- JNJ has made headway on cost reduction

- Shares are fairly expensive relative to trailing and expected earnings

- Wall Street consensus outlook is bullish

- Market-implied outlook is bullish

- Selling covered calls looks attractive

Shares of Johnson & Johnson (NYSE:JNJ), the New Brunswick, New Jersey-based healthcare giant, rallied 5% last Friday on news that the company can move forward with its plans to resolve lawsuits relating to talc products as well as a settlement on opioid lawsuits.

As a result, the shares have returned a total of 4.6% over the past 12 months, far below the 17.2% total return for the drug manufacturing industry as a whole.

While the cumulative change in JNJ in the past 12 months is modest, the shares have ranged fairly substantially, with a 12-month high close of $179.47 on Aug. 17, 2021 (9.7% above the current price), after closing at a YTD low of $153.07 on Mar. 4, 2021 (5.9% below the current price), and subsequently closing at a second half low of $155.93 on Nov. 30, 2021 (4.7% below the current price).

Source: Investing.com

However, the New Jersey-based healthcare giant still looks relatively expensive compared to competitors such as Pfizer (NYSE:PFE) and Merck (NYSE:MRK). JNJ's trailing 12-month (TTM) P/E of 21.25 is significantly higher that 12.2 for Pfizer and 15.7 at Merck.

Comparing pharma companies on the basis of trailing P/E ignores the potential for substantial variations in expected earnings, but JNJ also looks fairly expensive using a forward P/E. Based on the consensus outlook for expected earnings JNJ's is 15.8, compared with 6.8 and 10.4 for PFE and MRK, respectively.

Given JNJ’s relatively high valuation, it is not surprising that the dividend yield, 2.55%, is also lower than the 3.35% at Pfizer or the 3.62% at Merck.

JNJ is a reliable dividend grower, with 3-, 5- and 10-year dividend growth rates of 5.6%, 5.8%, and 6.4%, respectively. With the current yield and dividend growth history, the Gordon Growth Model gives an expected total return of 8.2%. This is very close to the trailing 15-year annualized return of 8.19% per year and slightly below the trailing 3- and 5-year annualized returns of 9.35% and 8.56% per year, respectively.

On Apr. 12, 2021, I assigned a buy rating. While the expected potential for gain was limited, the stock looked attractive on a risk-adjusted basis. With its low beta and volatility, along with a generally favorable outlook, JNJ seemed like a decent bet for a stable equity component of a portfolio—what I call portfolio ballast. Over the subsequent months, JNJ has returned a total of 4.04% as compared with 6.4% for the S&P 500 (including dividends).

In evaluating JNJ, I looked at the fundamentals and two types of consensus outlooks. The first is the well-known Wall Street analyst consensus rating and 12-month price target. The second, which may not be familiar, is the market-implied outlook, which represents the consensus view among buyers and sellers of options on JNJ.

In brief, the price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a wide range of strike prices, it is possible to calculate a probable price forecast that reconciles the options prices. This is the market-implied outlook and represents the implied consensus outlook from the options market.

In April, JNJ shares looked somewhat expensive relative to earnings, but the Wall Street analyst consensus outlook was bullish and the consensus 12-month price target was about 15% above the share price at that time. The market-implied outlook to early 2022 was neutral, with low volatility. I assigned a bullish rating overall but indicated that a covered call strategy was worth considering because of the high valuation.

With about 10.5 months since I analyzed JNJ, I have updated the market-implied outlooks for JNJ and compared these with the current Wall Street consensus outlooks.

Wall Street Consensus Outlook For Johnson & Johnson

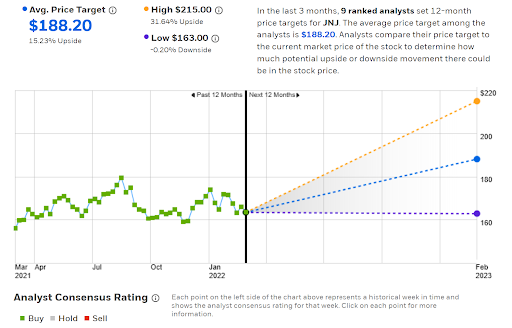

E-Trade calculates the Wall Street consensus by combining the views of nine ranked analysts who have published ratings and price targets over the past 90 days. The consensus rating is bullish and the consensus price target is 15.2% above the current share price. In April, the consensus rating was also bullish, and the consensus 12-month price target was $191.21, 18.6% above the share price at that time.

