A return to $1,800 pricing may have surprised even some of gold's ardent bulls, but the yellow metal needs to pass two stringent tests to stay in that vicinity.

The first is the minutes of the Federal Reserve’s June meeting, due at 2:00 PM ET (18:00 GMT) today, which could reveal more hawkish ideas for interest rates that would be bearish for gold.

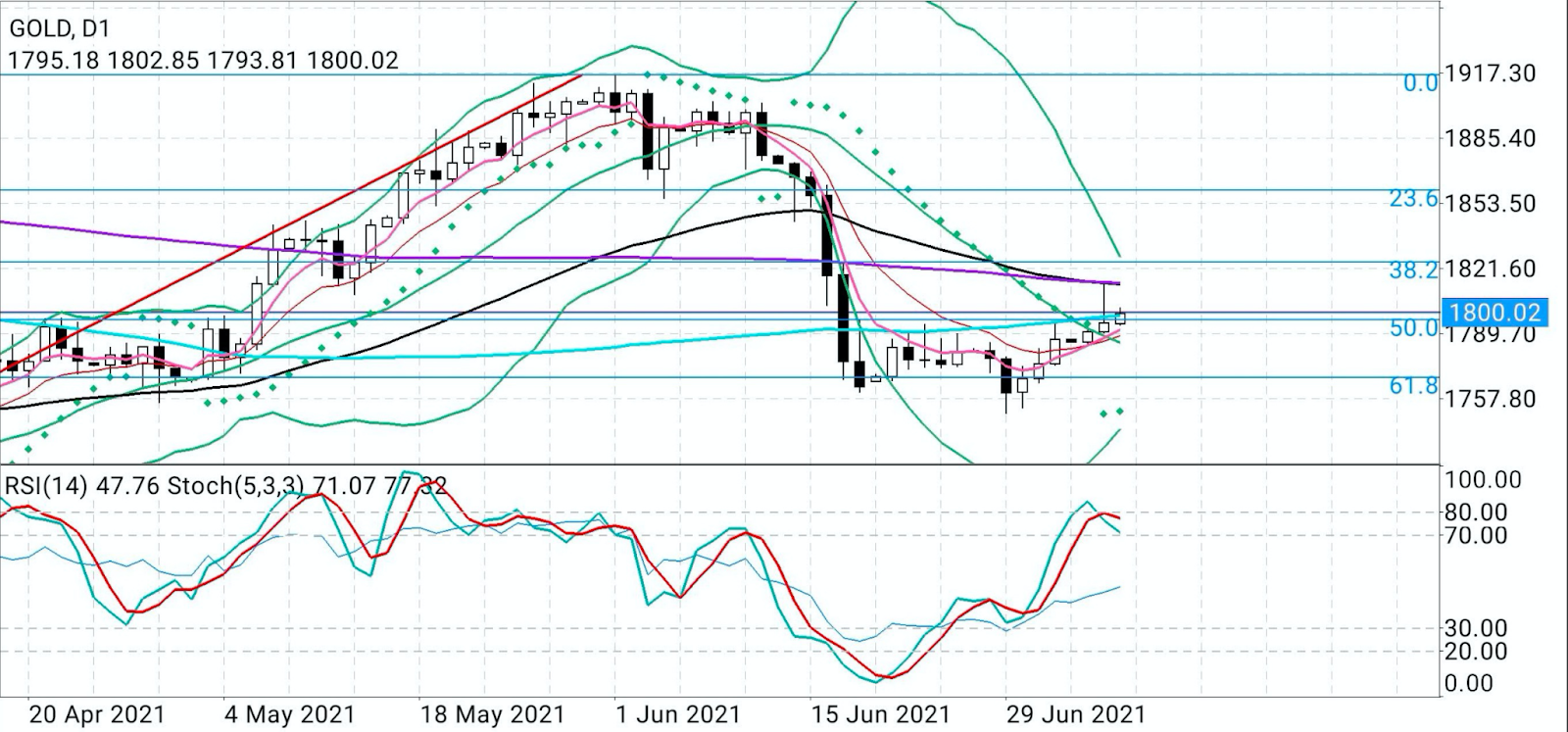

The other is gold’s RSI, or Relative Strength Index, which remains below required support levels to underpin such a pricing.

Thus the metal needs to close above the crucial $1,790 level, or at least $1,7678, to sustain further upside trajectory in the $1,800 area.

All charts courtesy of S.K. Dixit Charting

Projections by the Fed’s all-important FOMC, or Federal Open Market Committee, that monetary tightening will occur by the end of next year were what drove gold to a near two-month low of $1,767.90 on June 17.

The FOMC’s so-called dot plot had two hikes penciled in before December 2022 that would lift rates to 0.6% from the pandemic-era super low of zero to 0.25% retained by the Fed from March 2020.

Officials at the central bank have also spoken at length about the need to set an expeditious timetable to end the $120 billion in bonds and other assets that the Fed has been buying since the COVID outbreak to support the US economy.

The Fed minutes will provide the first insight into how much the FOMC had emphasized the need for the so-called “Fed taper” on asset purchases that what we’ve heard incessantly over the past month.

While bearish talk had dominated gold more than any bullish chatter over the past month, the yellow metal’s prices had suddenly surged this week on global central banks’ buying, reaching a near two-week high of $1,815.70.

One reason for the yellow metal’s strength: the battered state of US 10-year bond yields versus the relative strength of the Dollar Index.

TD Securities said in a note, commenting on the action:

''Following a multi-month hiatus, central Banks have proven to be a crucial pillar of support for gold's bull market at much needed time in recent months, with an increase in official purchases coinciding with periods in which gold trades near its pandemic-era trendline.''

''As the world exits from the pandemic with a massive stock of debt, alongside closer coordination between governments and their respective central banks, nations may increasingly seek to add to their gold reserves.''

Gold blogger Dhwani Mehta added in a post on FX Street:

“Heading into the FOMC minutes showdown, gold price is once again testing bullish commitments above $1800, as the persistent weakness in the US rates and cautious market mood continue to underpin.”

“Further, the US dollar’s modest retreat from overnight highs also helps revive the upbeat momentum in gold price. The next direction for gold depends on the Fed’s June meeting’s minutes, which could disappoint the hawks, especially after the world’s powerful central bank delivered a hawkish surprise at its policy meeting last month. In the meantime, the broader market sentiment and COVID updates will likely influence gold’s price action.”

On the technical front, the spot price of gold has hovered beneath the 50 Day EMA, or Exponential Moving Average, and 200-Day SMA, or Simple Moving Average at $1815, said Sunil Kumar Dixit at S.K. Dixit Charting in Kolkata, India.

He added:

“The intraday outlook is positive subject to prices holding above 1790 and 1768 which is an important Fibonacci level with targets reaching 1815-1825 and may extend to 1850-1868.”

“The daily Stochastic RSI points negative overlap while weekly Stochastic RSI shows positive moves.”

Gold blogger Mehta said a daily closing above $1,800 on the spot price might be critical to confirm a bullish reversal for gold.

Said Mehta:

“The 21-Day Moving Average at $1804 offers immediate resistance and as the 14-day RSI continues to trend below the central line even though it is pointing northwards.

On the flip side, Mehta noted that the 100-Day Moving Average of 1789 for spot gold had turned support now and could limit any retracement.

She added:

“So long as this level holds, the bulls remain hopeful for further upside. The next relevant cushion for gold bulls is seen at Monday’s low of $1,785, below which the $1,780 round figure could be brought back into play.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.