- Central Banks had a big impact on gold and silver last week.

- Gold futures have made new highs - and traders should watch out for a potential correction because of PCE, GDP data.

- Meanwhile, silver prices are holding steady near a key resistance level.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

On Thursday, gold futures soared to record levels, with the June contract breaking through the $2,200 per ounce mark and reaching an astonishing $2,233 per ounce.

Currently, there's a 62% probability of the first interest rate cut happening in June.

If the pivot is postponed to the third quarter or the number of cuts is reduced to two or one instead of the expected three, it will trigger a correction in both silver and gold prices.

Gold, in particular, is vulnerable to a pullback toward key support levels after its steady rise.

Next up, after the dust settles from the Fed meeting, the market will shift its focus to upcoming macroeconomic data.

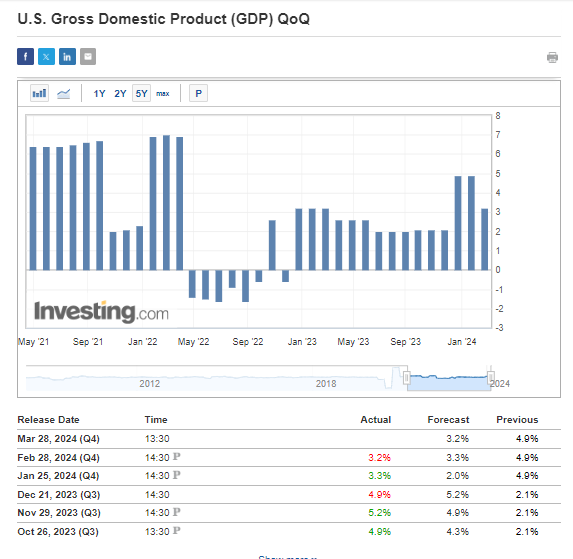

Today, we await the release of GDP growth figures from the US. If these figures confirm the initial estimates, we can expect a significant decline compared to recent quarters.

There are still no clear indications of a recession in the US economy. The basic scenario therefore remains a soft landing, which should be welcomed by Federal Reserve officials.

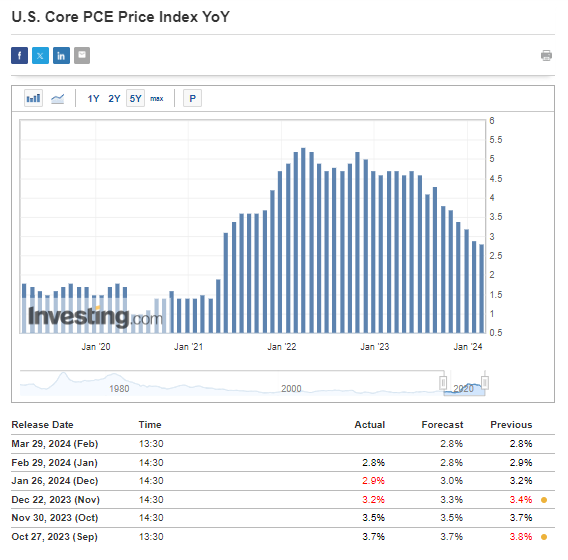

On Friday, the most important reading will be the Fed's preferred measure, the PCE inflation.

The current market consensus confirms disinflation slowing at 2.8% y/y, which corresponds with the stagnation of the headline consumer inflation index.

The final readings, if in line with forecasts, could give the Fed space to postpone interest rate cuts.

Gold Technical View

Gold prices, despite two minor corrections, continue to rise and are on track toward historical highs. However, the direction may change depending on upcoming US data.

If PCE inflation and GDP data show an increase, sellers might gain temporary control.

If this happens, sellers will likely target the support level around $2150 per ounce, which has been tested before.

In the longer term, deeper corrections to around $2100 per ounce could offer good buying opportunities at lower prices.

Silver Remains in a Consolidation

After experiencing a strong upward movement, silver prices halted around the $26 per ounce mark, which acts as a tough barrier. This level also marks the highest point of a long-term consolidation phase.

Presently, the expected scenario is for the price to consolidate, while the US dollar continues to rise.

In this outlook, the bears' target range is approximately $22 per ounce. If this level is breached, the $20 mark is seen as a robust support area.

Conversely, in a scenario where there is significantly weaker data from the US economy, buyers will aim for the $28 per ounce region.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.