- Intel is set to report Q4 earnings tomorrow after the bell.

- The stock has surged over the past year despite facing tough competition from rivals in the AI space.

- With plans to ramp up chip production and the introduction of a new AI chip, the stock holds the potential for sustained upward momentum.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Despite facing tough competition from Advanced Micro Devices (NASDAQ:AMD) and Nvidia (NASDAQ:NVDA), Intel's (NASDAQ:INTC) stock has gained over 60% in the past 12 months.

While the Santa Clara, California-based company has faced declines in the PC sales segment, its latest artificial intelligence chips, such as the Gaudi3, which is used in generative AI, appear to be putting Intel back on the right track to sustained growth.

This positive streak, however, will be put to the test tomorrow after market close as the company reports earnings for Q4 2023.

If numbers come out in line with expectations, it should affirm the positive trend in core revenue and earnings per share indicators. Barring negative surprises, the company's stock is poised to confidently maintain its upward trajectory.

Plans to Increase Spending on AI Chip Production in Motion

Intel's strategy for the present and future revolves around sustaining its positive momentum in the chip market and artificial intelligence. In addition to the existing factory in Arizona, Intel is strategically investing in new locations such as Israel and Poland.

A potential contract to supply chips to the US military, although unconfirmed, could play a crucial role in ensuring stable demand in the forthcoming years.

The recently unveiled Gaudi3 chip is anticipated to deliver substantial performance improvements in network performance and throughput compared to its predecessor, contributing to revenue and profit growth in the upcoming quarters.

Noteworthy is Intel's increased involvement in chips for generative artificial intelligence in the automotive sector, a market with significant growth potential, as AI demand is projected to surge by 40% by 2027, reaching up to $16 billion in revenue.

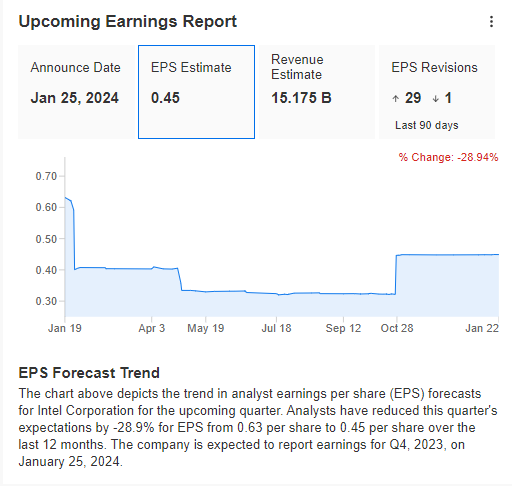

As Intel gears up for its quarterly results release, market expectations set the benchmark at $0.45 earnings per share and $15.75 billion in revenue. If these expectations are met or exceeded, Intel's positive trajectory seems well-supported.

Source: InvestingPro

Of particular note are the recent revisions, totaling 29 upward and only one downward. This indicates the market's increasing expectations for the upcoming report.

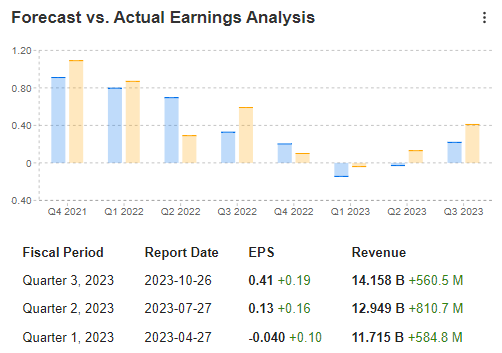

Another important aspect is the uptrend observed in earnings per share and revenue over the past year. Additionally, all quarterly final readings surpassed the market consensus.

Source: InvestingPro

Technical View: Uptrend Continues Unthreatened

Intel's stock price has confidently followed an uptrend for over a year, reaching a recent high around the $51 zone. Buyers have encountered resistance within a supply zone at this level.

The baseline scenario anticipates a continuation of the ongoing trend, with tomorrow's quarterly results playing a pivotal role.

Positive information could provide the necessary momentum for the demand side to overcome the indicated zone and sustain the upward movement.

However, the bulls face a limited range, as another supply area emerges slightly higher in the $55 region. Only a breakthrough above $55 would technically open up space for further growth.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 952% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here for up to 50% off as part of our year-end sale and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.