This article was written exclusively for Investing.com

- Lots of firsts for CoinShares

- CEO understands volatility

- Expanding products and services

- 2021 showed impressive growth

- Attractive acquisition candidate

Cryptocurrencies remain a still-relatively new and burgeoning asset class. Over the past years, the incredible price appreciation for digital currencies has moved them further into the mainstream. As more investors dip their toes into cryptos, they look to the asset class’s pioneers for guidance.

CoinShares (ST:CS) is a service company for investors and cryptocurrency. The company develops infrastructure as well as financial products and services for the digital asset class in order to expand access to the asset ecosystem.

Cryptocurrencies appeared on the scene in 2010 after Satoshi Nakamoto’s 2008 Bitcoin white paper. CoinShares has been in the business since 2014, when it launched its first investment fund.

Compared with crypto asset price-tracking website CoinMarketCap, and crypto online trading exchange Coinbase (NASDAQ:COIN), as well as other leading exchanges and service providers, CoinShares has a low profile. The company is publicly traded in Sweden and operates out of the Isle of Jersey and the United Kingdom.

Lots Of Firsts For CoinShares

CoinShares’ website says it has been building products and services to meet the digital asset needs of clients, from individuals to institutions. As cryptocurrencies and other digital assets have moved more into the mainstream, the company has been first to market for a slew of products:

- First regulated Bitcoin hedge fund

- First exchange-traded Bitcoin product

- First private fund dominated in ether, Ethereum’s cryptocurrency

- Released the first exchange-traded ether product

- CoinShares also made ETPs on Litecoin and XRP available to EU investors

The company recently expanded its stake in Swiss banking company FlowBank a $26.50-million investment. FlowBank offers clients a wide range of products, including crypto assets. CoinShares now owns 29.3% of FlowBank, with voting rights at 32%.

Last July, CoinShares purchased Elwood Technologies' ETF index business for $17 million in stock. In December 2021, CoinShares bought French crypto investment product provider Napoleon Crypto SAS for $15.7 million.

Through acquisitions, CoinShares is becoming an integrated digital asset fintech company.

CEO Understands Volatility

Daniel Masters is CoinShare’s chairman. He was the head oil and energy trader at J.P. Morgan and worked at Phibro under Andy Hall. I worked with Masters at Phibro and briefly at his hedge fund, Global Advisors.

Masters transitioned from the volatile energy trading markets to cryptos, seeing the potential for the burgeoning asset class long before many other market professionals.

His experience in the volatile commodity asset class prepared him for the wild price swings in cryptocurrencies. Masters understands that volatility creates opportunities for investors and market participants. He believes that blockchain spells the end for traditional commercial banks. In a 2020 interview with Forbes, he said:

“There’s just so much brilliant innovation taking place. Today, the borrowing and lending can be done transparently, remotely and in a self-governed manner on chain. That’s a hell of a lot better than doing it with Citigroup. It means something. That is the Netflix to Blockbuster, it’s just that Blockbuster hasn’t figured out what Netflix does yet.”

Expanding Products And Services

CoinShares has been at the cutting edge of the digital asset class as it moves into the mainstream. The company continues to expand its products and services. For example:

- Adding exchange-traded products in Europe

- Providing electronic trading, liquidity and risk management systems to capital markets

- Tailoring “active” strategies for accredited investors

- Index strategies

- Offering advisory services, including private placements in the digital arena

Coinbase (NASDAQ:COIN) and Binance are digital currency platforms. CoinShares is a European boutique digital asset investment bank growing via an aggressive acquisition and M&A strategy.

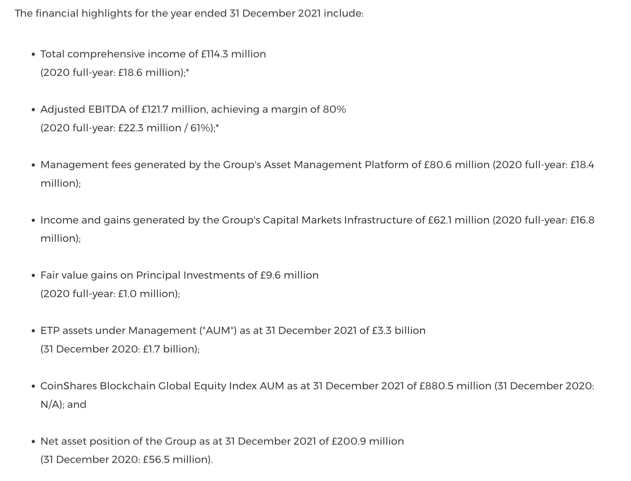

2021 Showed Impressive Growth

CoinShare’s performance in 2021 reflects impressive growth:

Source: PRNewswire.com

Attractive Acquisition Candidate

CoinShares began with one Bitcoin fund, but has grown into a full-service, integrated digital asset investment bank. The company's growth strategy has translated into increasing profits.

As the asset class has expanded, CoinShares has remained one step ahead of traditional financial institutions. Keep an eye on the company going forward, it could be an attractive acquisition candidate for one of the world’s leading investment banks. Access to capital for this plug-and-play business with a proven track record would make it an accretive acquisition.