Forget about Russia turning off gas to Poland and Bulgaria due to a row over payment in rubles. That’s just headline fodder because Europe will still get its gas through existing liquefied natural gas (LNG) terminals aside from the shuttered Yamal line (more context on this later). Also, with the “shoulder season” now between mid-spring and summer, the EU won’t need much gas till it starts prepping for the 2023 winter.

No, the story for the US natural gas trader is the increasingly-scary stockpile situation there. A stubbornly-cold April has forced more burning of gas than thought as production keeps decreasing week after week.

The Biden administration’s pledge to help wean Europe off Russian gas with as much US LNG as possible; Moscow’s demand for ruble payment and benchmark Dutch Gas Futures reprising highs above 100 euro have all added to the upward pricing pressure on New York’s Henry Hub.

But the hub’s recapturing of the key $7 level on Wednesday—as the May contract gave way to June as the front-month—might have happened anyway, even without the European input, because there was enough going on in the US to rally the market.

“On the demand side of the market, domestic weather forecasts strengthened and the latest models have added a marginal degree of cold,” Houston-based gas markets consultancy Gelber & Associates said in a note to its clients on Wednesday.

There were 82 heating degree days (HDDs) last week compared with a 30-year normal of 66 HDDs for the period, Reuters-associated data provider Refinitiv said.

HDDs, used to estimate demand to heat homes and businesses, measure the number of degrees a day's average temperature is below 65 degrees Fahrenheit (18 degrees Celsius).

