What will this summer bring in terms of natural gas fills?

With US gas storage persistently below five-year averages from either lower-than-expected production, inclement weather, or Europe’s reliance on American LNG—or all three put together—hazarding a guess on how inventories progress for this season couldn’t get any harder.

Two schools of thought are emerging so far on this.

One, advocated by London-based consultancy Energy Aspects, is that with the heat building, particularly, in the southern United States, the market may have already seen its peak injection for the season at 89 billion cubic feet (bcf). If that proves to be the case, it would mark the first summer without a triple-digit build in six years.

This idea, first appearing on the naturalgasintel.com site, argues that rising exports amid growing summer demand in Asia and an ongoing urgency to replace Russian gas supply in Europe mean the US market has few levers to pull to refill stocks.

Energy Aspects said the New York Henry Hub’s summer strip for gas futures is failing to provide injection incentives. Case in point: The prompt June gas contract rallying to trade above October at expiration and nearby July now commanding a premium as well in the days since moving to the front of the curve.

In Wednesday’s session, July jumped 55 cents, or 6.8%, gaining more than the previous day’s loss to settle at above $8.70, up 134% on the year.

With its monstrous rally so far, the gas market is “seeking industrial price triggers as structural demand growth” is hard to reverse, according to Energy Aspects.

However, that may be wishful thinking, according to recent data by Oxford Economics, another UK-based consultancy, which said manufacturing activity maintained fairly steady momentum in May despite ongoing supply-side problems.

Production and new orders were more encouraging, though supply-side dynamics were mixed as inventory growth firmed and prices rose more slowly, but employment contracted and vendor performance worsened.

The Oxford team, which includes lead US economist Oren Klachkin and chief US economist Kathy Bostjancic, expects growth in the manufacturing sector to moderate in the second half of the year. However, “a mix of still-healthy goods spending and plenty of backlogs will keep factory output rising.”

That thinking seems to align with Houston-based Gelber & Associates. In an email to its clients on Wednesday, seen by Investing.com, it said:

"Gas generation’s role in the fuel mix has declined over the week after lower wind generation saw average gas generation spike up to higher than 160,000 megawatt-hours last week. Lower gas demand in the power markets is expected to ease some tightness in the market, as overall demand gains overtook those of supply this week."

