I am not talking about stock ownership vis a vis Lithium Americas (NYSE:LAC) in the title, rather, I am noting their sources of potential revenue from lithium extraction.

That’s right, I said “potential revenue.”

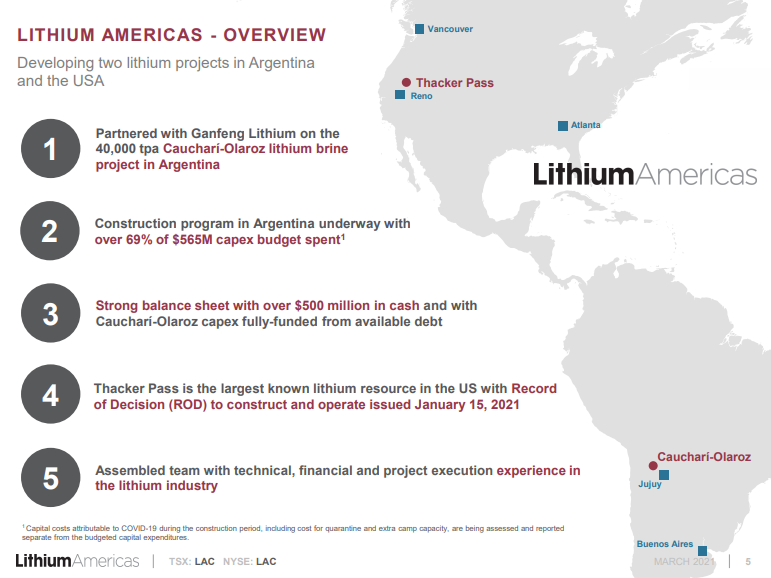

Recent legal rulings in the USA have cleared the runway for growth in the US and the company’s 49% ownership of the Caucharí-Olaroz lithium project in Jujuy Province, Argentina is set to begin production within the next 3 months. Ganfeng Lithium Co Ltd (HK:1772) , China’s largest lithium company, is LAC’s joint venture partner, with a 51% ownership stake.

According to the chairman of Lithium Americas:

“Caucharí-Olaroz is on track to become the largest new lithium brine operation in over 20 years.”

Note however that Lithium Americas is not a steady, old line, huge firm like Albemarle (NYSE:ALB) or almost all the others I have discussed in previous articles about lithium extraction and production. LAC is a relatively small company that is, as they boast on their website, "On the Road to Production."

With this in mind, please note that, if you visit their website for their latest corporate presentation, you will see 3 pages of "Cautionary Statements." (The presentation was just updated in August.)

That said, this is big stuff. Caucharí-Olaroz is the largest known NI 43-101 lithium brine resource in development in South America. I personally believe that will guarantee the success of this project.

