- Find the most powerful stocks in the market with the InvestingPro filters explained in this article.

- Here's everything you need to know about stocks to help you get the most out of your portfolio.

- Market capitalization, dividend yield, asset efficiency... perform your own search and narrow down the results to get the best results.

What's happening in the market? Why is the current volatility having such a big impact on my portfolio? How can I identify the stocks that pique my interest and have the potential for the best returns right now?

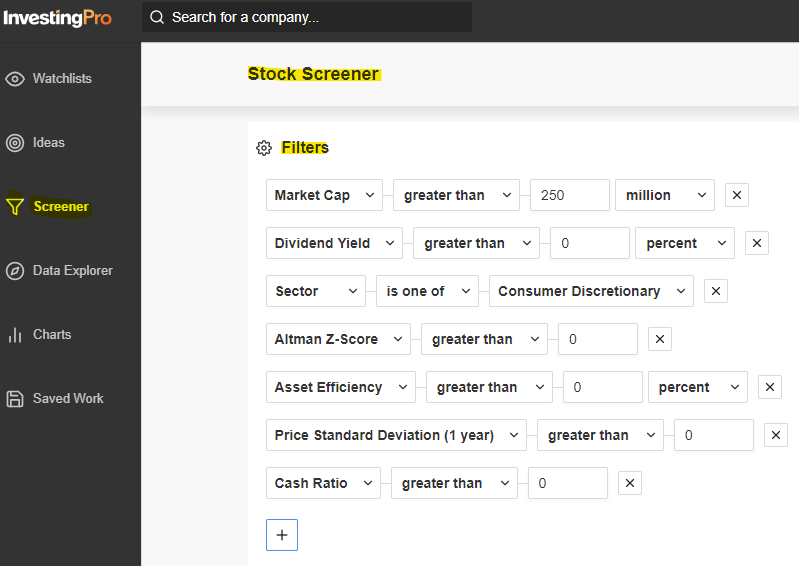

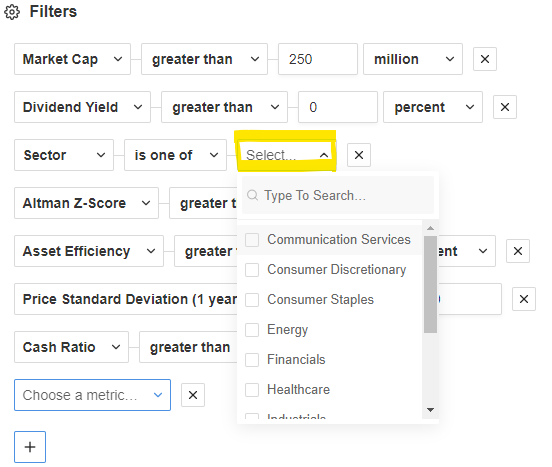

InvestingPro has the answers to these questions. The stock finder in the "Filters" section provides you with up-to-the-minute market data and a breakdown of the pros and cons that can influence stocks.

Source: InvestingPro

For instance, InvestingPro provides a range of valuable filters, including:

- Market Cap: This metric gauges the total equity value of a public company, calculated based on the most recent stock trading price. For cryptocurrencies, it's computed by multiplying the last trading price by the outstanding supply.

- Dividend Yield: It quantifies the cash returned to shareholders by a company as a percentage of the price paid for each share.

- Sector: This filter categorizes shares based on their area of business activity.

- Altman Z-Score Formula: A predictive formula used to assess the likelihood of a company going bankrupt within a two-year period.

- Asset Efficiency: This ratio measures the cash flow generated by a company in relation to its assets.

- Stock Price Standard Deviation (1-year): This metric calculates the standard deviation of a stock's price over the past year.

- Cash Ratio: It evaluates a company's short-term liquidity.

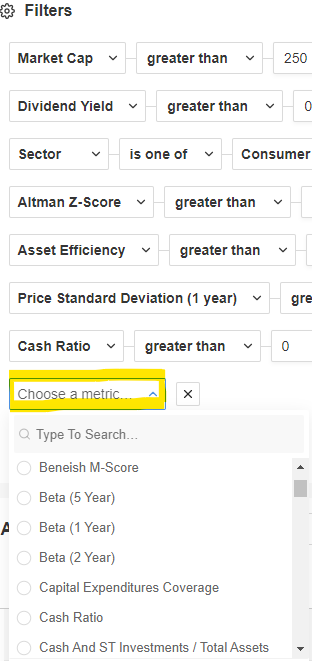

You also have the option to introduce new filters to tailor your search further. For example, consider adding filters like the Beneish M-Score Formula, Beta (1, 2, or 5 years), capital expenditure coverage, solvency ratio, total debt, and more to your selection.