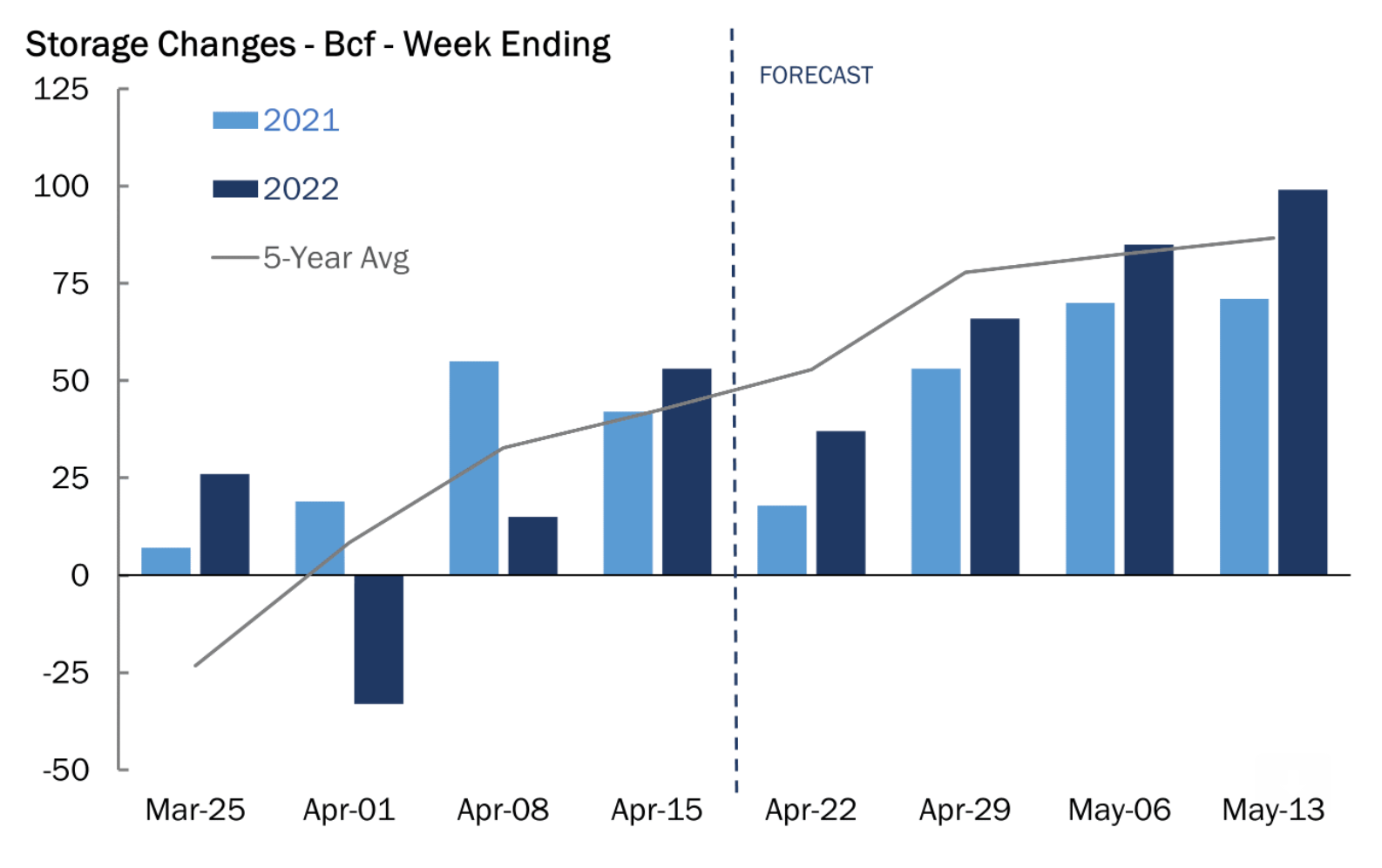

“Storage injections will continue to underperform the five-year average through the remainder of April, contributing to the widening deficit between 2022 storage and the five-year average and adding upward pressure on price in the extreme near term,” the note by Gelber & Associates said.

The note came as market participants braced for the US Energy Information Administration’s weekly gas storage update, where industry analysts expected a smaller-than-usual addition of 38 billion cubic feet (bcf) to storage last week owing to colder-than-normal weather that boosted heating demand.

The 38 bcf build would compare with the 18 bcf addition during the same week a year ago, and the five-year (2017-2021) average injection of 53 bcf.

In the prior week to Apr. 15, utilities added 53 bcf of gas to storage.

Source: Gelber & Associates

If the forecasters are on target, the latest injection for the week ended Apr. 22 would lift gas in storage to 1.488 trillion cubic feet—about 17.1% below the five-year average and 21.5% below the same week a year ago.

NatGasWeather said it expected a little more chill in the week ahead that would keep pressure on gas in storage and convince bulls to buy dips in the market. “Bears won a few battles last week but are back to losing every one so far this week,” the forecaster said in comments carried by naturalgasintel.

Natural gas technicals seemed aligned with the bulls too. “Our preference is a long position at above $7.22, with targets at $7.50 and $7.80 in extension,” said Sunil Kumar Dixit, chief technical strategist at skcharting.com. Adding:

“The Relative Strength Indicator shows upside momentum.”

NatGasWeather projected a mix of chilly late-season weather systems sweeping across the northern and eastern United States that would keep demand relatively bullish through May 10.

Wood Mackenzie, meanwhile, estimated a 1 bcf-plus day/day decline in output on Wednesday alone, naturalgasintel.com said. Of the total, roughly 760 million cubic feet per day appeared to be linked to pipeline maintenance in the Northeast. Nexus Gas Transmission LLC, Rover Pipeline LLC and Millennium Pipeline Co. LLC were reporting various pipeline work that limited gas flows in the region.

Over the summer as well, upside risk cannot be overstated. Tudor, Pickering, Holt & Co (TPH) said imports into Europe already were showing signs of falling off, and the prospect of a further decline should “keep a bid in prices as we progress into the summer” and spur demand for LNG imports.

“Closer to home, with what we see as a continued elevated risk profile for European balances and thus firmness in pricing, we see the present dynamics continuing to support healthy” economic incentives for US LNG exports, the TPH analysts said. In addition, there should be a “positive risk/reward skew for Henry Hub prices.”