Source: Lithium Americas Corporate Presentation

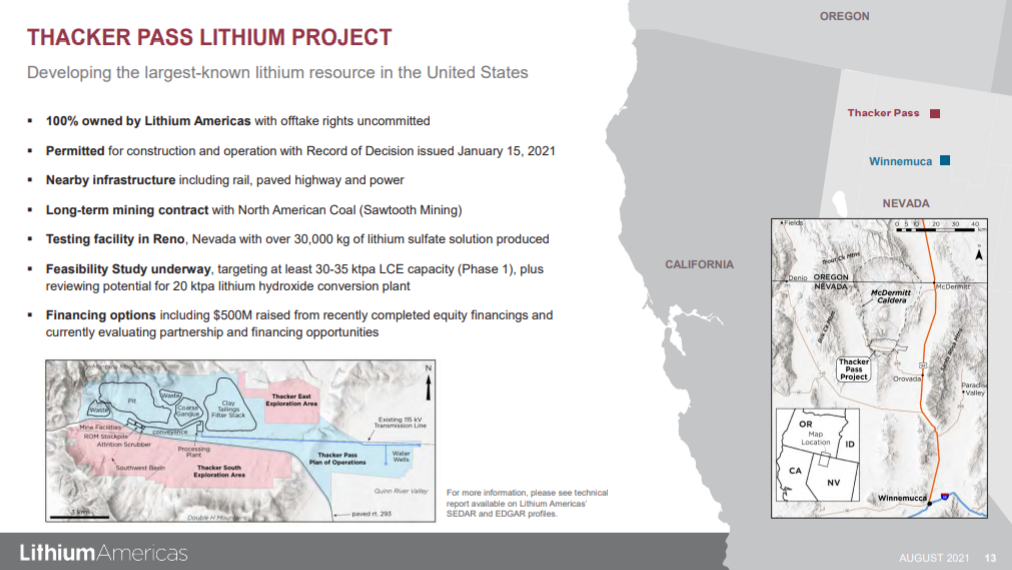

That’s just in Argentina, a key nation in The Lithium Triangle. (The others are Chile and Bolivia.) This next one is possibly even bigger. Thacker Pass is the largest known lithium resource in the USA. I believe it, too, will be opened.

The "largest known lithium resource in the USA" must be opened. This property is 100% owned by LAC.

Source: Lithium Americas Corporate Presentation

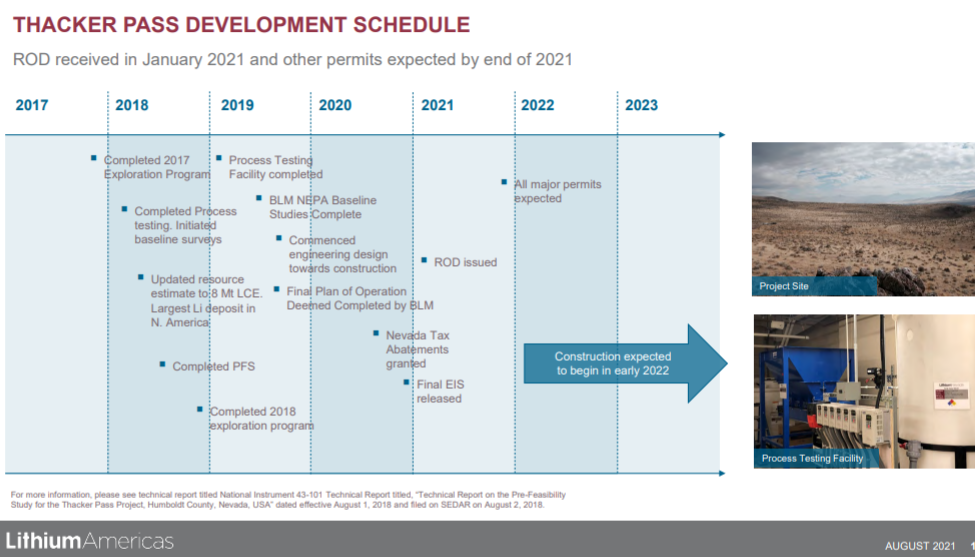

As you can see below, LAC has jumped through almost all the hoops to make Thacker Pass a reality.

Source: Lithium Americas Corporate Presentation

Realizing this dream has not been easy. While the appropriate regulators approved this milestone US project and all EIS (Environmental Impact Studies) were completed in good order, “activists” who say they want to see an all-electric future for transportation in the US also will do anything they can to block the production of the lithium, nickel, cobalt and other metals necessary to make this a reality.

Like it or not, life involves making choices. If we want EVs, we need the electrochemical batteries that provide their propulsion. Getting the raw materials at home is preferable to getting them from a nation that may shut down production any time their autocrat du jour decides he isn't getting enough baksheesh.

The “we want to have our cake and eat it, too” crowd spent millions fighting to retain the desert sagebrush surrounding Thacker Pass in its pristine pre-human state. On Sept. 3 Judge Miranda Du, having previously denied what she called conjecture and hypotheses without evidence of harm to a future nesting site for Nevada sage grouse, removed a different obstacle. Some Native American tribes had indicated Thacker Pass may have been the site of a massacre in the 1800s, but provided no evidence of same.