Source: InvestingPro

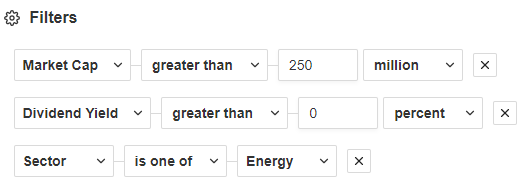

Refine Your Search

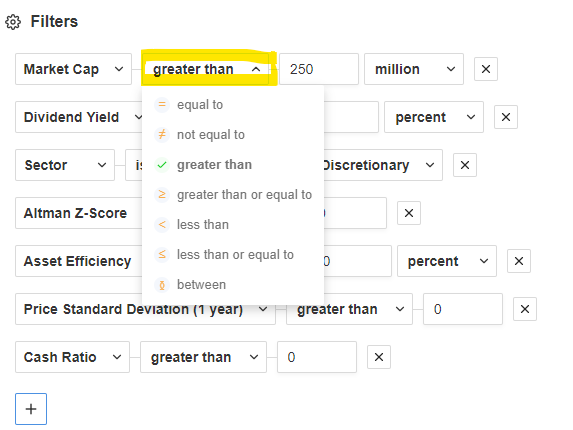

Within each filter, the search engine provides a variety of options. For instance, in the market cap or dividend yield category, you can search for amounts that are "greater than," "less than," "between," and more.

Source: InvestingPro

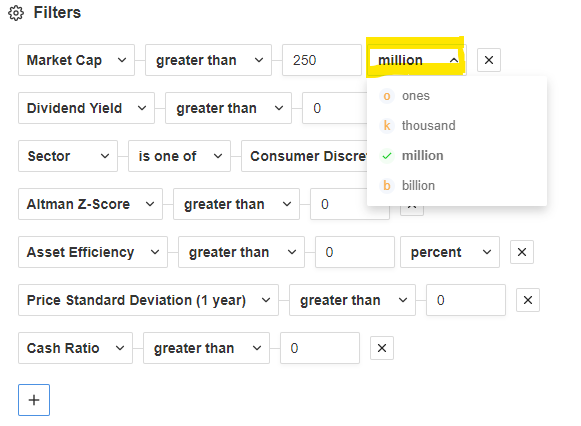

Subsequently, it permits us to manually input the specific amount and choose the desired unit, whether it be in thousands, millions, or billions.

Source: InvestingPro

The sector filter enables us to search by industry, such as communication services, consumer discretionary, consumer staples, healthcare, energy, industrials, information technology, real estate, and more.

Source: InvestingPro

Let's take an example: if you want to search for companies with a market capitalization of more than $250 million, with a dividend yield of more than 0%, and belonging to the energy sector, you should search for the parameters as follows:

Source: InvestingPro

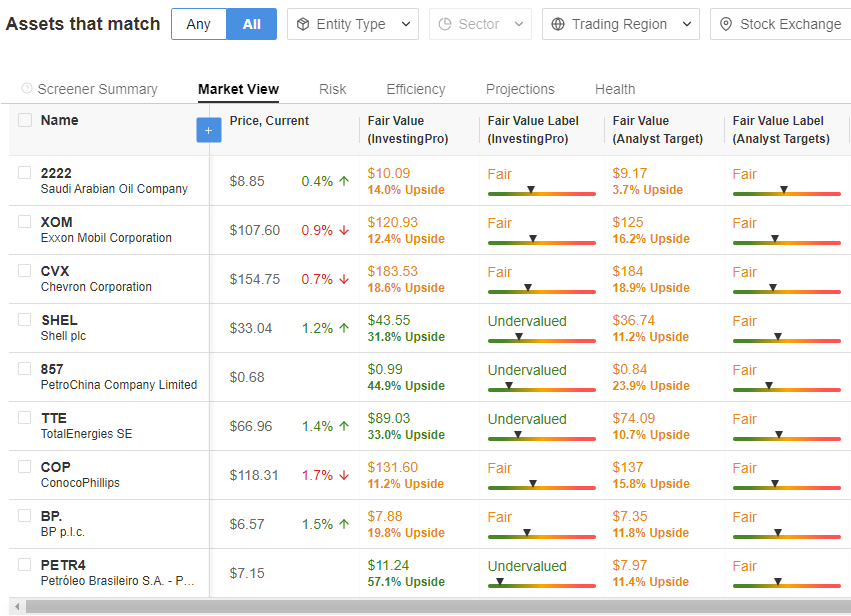

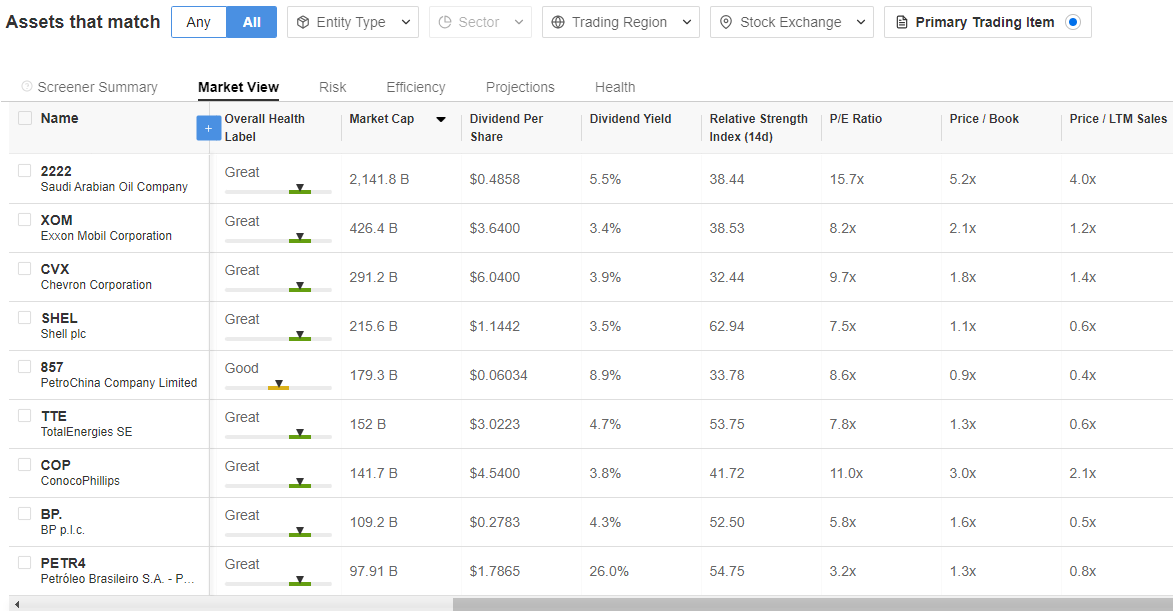

Search Results

Once you have made your selection, InvestingPro displays the list of stocks that match your search parameters:

Source: InvestingPro

The listing provides market value, fair value, market capitalization, dividend per share, dividend yield, Relative Strength index, P/E, etc.

Source: InvestingPro

You can also find interesting data on the risk of these companies, their earnings forecasts, different efficiency ratios and everything you need to know about the stocks to help you get the most out of your portfolio.

*All figures in the results table are shown in dollars.

Save Your Searches

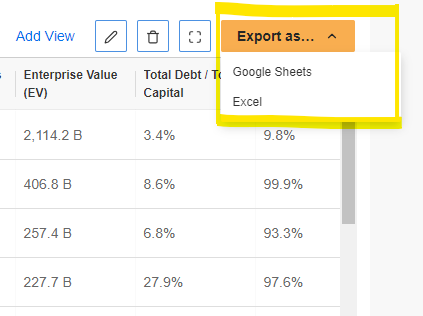

Remember that you can save and always have your search results at hand. To download your results, click on the "Export As" drop-down menu at the top right of the search engine.

Source: InvestingPro

As we find ourselves in the latter part of the year, amidst the corporate results season, when investors are keen on reshaping their portfolios, seize the chance to access privileged information, empowering you to make well-informed investment choices.

Don't fall behind; discover how to uncover the market's most potent stocks with the added advantage of InvestingPro's "Filters" section today with the link below.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice or recommendation to invest as such and is in no way intended to encourage the purchase of assets. I would like to remind you that any asset class is evaluated from multiple points of view and is highly risky. Therefore, any investment decision and the associated risk remains with the investor.