Russia's decision to stop supplying Poland and Bulgaria through Yamal pipeline

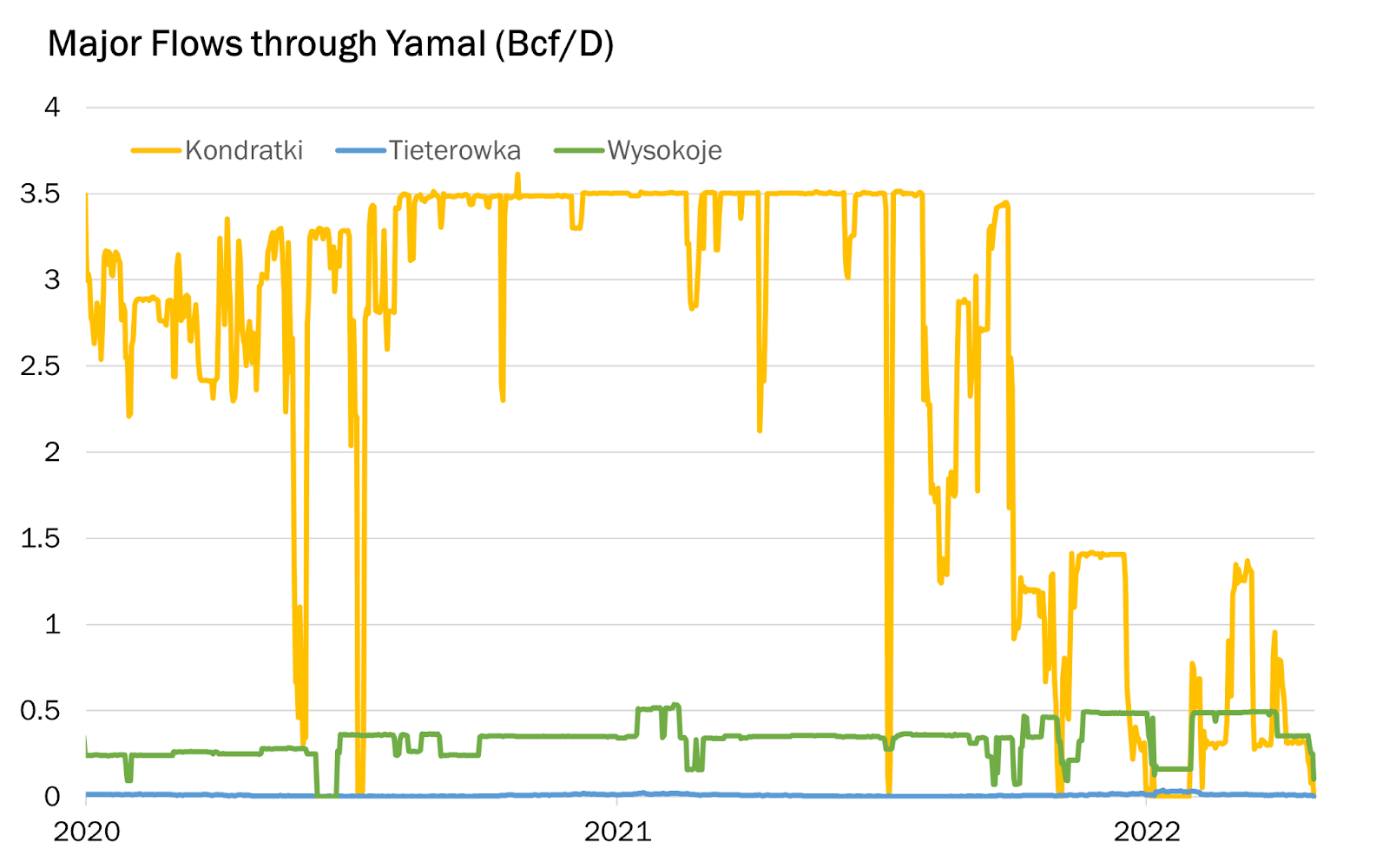

While Wednesday’s decision by Russia to shut Poland and Bulgaria off its gas grid may have shook the market, the reality is flows to Poland through the Yamal pipeline had already experienced severe losses towards the end of 2021, well before Moscow’s proclamation.

Most of Yamal gas flows through the point of Kondratki, though the pipeline also has smaller entry points into Poland through the cities of Tieterowka and Wysokoje. In early January, the Kondratki point—the largest entry point into Poland capacity-wise—already experienced near zero bcf per day flows.

While flows had stabilized briefly in February and March, gas pipeline volumes never surged back to their 3.5 bcf per day peaks from pre-2021.

Therefore, Russia’s announcement to cut off flows happens to just be a formal verbal confirmation of a reality that historical Yamal pipeline flows had already indicated the potential for.

Volumes for other pipeline routes into Europe, on the other hand, have remained steady—the Nord Stream I is still flowing a stable 6 bcf per day; flows to Ukraine have suffered somewhat, falling from ~3.9 bcf per day a month ago to ~2 bcf per day on Wednesday. Unlike the Yamal, these pipeline flows have never dropped to 0 other than during their annual maintenance periods.

Source: Gelber & Associates

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.