Source: E-Trade

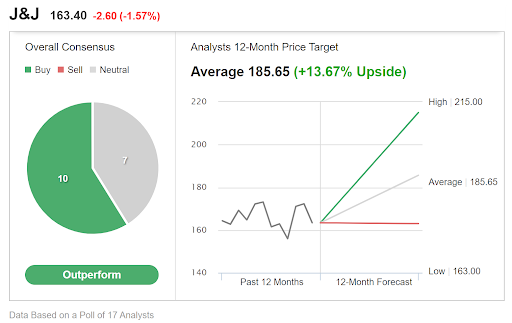

Investing.com calculates the Wall Street consensus outlook using the views of 17 analysts. The consensus rating is bullish, and the consensus 12-month price target is 13.7% above the current share price.

Source: Investing.com

While the consensus outlooks can vary with the source, the E-Trade and Investing.com estimates are very close to each other. The average of these two 12-month consensus price targets is 14.45%. Combined with the 2.55% dividend yield, the consensus outlook for expected total return is 17%.

Market-Implied Outlooks For Johnson & Johnson

I have calculated the market-implied outlook for JNJ for the 3.6-month period from now until June 17 and for the 10.7-month period from now until Jan. 20, 2023 by analyzing options that expire on these dates.

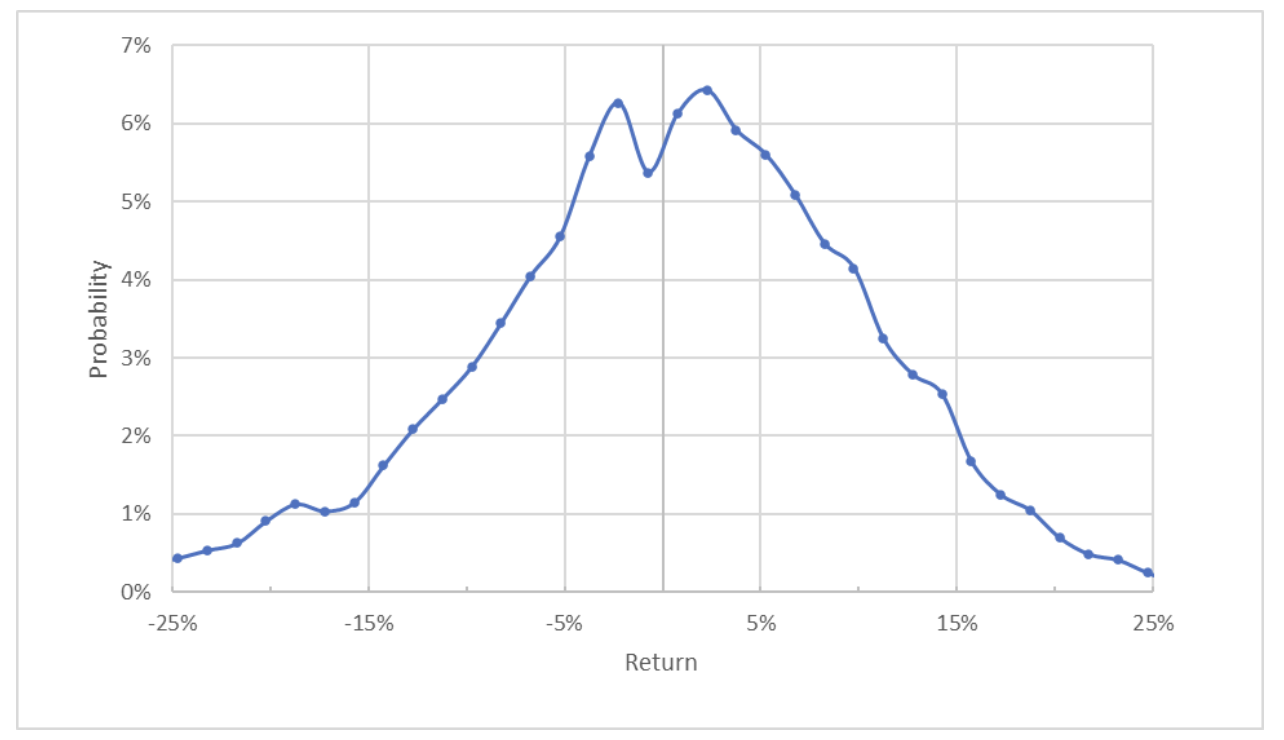

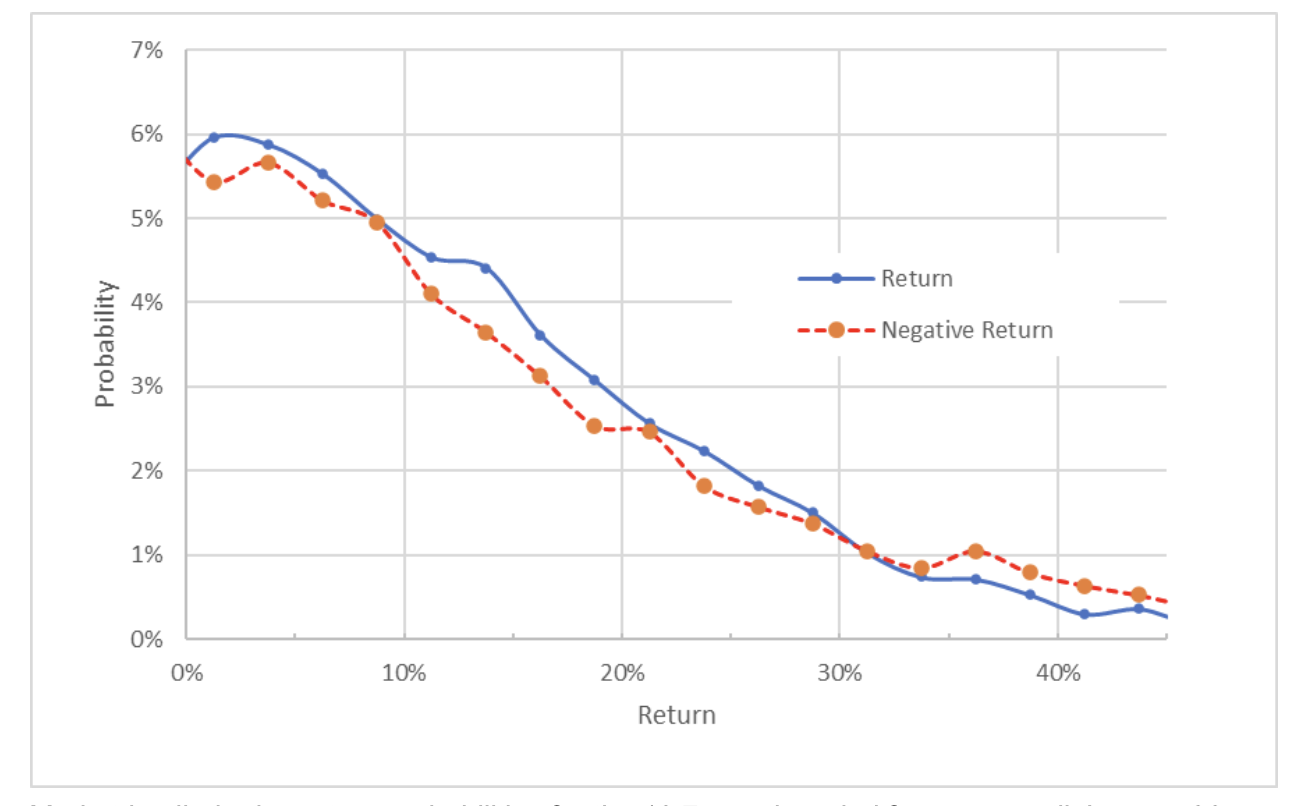

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook to June 17 has two small peaks in probability corresponding to returns of +2.25% and -2.25%. This type of dual peak market-implied outlook is not uncommon, but there is no practical significance in the details. The probabilities are tilted to favor positive returns, and the expected volatility calculated from this distribution is 22.1% (annualized). For comparison, the annualized volatility calculated from the market-implied outlook in April of 2021 was 19.8%.