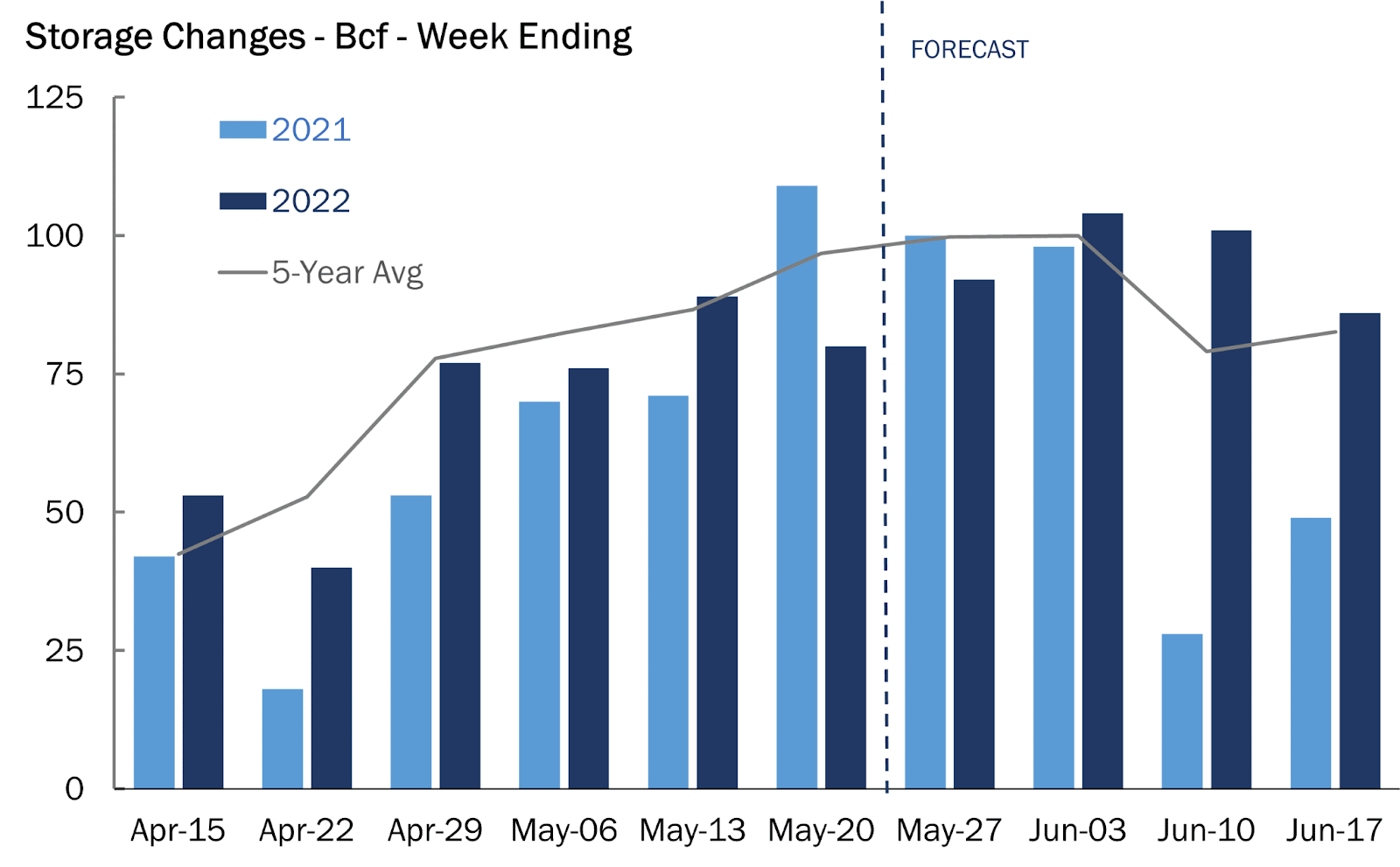

“Looking a few weeks ahead into the storage forecast, it is evident that incoming 2022 storage injections will outpace those of the five-year average and the 2021 injection average,” Gelber & Associates said in its note.

It added that a large reason behind the decline of both averages post-mid-June is the reclassification of 51 bcf of working gas to base gas at PG&E last year.

“As a result of the reclassification, natural gas storage has a rare opportunity, where if weather forecasts hold, the current storage deficit to the five-year average can be drawn down,” the consultancy said, concluding that “such a reduction in the storage deficit would result in a marginal decline in upwards price pressure.”

The debate over summer gas fills came as the market braced for yet another weekly update on gas storage from the US Energy Information Administration (EIA) on gas storage levels for the week ended May 27.

Source: Gelber & Associates

According to a consensus of analysts tracked by Investing.com, the EIA report due at 11:00 AM ET (15:00 GMT) today will likely state that US utilities added a smaller-than-usual 86 bcf to storage last week after burning more gas to produce electricity due to high coal prices and a lack of wind power.

The build will compare with an injection of 100 bcf during the same week a year ago and a five-year (2017-2021) average increase of 100 bcf.

In the prior week, utilities added 80 bcf of gas to storage.

The injection analysts forecast for the week ended May 27 would lift stockpiles to 1.898 trillion cubic feet (tcf), about 15.2% below the five-year average and 17.4% below the same week a year ago.

Energy traders noted that US utilities likely injected a lower than usual amount of gas into storage last week in part because high coal prices and low wind power forced generators to burn more gas to keep the lights on.

Wind produced about 12% of US power last week and gas produced about 37%, the same as in the prior week and down from a recent high of 16% for wind and a recent low of 33% for gas, according to federal data.

Reuters-related data provider Refinitiv indicated that neither was much of a factor in gas use last week since there were around 38 cooling degree days (CDDs) less than the 30-year normal of 41 CDDs for the period.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit.

Over the week of storage, the market observed a 0.82 bcf/d week-on-week change in LNG exports as well as a 0.3 bcf/d week-on-week change in production, said Gelber & Associates which anticipates an above-consensus 92 bcf injection that undercuts the five-year average by around 12 bcf.

Naturalgasintel.com reported that production, after coming within an earshot of late 2021 highs after the Memorial Day holiday, took a nosedive on Wednesday. It added:

“Though first-of-the-month declines are common, traders took notice of the roughly 2 bcf day/day drop in output.”

The drop in wind generation—which likely equates to at least some pickup in natural gas demand—drove increases in the cash market midweek and could help send futures back above $9 over the next week or two if current wind forecasts pan out, according to Bespoke Weather Services.

Charts show that Henry Hub‘s current technical strength could preserve the market’s upside.

“Prices trading on the weaker side of $8.10 will indicate more downside correction but price action above $8.10 signals further upside to retest $9.40 and $9.90,” said Sunil Kumar Dixit, chief technical strategist at skcharting.com.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.