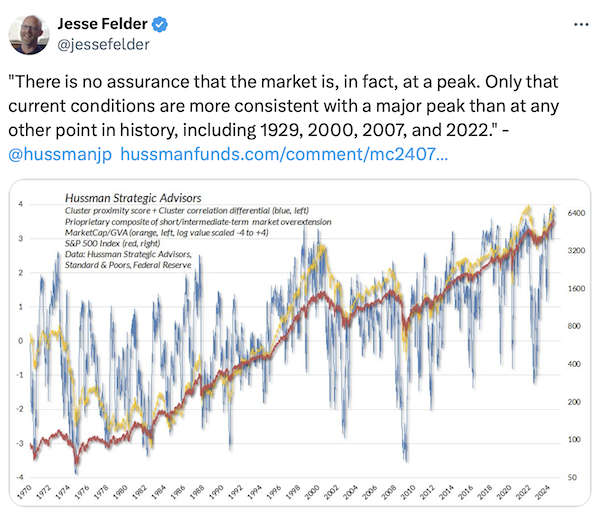

Investor optimism is at a fever pitch, but history suggests caution. In this article, we'll take a deep dive into market behavior and valuation metrics that could reveal potential risks lurking beneath the surface.

The combination of extreme valuations and rising dispersion is a classic sign of a stock market top.

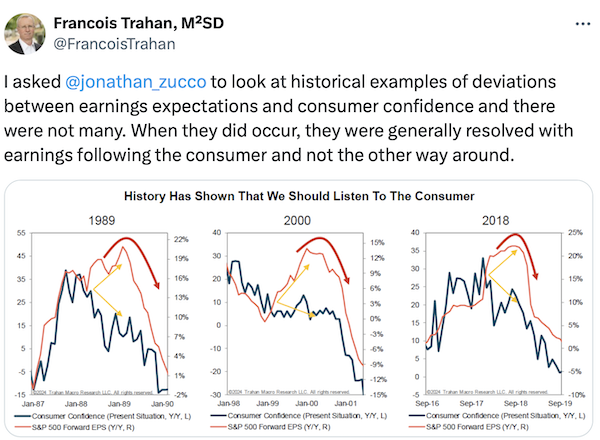

Consider the S&P 500 chart's historical comparison below:

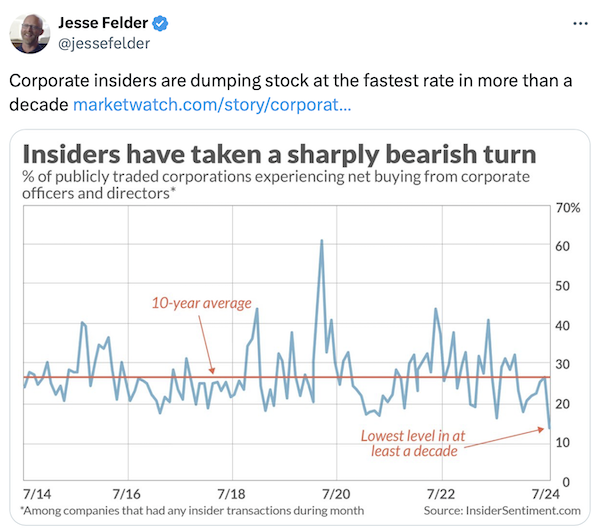

Corporate insiders are certainly behaving in a manner consistent with that appraisal.

Perhaps they understand better than most that analyst estimates are just far too optimistic and will soon be revised down to match falling consumer sentiment.

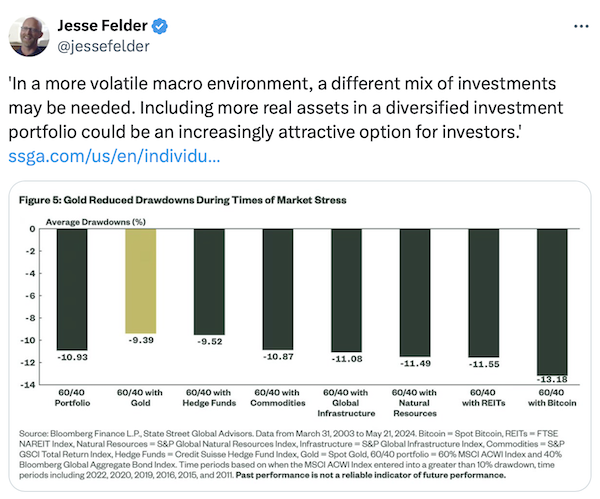

For this reason, it may make sense to ensure portfolios are adequately diversified, including a healthy allocation to real assets.

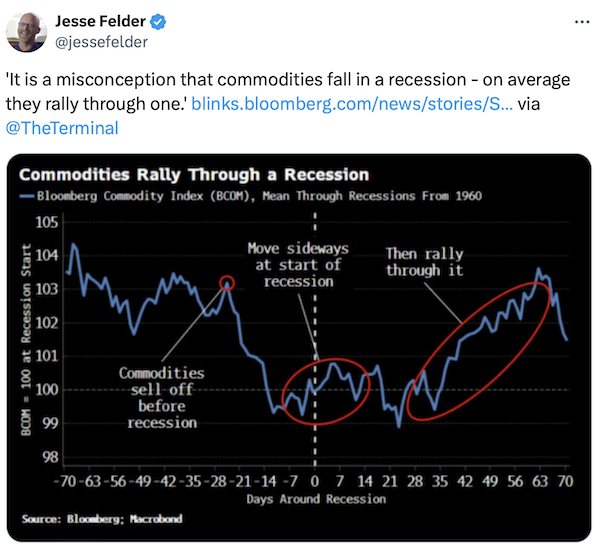

Investors have been shunning commodities, specifically, due to fears regarding the economic cycle but this only creates opportunity for those who understand how their diversifying virtues are derived.