We asked Joe Feshbach for an update of his take on the stock market from a trading perspective. He said,

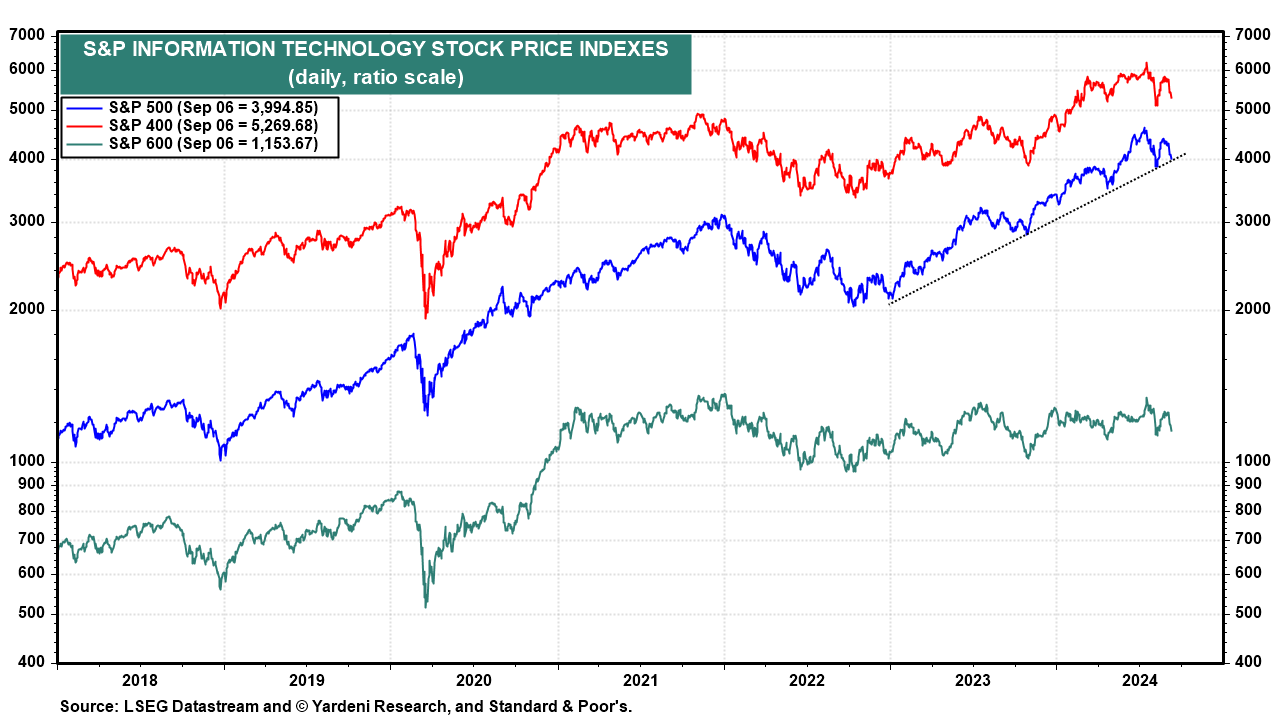

"Even with the recent decline in the stock market, I’m still recommending a cautious/defensive approach to stocks. My two biggest concerns have been the optimistic levels that the sentiment indicators have reached and the parabolic moves in technology charts followed by their significant recent declines.

