- Ahead of Thanksgiving, commodities have declined as funds move into equities and bonds, anticipating a potential Santa Claus rally.

- The S&P 500 to commodities ratio breaking above the downward trendline indicates a positive shift toward stocks.

- High-beta stocks are resurging and could lead the next move higher.

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

A new week has kicked off with Thanksgiving on the horizon, and commodities continue to lose ground as liquidity has moved into equities and bonds in hopes of a Santa Claus rally.

The S&P 500 has again violated the two downward trend lines created since 2020 relative to the Commodity index, signaling a potential and final reversal.

This is undoubtedly very positive for stocks, but we will have to wait for the ratio to break above the June 2023 highs and recover the February 2020 highs at $160.

Stocks could consolidate outperformance against commodities and record new highs. The S&P 500 last touched a new all-time high on Jan. 3, 2022, and has since spent 473 days below it.

Although it might seem like a tough climb to those heights to many, it is slowly inching up to those levels.

Speaking of all-time highs, the market is now within 2% of the new annual high, this is to point out how strong the last few weeks have been, and within 6%.

from the January 2022 all-time high at 4800 points. The top performer remains Nvidia (NASDAQ:NVDA) with +240% gained since the beginning of the year, recording +20% in the last month.

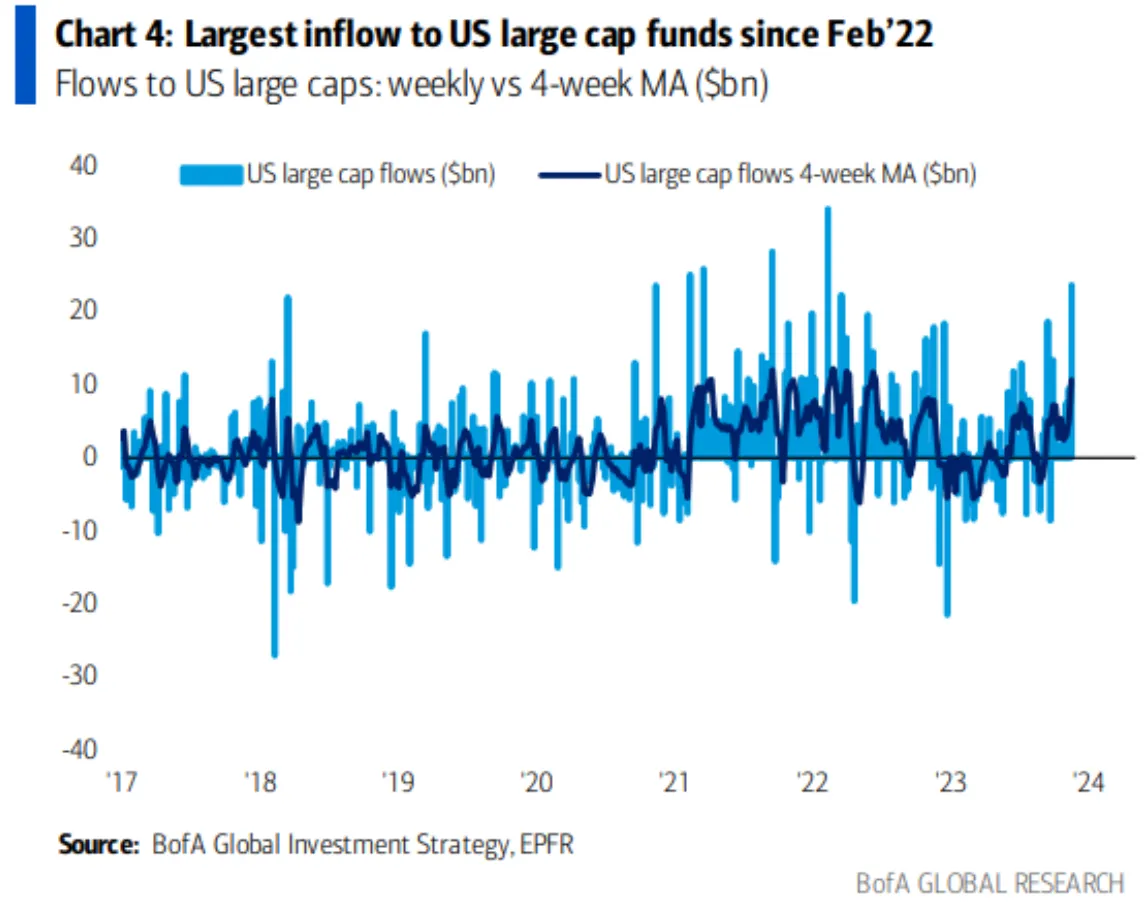

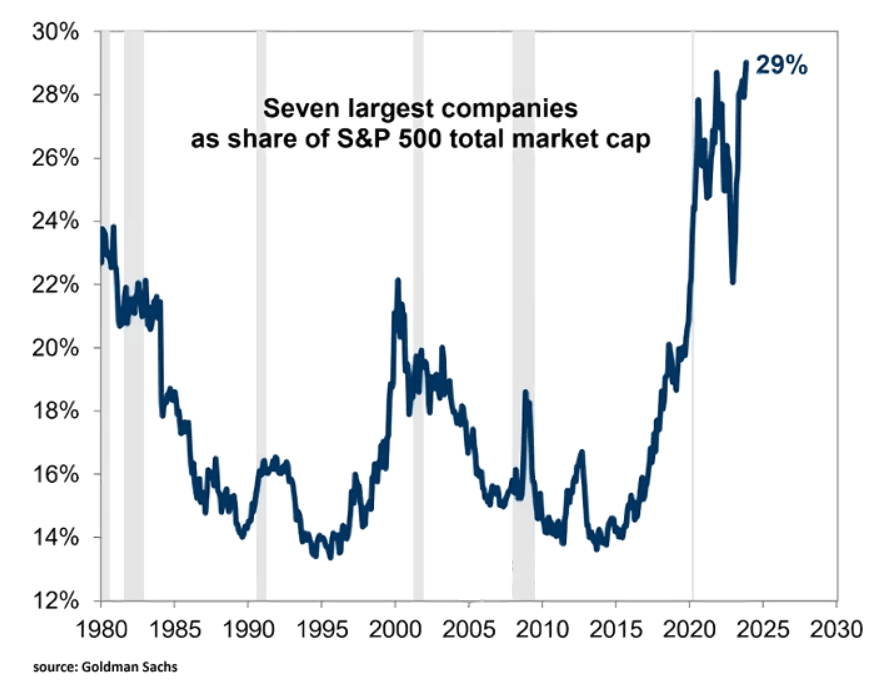

This coincides with the largest inflow of cash to U.S. large-caps since February 2022 and the increasing share that the top 7 companies in the S&P500 continue to have, although this situation is also raising some concern about index diversification (if these selloffs and underperforms could undermine market stability)

