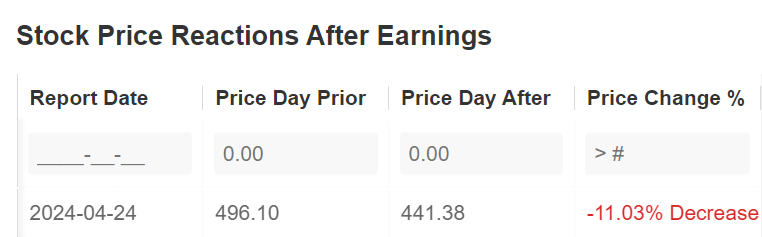

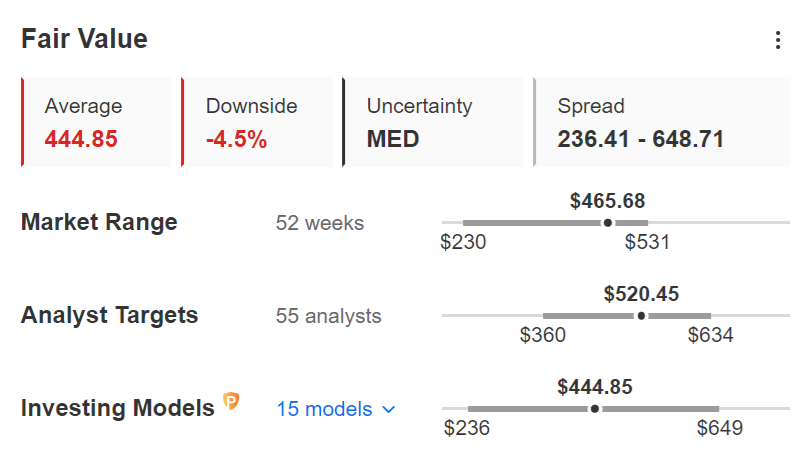

Meta suffered a heavy blow from the quarterly report, despite its overwhelmingly positive nature. The following day saw a double-digit decline for the tech giant. It's worth noting that Meta had been one of the top performers in 2023, possibly indicating that a break was overdue.

However, the sharp decline following such a promising quarterly report is undoubtedly frustrating for its shareholders. This is especially true when contrasted with Tesla's performance, which reported worse-than-expected accounts but still managed to deliver strong earnings.

Source: InvestingPro

The stock in any case still remains overvalued thanks to the 2023 run.

Source: InvestingPro

Alphabet

Alphabet stands out in this regard, as it not only reported a strong quarterly performance but also saw a significant increase in its stock price.

Unlike its peers, Alphabet appears to have capitalized on the emerging trend in artificial intelligence more effectively, resulting in a notable boost to its financials. Following the data release, the stock surged by nearly 8%.

Source: InvestingPro

Alphabet, like all the other biggies, also trades at high valuations to date.

Source: InvestingPro

Yet to Report: Nvidia

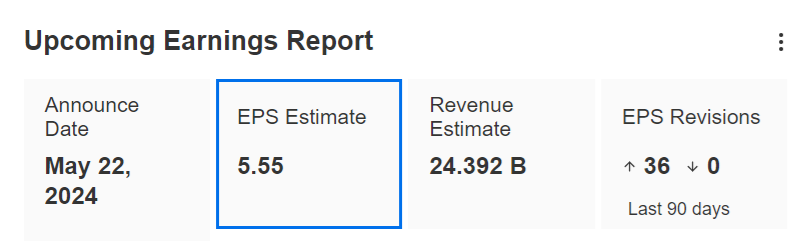

We now come to Nvidia, the most talked-about stock in recent months, which is yet to report. The date is May 22, where EPS estimates are at $5.55 per share and revenue estimates at $24.4 BILLION.

Source: InvestingPro

Nvidia has consistently delivered strong quarterly performance, setting a precedent for market outperformance. The recent announcement of a dividend has further bolstered investor confidence, typically resulting in a surge in the stock's value post-data release.

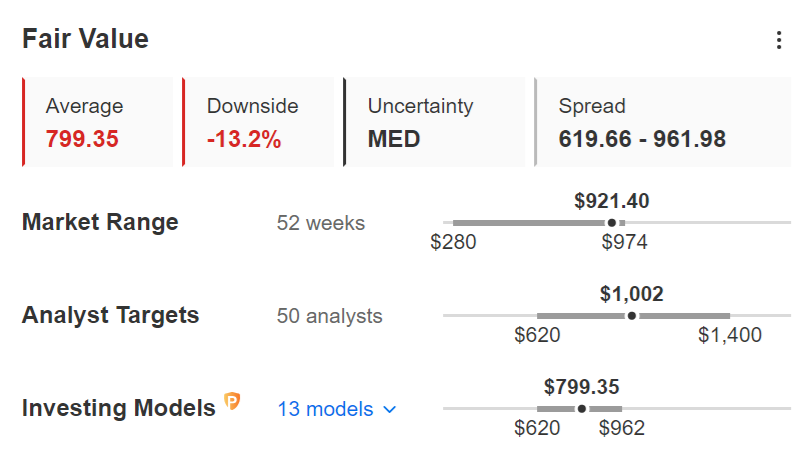

However, a looming question remains: will this trend persist? Given current valuations, there's speculation as to whether the market will continue to factor in Nvidia's impressive and sustained growth trajectory.

Source: InvestingPro

- Identify the next hot stocks with Fair Value or trust our AI ProPicks stock picks (and enjoy many other benefits) with InvestingPro!

- Identify and build better-performing portfolios with InvestingPro, for under $9 per month thanks to our one-year limited subscription offer!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.