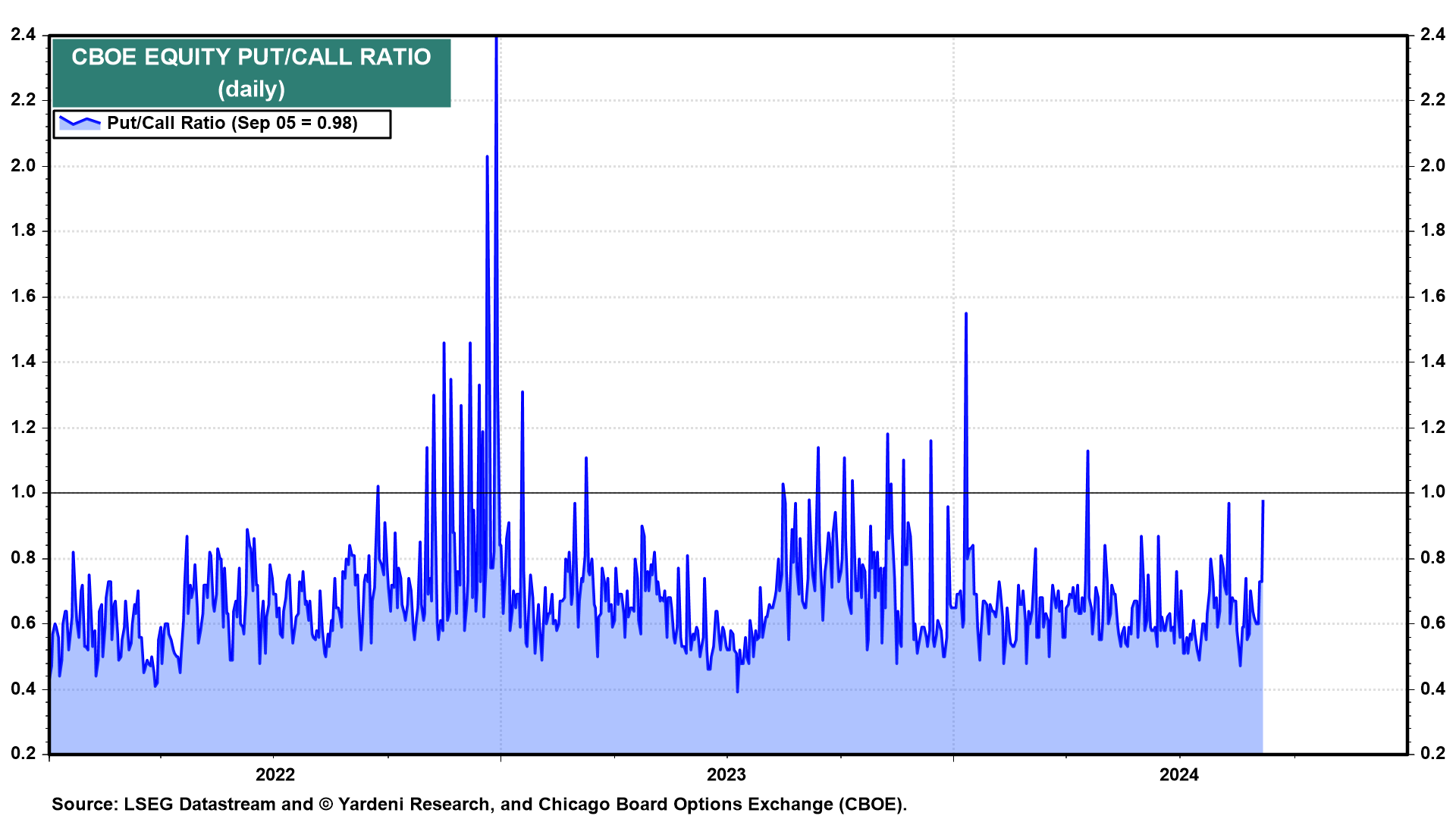

We’ve had a few improved readings in the Put/Call Ratio recently but only one day of a great ratio. I like to see a minimum of five days of ratios reflecting fear. We just haven’t had that. On the technology stock front, I believe these previous leaders have limited upside potential; even if some have sharp bounce-back rallies, they’d be tops made in broken charts. I would just be patient and wait for a more attractive entry level."