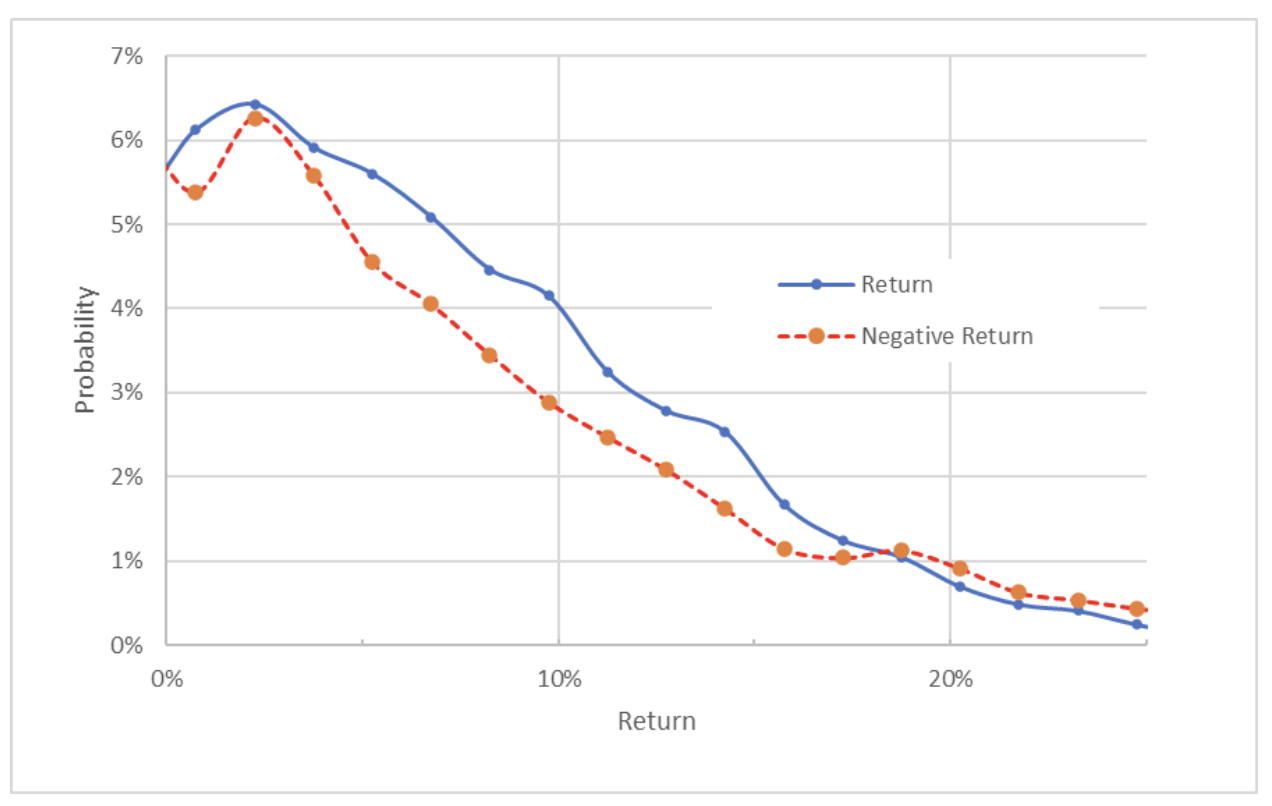

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution around the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view shows how consistently the probabilities favor positive price returns. The probabilities of positive returns are notably higher than the probabilities of negative returns of the same magnitude across a wide range of the most probable outcomes (the solid blue line is above the dashed red line on the left three quarters of the chart above). This is a bullish outlook for JNJ.

The outlook to Jan. 20, 2023 is slightly bullish with a less pronounced shift in probabilities to favor positive returns. The annualized volatility calculated from this outlook is 21.6%.

Source: Author’s calculations using options quotes from E-Trade

These two market-implied outlooks indicated a bullish view to the middle of 2022 and a slightly bullish view to early 2023. The expected volatility appears stable at 21-22%. The market-implied outlook was neutral in April of 2021 but has now shifted to a bullish orientation.

As I write this, JNJ is trading at $164.53 and it is possible to sell a Jan. 20, 2023 call with a strike of $165 for $11.25 (this is the bid price). Buying JNJ at this price and selling the call option, income from the option premium represents a yield of 6.84% over the next 10.7 months.

Over this period, JNJ is expected to have three dividend payments of $1.06 apiece, for a total income from the covered call strategy of 8.8% (9.9% annualized total income). This is an attractive level of total income for a stock with such low volatility.

Summary

JNJ is a low-beta defensive equity stalwart. The shares have had total returns of 9.4% and 8.6% over the past three- and five-year periods. The Gordon Growth Model indicates expected return of 8.2%. In light of these numbers, the Wall Street consensus 12-month price target, with expected total return of 17%, looks very bullish.

As a rule of thumb for a buy rating, I want to see an expected 12-month return that is at least half the expected volatility (which is around 22%). The Wall Street consensus price target substantially exceeds this threshold. The market-implied outlooks for JNJ are also bullish.

I am maintaining my bullish rating on JNJ. Income-oriented investors, along with those who are concerned with JNJ’s valuation, may want to consider selling covered calls on JNJ.