Keep an Eye on High-Beta Stocks

We see how from March 2020 to November 2021 the stock market was driven upward by High-beta sectors, outperforming Low-beta sectors.

From April 2022 to December things changed, Low Beta stocks prevailed and then changed the trend again in favor of High Beta, hitting highs in July 2023, taking advantage of the positive sentiment in the economy, and this is also reflected in low-rated companies (which in theory should perform).

In fact, stocks of unstable and distressed companies, when there is fear and volatility, are the first to be dumped by investors and vice versa.

Another interesting relationship is between iShares Russell 2000 Value ETF vs iShares Russell 1000 Growth ETF.

From the chart above, we notice how the ratio has created a side channel broken by the bullish trend that started in May 2022 recording the peak in January 2023 in favor of Value stocks.

Subsequently, it failed to overcome the February 2020 levels, falling back and returning to the lows, confirming that there was a rotation in favor of Growth stocks.

Conclusion: High-Beta Stocks That Could Be Worth a Bet

Finally, with the possibility that we could see new all-time highs on the S&P 500 by the end of this year or early next year, using InvestingPro we identified the undervalued S&P 500 high beta stocks with a possible average upside of 40%.

Here are the results:

- Aptiv (NYSE:APTV) PLC,

- PayPal (NASDAQ:PYPL),

- Comerica (NYSE:CMA),

- eBay (NASDAQ:EBAY),

- Tapestry (NYSE:TPR),

- Bath & Body Works (NYSE:BBWI),

- Regions Financial Corporation (NYSE:RF)

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.