- Gold faces the risk of retracing recent gains after closing lower on Friday, reacting to a robust US jobs report and a strengthening dollar.

- The light economic calendar for the week suggests a continued bullish trend for the dollar, potentially keeping gold on a downward trajectory in the short term.

- Despite a hawkish Fed meeting last week, the dollar's positive momentum could be bearish for the yellow metal.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Gold is at risk of giving back more gains at the start of this week, after ending lower on Friday in response to a robust US jobs report.

A light economic calendar for this week argues against a quick US dollar reversal, which may well keep gold in a downward trajectory in the short-term outlook.

US Dollar unlikely to reverse bullish trend in a hurry

There are no real reasons for investors to sell the dollar this early after a strong jobs report that was published on Friday all but ended talks of an early rate cut.

That being said, you would have thought that investors wouldn’t sell the dollar post a hawkish Fed meeting last week, but they did.

So, let’s see if there will be any real commitment from the dollar bulls this time. So far, it looks like there may well be this time around.

The January jobs report showcased broad strength, prompting investors to shift from bonds to the dollar on Friday, a trend that is unlikely to reverse without any major deterioration in US data.

The yield curve reverted to a bearish flattening mode, contradicting the prevailing belief in an early Fed rate cut, with the likelihood of a March trim pushed down to around 20%.

It will be interesting to see whether these initial post-NFP moves will last.

Fundamentally, there is little reason to fade these moves, but there was an interesting reaction that followed the FOMC meeting in mid-week when US bond yields fell even though Chairman Powell downplayed the chances of an early rate cut.

In response, the US dollar weakened as falling yields helped to underpin foreign currencies, and gold.

But those moves more than reversed post-NFP reaction. Based on the price movements observed last week, it appears that the market misinterpreted the situation.

Investors had convinced themselves that interest rates would decrease this year, and consequently, yields should not remain high simply because the Fed sounded somewhat cautious.

To some extent, this perspective is understandable, especially considering we had a couple of recent data misses that supported such a belief.

After all, the market tends to anticipate future developments, and evidently, investors do not perceive a high likelihood of inflation persisting as a significant risk.

This could be the reason why the US dollar struggled to extend its gains from January. However, with the release of Friday's data, there is now the potential for a new bullish trend for the greenback and a bearish one for gold.

Looking ahead, today’s key data is the ISM services PMI. The data is anticipated to improve to 52.0 from 50.5. A strong report should keep the dollar bulls happy although even a modestly soft report is unlikely to reverse Friday's moves.

All told and given a relatively light calendar week for US data, the renewed strength in USD should keep the dollar bears at bay.

In turn, gold, a dollar-denominated commodity, should remain out of favor, especially as investors continue to favor the racier equity markets with the major US indices hitting fresh highs on Friday.

Gold technical analysis and trade ideas

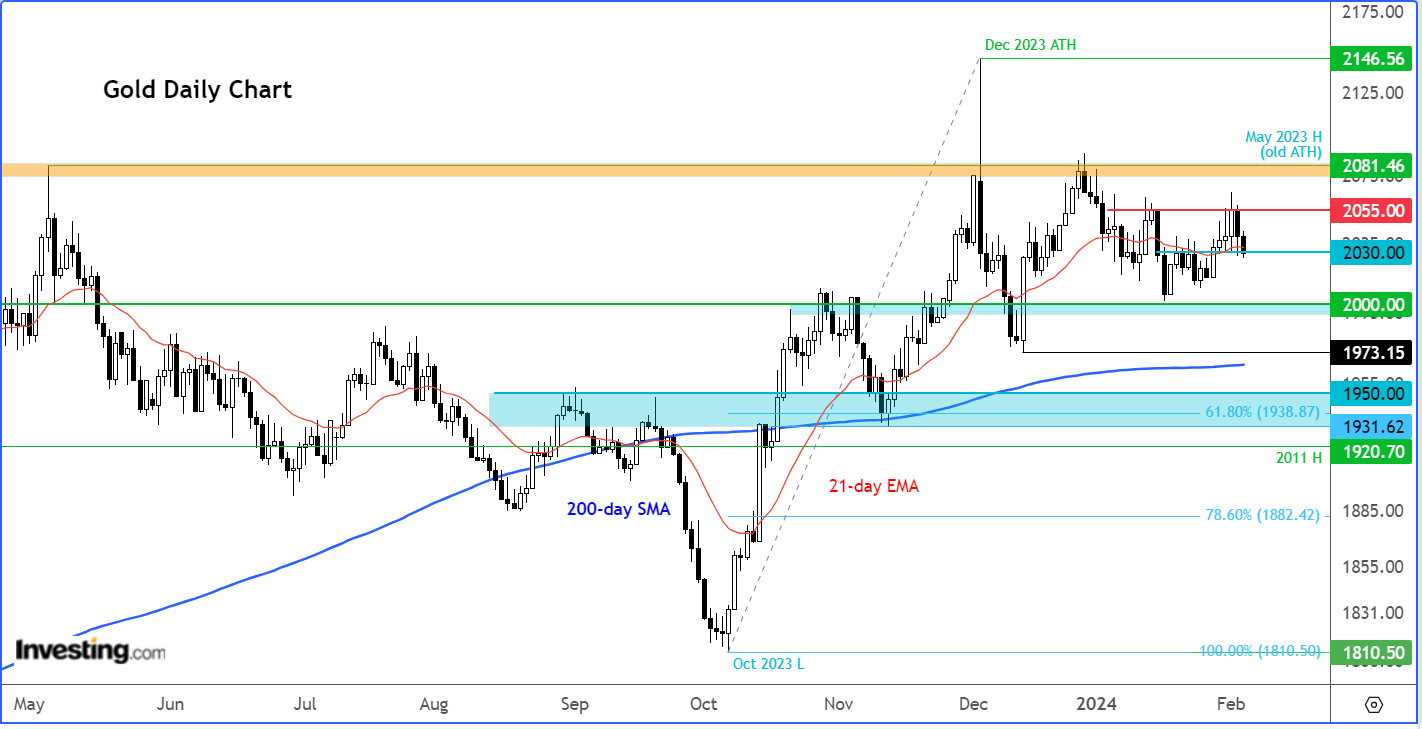

Gold’s attempted breakout failed last week with the sellers returning around the previous short-term resistance in the zone around the $2055/60 area to send prices back down to $2030 where it was trading at the time of writing.

Despite Friday’s reversal, we haven’t yet seen much downside follow-through. But a breakdown and a bit of correction looks likely now, which could make things a bit interesting after what has been a side-ways chop for several weeks.

A clean move below $2030 support could pave the way for $2000 and potentially the December low at $1973 thereafter.

The bulls will have to remain patient now and await a fresh ‘buy’ signal in light of Friday’s bearish reversal. This could take a while to form given the recent moves in the bond markets.

So, I would favor looking for downside in gold in the short-term outlook, until such a time that the dollar starts looking heavy again.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code OAPRO1 at checkout for a 10% discount on the Pro yearly plan, and OAPRO2 for an extra 10% discount on the by-yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.