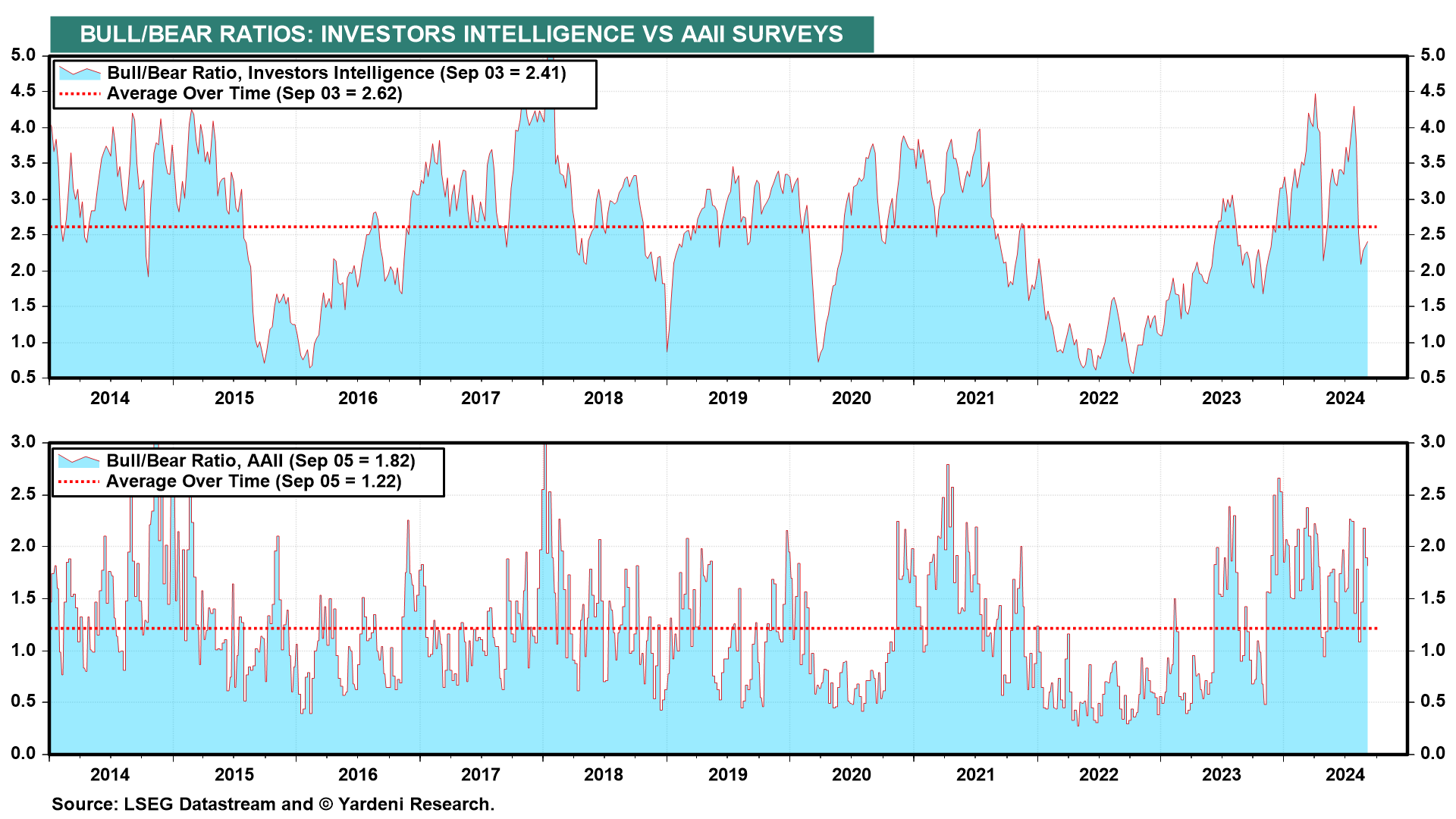

Joe is right: The sentiment indicators have turned less bullish, but perhaps not bearish enough to make a bottom in stock prices. That should change when they are updated with Friday's sentiment, which must have turned more bearish as stock prices plunged (chart).

On a ratio scale, the S&P 500 Information Technology stock price index is testing its uptrend line (chart).

As Joe noted, the Put/Call Ratio jumped to 0.98 on Thursday, but it was back down to 0.75 on Friday (chart)

We asked Michael Brush for an update on insider trading. He said,

"Insider buying picked up in the holiday-shortened first week of September as the S&P 500 worked its way toward a 4% decline. By far, the biggest buying happened across the energy complex. But there were also sizeable buys in tech, a household-name retailer, and a uranium miner."