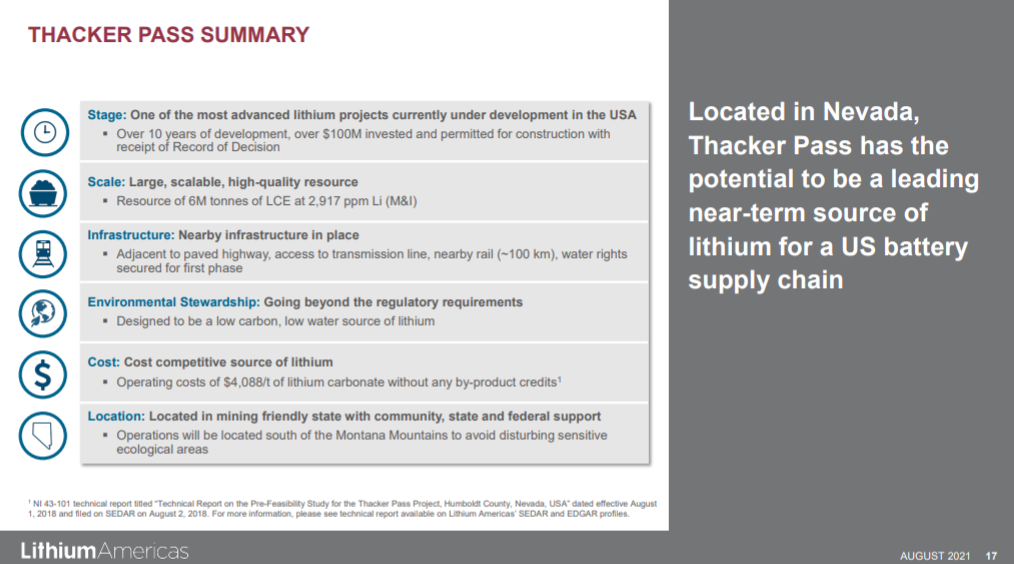

Here is the summary page for Thacker Pass from the LAC presentation:

Source: Lithium Americas Corporate Presentation

I should note that one of the benefits Lithium Americas cites above is that Nevada, where I live, is a mining-friendly state. That is most certainly true.

Nevada is a rancher/farmer/miner friendly state. There are really two Nevadas—Clark County (Las Vegas) and with the exception of Reno, a more rural countryside. I think it fair to say that most Nevadans are quite environment-conscious. Our residents tend to be much closer to the land than most.

I think we also realize that to create the new BEV (battery electric vehicle) ecoverse, we need to disturb the land somewhat and then restore it 100%. We have been doing just that for more than 100 years.

I should also suggest that it is important to garner our supply of the essential minerals from friendly nations, regions and environments. For example, I continue to see “news” articles saying that, in abandoning Afghanistan, the US has handed China “trillions in rare earths, lithium, etc."

No matter how many times you read this, please note that the source is almost always a DoD estimate (without a geologist anywhere in sight) from 2010 based mostly upon a highly outdated and biased joint Russian and then-communist Afghan government study.

Even if it were true, Afghanistan's lack of roads, railways, water (lithium needs *lots* of water for extraction) and transparency / honesty (AFG ranks among the most 15 corrupt nations on earth) mean the costs of extraction would be astronomical compared to Argentina/Chile/Bolivia (the "Lithium Triangle") the USA, Canada and other nations.

Hence my delight to see LAC operating in a highly-regulated but “mining friendly” environment like the USA in general and Nevada in particular.

A potential of 6 million metric tons, a state built on mining with vast experience in dealing with responsible mining companies, all transportation infrastructure in place, and the Biggest Little City (Sparks, Nevada, just east of Reno) which used to have gambling and now has Tesla (NASDAQ:TSLA), Panasonic (OTC:PCRFY) and others hungry for lithium? I think this is a slam dunk.

Revenue? None.

But $518 million in cash, a $184 million credit facility, $173 million in long-term liabilities, and good research coverage? For my personal investing and those I advise via my money management firm, I'll stick with ALB, LAC and others mining in reliable locations!